The steep rise in awareness levels around health insurance after COVID-19 has prompted many individuals to scout for suitable health covers.

Not surprisingly, the market is set to expand to cover 250 million individuals under retail and corporate health insurance policies over the next five years, according to Avendus Capital research.

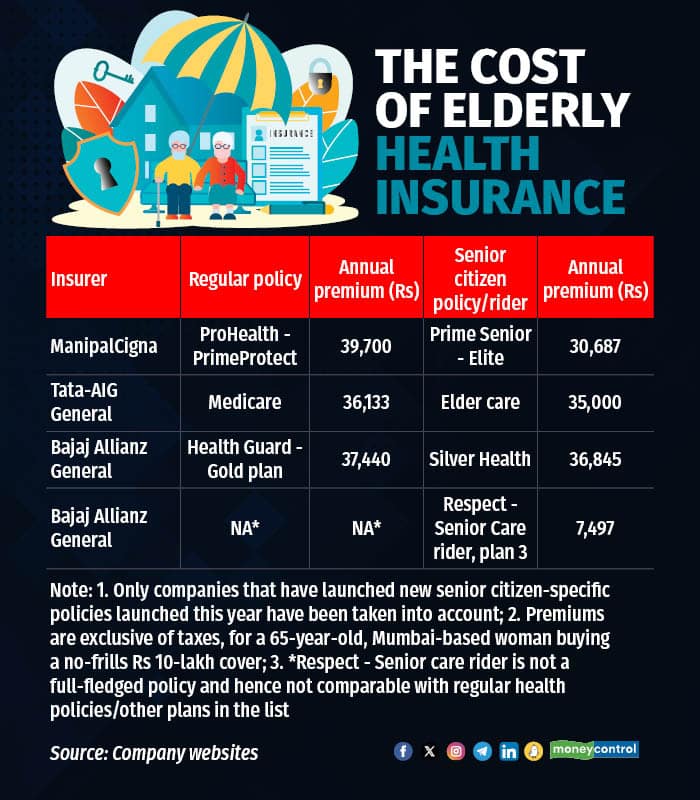

While awareness levels have gone up across age groups, it’s the senior citizens—individuals over the age of 60—who have felt the necessity of having a health cover in place the most. “Insurers did not promote this segment aggressively earlier. Economical product options available for this category were limited. Post-COVID-19, the acceptability of health insurance in this segment has gone up and, hence, the pool size has increased as well,” said Ashish Yadav, head of products, ManipalCigna Health Insurance.

Also read: Senior citizen policies vs regular plans: How to make the right choice

The volumes are substantial now, potentially boosting viability and, thus, prompting insurers to devise products for this cohort. “Senior citizens constitute 10-15 percent of the industry’s retail health portfolio. The growing demand has prompted insurers like us to devise products keeping the elderly population’s needs and challenges in mind,” added Yadav.

Insurance companies have traditionally not been fans of this category due to chances of more frequent claims and larger claim sizes. “Insurers are generally reluctant to underwrite policies of senior citizens as such applicants are likely to have developed some illness or the other at the time of entry. As the market matures, insurers would want to tap various segments. More insurers are likely to develop underwriting capabilities to cover the senior citizen segment. The demand for health insurance policies has gone up in general, including from senior citizens. The premiums have gone up by 10-15 percent post-COVID-19,” said Abhishek Bondia, managing director and principal officer, SecureNow Insurance Brokers.

The newer policies come with shorter waiting periods for pre-existing diseases, option to do away with co-pay as also proportionate deduction clause linked to room rent that bring down claim payouts.

Also read: Moneycontrol-SecureNow Health Insurance Ratings - How to pick the right health insurance policy

Newer policies with no co-pay, proportionate deduction clause

ManipalCigna launched its dedicated policy Prime Senior in February this year. The company offers optional add-ons to reduce the pre-existing disease (PED) waiting period to 90 days and choose zero co-pay. Shorter waiting period for PED—it is 48 months under regular policies—is critical for senior citizens as most are diagnosed with conditions such as diabetes or hypertension at the time of buying health insurance.

