The market fell sharply to hit nearly two-week low on December 17, as weak global cues amid hawkish stance of major global central banks & rising Omicron cases, along with surprise rate hike by Bank of England dented market sentiment.

The BSE Sensex plunged 889.40 points or 1.54 percent to close at 57,012, while the Nifty50 has breached the crucial 17,000 mark, falling 263 points or 1.53 percent to 16,985.20 and formed a large bearish candle on the daily charts. The index lost 3 percent during the week and saw bearish candle formation on the weekly scale.

"Nifty50 appears to have registered a fresh breakdown as it closed below its 14-day old ascending channel with Long Black Day kind of candle formation. This breakdown is projecting a higher target placed around 16,450 levels on the downside," says Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.in.

He further says on weekly charts a strong bearish candle is registered hinting that Nifty might have resumed a downswing after a brief consolidation with positive candles of preceding two weeks.

Hence, "in the next session, if Nifty registers a close below 16,900 levels then the recent corrective swing low of 16,782 can come under threat by opening up more downsides. Contrary to this if Nifty manages to defend 16,900 levels on a closing basis then the near term trend shall remain sideways with upsides capped around 17,300 levels," Mazhar adds.

The broader markets also corrected sharply with the Nifty Midcap 100 and Smallcap 100 indices falling nearly 2.5 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,868.34, followed by 16,751.47. If the index moves up, the key resistance levels to watch out for are 17,200.13 and 17,415.07.

Nifty Bank

The Nifty Bank also caught a bear trap on Friday, correcting 930 points or 2.54 percent to 35,618.65 on December 17. The important pivot level, which will act as crucial support for the index, is placed at 35,252.21, followed by 34,885.8. On the upside, key resistance levels are placed at 36,267.91 and 36,917.2 levels.

Call option data

Maximum Call open interest of 39.53 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 23.74 lakh contracts, and 17000 strike, which has accumulated 18.41 lakh contracts.

Call writing was seen at 17100 strike, which added 11.35 lakh contracts, followed by 17200 strike which added 9.66 lakh contracts, and 17000 strike which added 3.89 lakh contracts.

Call unwinding was seen at 17600 strike, which shed 59,150 contracts, followed by 16000 strike which shed 18,850 contracts and 17,900 strike which shed 13,800 contracts.

Put option data

Maximum Put open interest of 46.04 lakh contracts was seen at 17000 strike, followed by 16000 strike, which holds 30.83 lakh contracts, and 16500 strike, which has accumulated 30.11 lakh contracts.

Put writing was seen at 17100 strike, which added 4.68 lakh contracts, followed by 16800 strike which added 3.26 lakh contracts and 16200 strike which added 2.49 lakh contracts.

Put unwinding was seen at 17300 strike, which shed 5.58 lakh contracts, followed by 17500 strike which shed 3.2 lakh contracts and 17400 strike which shed 2.57 lakh contracts.

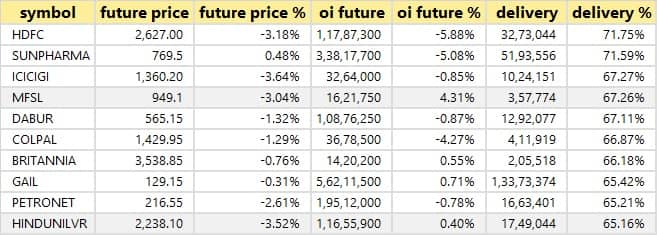

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

3 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 3 stocks in which a long build-up was seen.

120 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

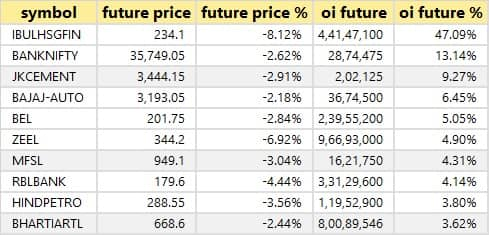

58 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

9 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 9 stocks in which short-covering was seen.

