Given the long bearish candlestick pattern formation after the record high on the daily charts, and the formation of a small-bodied bearish candlestick pattern with a long upper shadow which resembles a Shooting Star kind of pattern on the weekly charts (not the ideal one) with a bearish divergence in momentum indicator RSI (relative strength index), as well as negative global cues, the market is likely to weaken further in coming sessions, experts said.

According to them, the Nifty 50 may try to take a support at 22,300-22,200, and 22,000 is likely to be crucial support which coincides with upward sloping support trendline, while on the higher side, 22,750-22,800 is expected to be key resistance area going ahead. Shooting Star pattern formation at the top is a bearish reversal pattern but needs to watch follow-up candle for the confirmation.

On April 12, the BSE Sensex tanked 793 points to 74,245, while the Nifty 50 plunged 234 points to 22,519, while for the week, the index was up 6 points.

"A long negative candle was formed on the daily chart, that has broken below the immediate support of ascending trend line at 22650 levels. Technically, this pattern indicates a formation of crucial top reversal pattern and one may expect more weakness in the coming sessions," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He further said the hurdle of the resistance trendline and Fibonacci projection around the 22,800 level have weighed high on the market and resulted in a reversal.

A small negative candle was formed on the weekly chart with an upper shadow, which indicates a reversal pattern formation as per daily as well as weekly timeframe charts. This is not a good sign for bulls, he feels.

Amol Athawale, vice president – technical research at Kotak Securities also feels the formation of the Shooting Star candlestick pattern indicates temporary weakness, though the medium-term texture of the market is still on the positive side.

He is of the view that, as long as the index is trading below 22,650, the weak sentiment is likely to continue.

The volatility also jumped nearly 4 percent last Friday, but is still below crucial levels of 13-14 as surpassing these levels decisively can be a discomfort for bulls. The India VIX, the fear index, rose 3.82 percent to 11.53 level.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty, and Bank Nifty

The pivot point calculator indicates that the Nifty 50 may take immediate support at the 22,498 level followed by 22,446 and 22,360 levels. On the higher side, the index may face resistance at the 22,540 level followed by the 22,721 and 22,806 levels.

On April 12, the Bank Nifty had negative higher highs, and higher lows formation of the previous five consecutive sessions, and fell 422 points to 48,565. The index has formed a bearish candlestick pattern with an upper shadow on the daily charts, while for the week, it was up 71 points and formed a Gravestone Doji kind of pattern formation at record high levels, indicating a bearish reversal.

"On last Friday, the Bank Nifty index experienced significant selling pressure, marking a return of bearish momentum after a prolonged period," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He feels immediate support for the index is established at 48,000, where the highest open interest on the Put side has been observed. "A breach below this level could intensify the selling pressure."

However, the index is currently facing strong resistance at the 49,000 mark, and only a decisive close above this level could revive the upward trend towards the 50,000 mark, he said.

According to the pivot point calculator, the Bank Nifty index is expected to take support at 48,487 followed by 48,391 and 48,236. On the higher side, it may see resistance at 48,602, followed by 48,892 and 49,047.

As per the weekly options data, the maximum Call open interest was seen at 22,700 strikes, with 83.27 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 23,000 strike, which had 60.57 lakh contracts, while the 23,500 strike had 58.54 lakh contracts.

Meaningful Call writing was seen at the 22,700 strike, which added 59.79 lakh contracts followed by 22,600 strikes and 23,000 strikes, which added 43.33 lakh and 34.79 lakh contracts, respectively.

The maximum Call unwinding was at the 23,200 strike, which shed 18.66 lakh contracts followed by 22,100 and 21,400 strikes, which shed 4,350 contracts and 3,400 contracts, respectively.

On the Put side, the 22,200 strike owned the maximum open interest, which can act as a key support level for the Nifty with 56.27 lakh contracts. It was followed by the 22,000 strike comprising 49.17 lakh contracts and then the 22,500 strike with 34.53 lakh contracts.

Meaningful Put writing was at the 22,200 strike, which added 39.09 lakh contracts followed by the 22,000 strike and 22,600 strike adding 22.77 lakh and 9 lakh contracts, respectively.

Put unwinding was seen at 21,800 strikes, which shed 15.74 lakh contracts followed by 22,700 and 22,800 strikes, which shed 8.39 lakh and 3.51 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Dabur India, Balkrishna Industries, Jubilant Foodworks, Axis Bank, and Mphasis saw the highest delivery among the F&O stocks.