Under the co-payment clause, policyholders have to bear a part of the cost—say, 10-25 percent—of the bill amount, while the insurer chips in with the rest, which is an additional burden for senior citizen customers. Prime Senior allows policyholders to buy an add-on at an extra cost and opt for zero co-pay.

Policies with room rent sub-limits come with a corresponding proportionate deduction clause—other expenses such as doctor’s fee and operation theatre charges are linked to room rent, inflating the bill. While settling claims, insurance companies reduce the eligible claim amount proportionately, resulting in lower claim payouts.

So, ManipalCigna offers an optional cover that allows upgrading to any room. “There will be no proportional deduction if the policyholder chooses a room category higher than what she is eligible for. Only the differential will have to be paid,” said Yadav.

Payouts for physiotherapy sessions, home care

To be sure, availability of senior citizen covers is not a new phenomenon. Bajaj Allianz’s Silver Health and Star Health and Allied Insurance Company’s Red Carpet are but two instances. However, the circumstances are more conducive now to devise targeted products.

“Insurers have long been offering tailor-made products for senior citizens. With wellness guidelines, now insurers are able to offer comprehensive healthcare ecosystem solutions for senior citizens. Additionally, numerous health-tech startups are providing care solutions delivered through technology, leading to increased action in this space,” said Bhaskar Nerurkar, head, health administration team, Bajaj Allianz General Insurance. Last year, the insurer rolled out a host of value-added services for senior citizens as part of its rider benefit termed Respect - Senior Care rider.

The product’s variants offer services such as home assistance, physiotherapy, nursing care at home, ambulance services and tele-consultations, with the premium variant also offering a smartwatch with fall detection technology, among other things. A free medical check-up once in two years or every year is another common feature offered under these plans.

Given their health condition, regular monitoring helps not only policyholders but also insurers as it enables pre-emptive action that can prevent hospitalisation and, thus, larger claims, say insurers.

Reduced waiting periods, home care the prime focus

The latest to launch a senior citizen-specific product is private insurance company Tata-AIG. The product, Elder Care, too, offers a shorter waiting period of 24 months for pre-existing illnesses. It also provides, among other things, home nursing services arranged by the company at its cost if the insured person requires post-operative care. It offers a fixed payout of Rs 5,000 if the policyholder’s condition following discharge necessitates alterations to her house. Given that senior citizens could need help with booking appointments with doctors, paramedical professionals and other service providers, the policy will give them access to a personalised health manager to assist them with such needs.

Be aware of the restrictions

While dedicated senior citizen policies come with a host of customised features and have diluted restrictive clauses, do read the fine print to understand the restrictions. For example, Tata-AIG’s Elder Care comes with a 20 percent co-payment clause. Also, in the case of certain treatment procedures such as hip or knee replacement surgeries, the waiting period is longer at 48 months, and not 24 months. The maximum age at entry is 85 years.

The outpatient department (OPD) cover that ManipalCigna provides pays for expenses such as doctor’s consultation fee, but only if the advice is sought from doctors in its specified cashless network. Also, while you can reduce the waiting period to 90 days, opt for premium category room and pay only for the differential, these benefits will come at a higher cost as you can avail of these only if you buy the relevant optional covers. Those older than 75 years cannot buy this policy, though it is renewable for life, like other regular health insurance policies.

Under Bajaj Allianz’ rider cover, nursing and physiotherapy services are restricted to five days (12 hours a day) and seven days (one-hour sessions) in a year, respectively.

Moreover, while senior citizen-friendly features are welcome, there is a need for a transparent underwriting process—risk assessment of the individual’s health before issuing the policy—so that they get a fair idea of whether or not they can obtain the policy in the first place.

“Most brochures are generally silent on underwriting norms. There is a need for greater transparency on this front. For instance, in the brochure they could specify whether the plan is open to diabetics and the acceptable levels or for those diagnosed with hypertension or have a history of surgery in the past. Better disclosures will make it easier for prospective policyholders to make a decision,” Bondia pointed out.

Despite this lack of clarity and the restrictions in the policies, however, you must consider buying these policies for yourself or your parents, particularly if you or your parents are not covered under a health plan. “Senior citizens must buy dedicated policies if they are eligible and can afford the premiums,” said Bondia.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.