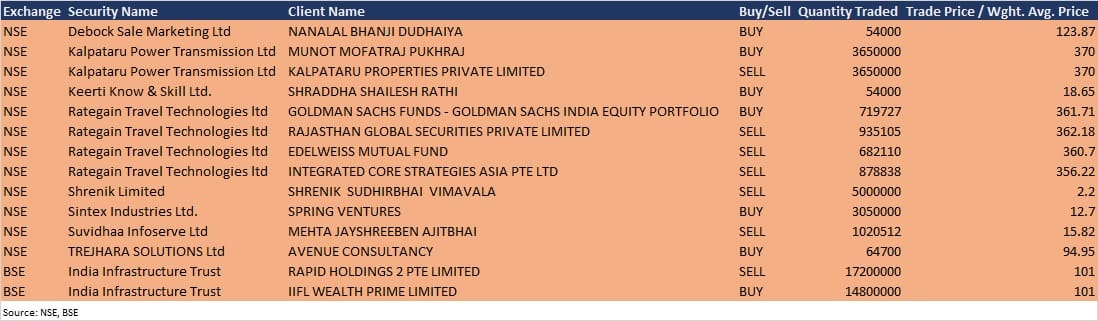

Bulk deals

Rategain Travel Technologies: Goldman Sachs Funds - Goldman Sachs India Equity Portfolio acquired 7,19,727 equity shares in the company at Rs 361.71 per share. However, Rajasthan Global Securities sold 9,35,105 equity shares in the company at Rs 362.18 per share, Edelweiss Mutual Fund offloaded 6,82,110 equity shares at Rs 360.7 per share, and Integrated Core Strategies Asia Pte sold 8,78,838 equity shares at Rs 356.22 per share on the NSE, the bulk deals data showed.

Sintex Industries: Spring Ventures bought 30.5 lakh equity shares in the company at Rs 12.7 per share on the NSE, the bulk deals data showed.

India Infrastructure Trust: Rapid Holdings 2 Pte Limited sold 1.72 crore equity shares in the company at Rs 101 per share, however, IIFL Wealth Prime Limited bought 1.48 crore equity shares in the company at Rs 101 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Brookfield India Real Estate Trust: The company's officials will meet investors and analysts on December 20 to discuss the acquisition of Seaview Developers, which owns Candor Techspace N2.

Cipla: The company's officials will meet White Oak Capital Management on December 20.

Bigbloc Construction: The company's officials will meet Roha Asset Managers LLP on December 21.

Blue Star: The company's officials will meet Spark Capital & Centrum Securities on December 22, and Enam AMC and Surveyor Capital on December 24.

Advanced Enzyme Technologies: The company's officials will meet Solidarity Investment Managers, Mosaic Ventures, and New Mark Capital on December 22.

Stocks in News

Shriram Properties: The company will make its debut on the bourses on December 20. The issue price has been fixed at Rs 118 per share.

HLE Glascoat: The company successfully completed the acquisition of the global business of Thaletec GmbH, along with its wholly owned subsidiary Thaletec Inc., USA, after receiving all necessary regulatory approvals.

Zomato: The company has completed acquisition of 7.89% of Bigfoot Retail Solutions.

Indiabulls Real Estate: The company on December 22 will consider raising funds through issue of equity shares and/or any other convertible or exchangeable securities.

Future Retail: Competition Commission of India suspended Amazon's deal with Future Group after it reviewed complaints that the American e-commerce giant concealed information while seeking regulatory approval.

Brookfield India Real Estate Trust: The REIT approved the acquisition of Seaview Developers, which owns Candor Techspace N2, a special economic zone located in Noida.

Ircon International: The company emerged as the lowest bidder for the project floated by National Highways Authority of India. The company entered into Share Subscription and Shareholders' Agreement with Ayana Renewable Power for the execution of the project of setting-up 500 MW solar power plant through a joint venture company which will be incorporated by IRCON and Ayana.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,069.90 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,478.52 crore in the Indian equity market on December 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Indiabulls Housing Finance, and Vodafone Idea - are under the F&O ban for December 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!