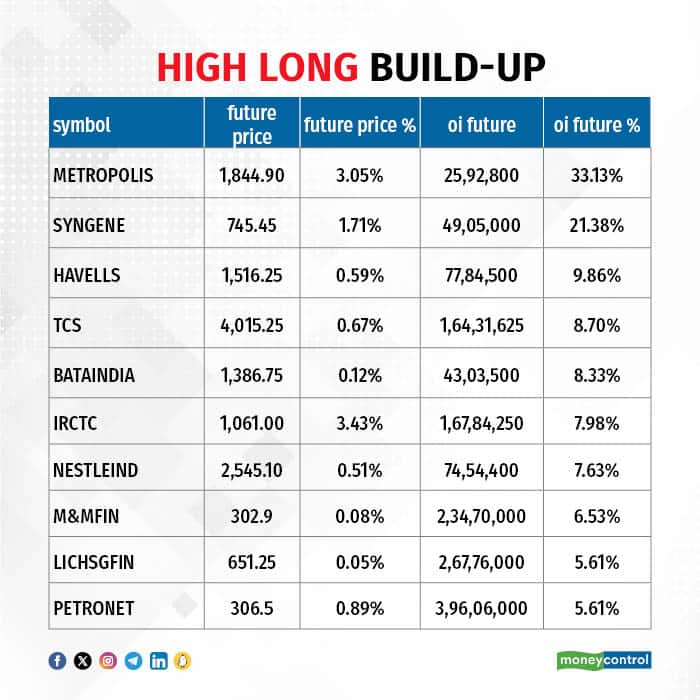

A long build-up was seen in 26 stocks, which included Metropolis Healthcare, Syngene International, Havells India, Tata Consultancy Services, and Bata India. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 43 stocks saw long unwinding, which included Dalmia Bharat, Vodafone Idea, National Aluminium Company, Balrampur Chini Mills, and United Breweries. A decline in OI and price indicates long unwinding.

96 stocks see a short build-up

A short build-up was seen in 96 stocks, including Page Industries, Sun Pharmaceutical Industries, GNFC (Gujarat Narmada Valley Fertilizers & Chemicals), Bandhan Bank, and Maruti Suzuki India. An increase in OI, along with a fall in price points to a build-up of short positions.

Based on the OI percentage, a total of 21 stocks were on the short-covering list. These included Exide Industries, Crompton Greaves Consumer Electricals, Hindustan Copper, Deepak Nitrite, and Tata Consumer Products. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell to 0.87 on April 12, from 1.32 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

For more bulk deals, click here

GTPL Hathway, Hathway Bhawani Cabletel & Datacom, Metalyst Forgings, Ontic Finserve, Rajoo Engineers, Hit Kit Global Solutions, Shekhawati Poly-Yarn, Atam Valves, and Sybly Industries will release their quarterly earnings on April 15.

Stocks in the news

Tata Consultancy Services: The country's largest IT services company has recorded a 9.1 percent on-year growth in net profit at Rs 12,434 crore for the quarter ended March FY24, beating analysts' estimates. Revenue from operations grew by 3.5 percent YoY to Rs 61,237 crore driven by India, UK and manufacturing segment, while the constant currency revenue grew at 2.2 percent.

Anand Rathi Wealth: The wealth management company has recorded nearly 33 percent year-on-year growth in net profit at Rs 56.6 crore for the quarter ended March FY24 despite weak operating margin performance. Revenue from operations for the quarter grew by 29 percent to Rs 184.3 crore compared to the same period last year.

Mphasis: The IT solutions provider has signed a multi-year global strategic collaboration agreement (SCA) with Amazon Web Services (AWS). The collaboration will enable the launch of Gen AI Foundry, led by Mphasis.AI, for the financial services industry.

Aster DM Healthcare: The healthcare company has declared a special dividend of Rs 118 per share.

Granules India: The US Food and Drug Administration (US FDA) has inspected the company’s Unit V facility at Visakhapatnam during April 8 and April 12, and concluded the said audit with Zero 483s.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 8,027 crore, while domestic institutional investors (DIIs) purchased Rs 6,341.53 crore worth of stocks on April 12, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added GNFC, Metropolis Healthcare, and Piramal Enterprises to the F&O ban list for April 15, while retaining Balrampur Chini Mills, Hindustan Copper, Vodafone Idea, India Cements, National Aluminium Company, and SAIL to the said list. Exide Industries and Zee Entertainment Enterprises were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.