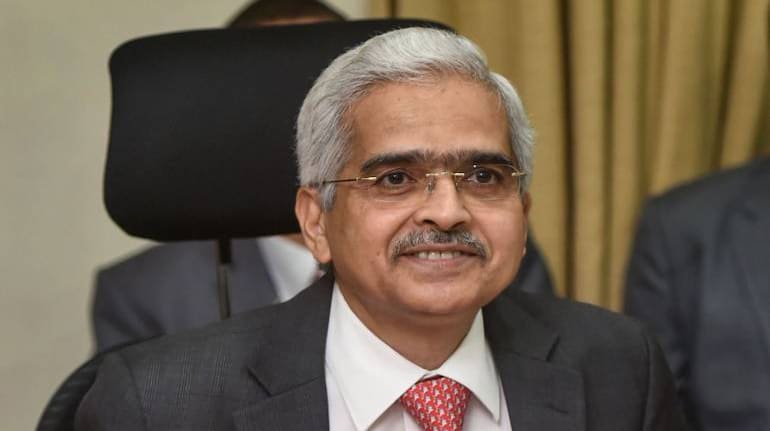

Reserve Bank of India (RBI) Governor Shaktikanta Das on April 7 quoted Mahatma Gandhi and Martin Luther King Jr. to project hope and as he sought to instil confidence among people amid the second wave of COVID-19 pandemic.

Speaking about the impact of a recent surge in novel coronavirus infections in the country, Das said: “In India, we are now better prepared to meet the challenges posed by this resurgence in infections. Fiscal and monetary authorities stand ready to act in a coordinated manner to limit its spill-overs to the economy at large and contain its fallout on the ongoing recovery.”

“We must accept finite disappointment, but never lose infinite hope,” Das said, quoting Nobel laureate and leader of the American civil rights movement Martin Luther King Jr.

Das also quoted Mahatma Gandhi and called on people to resiliently face the pandemic. “I truly believe in the indomitable spirit of the human race which confronted the trial by virus during 2020 with resilience and fortitude and the will to survive. Let 2021 be the harbinger of a new economic era for India,” Das said.

“If patience is worth anything, it must endure to the end of time. And a living faith will last in the midst of the blackest storm,” Das said, quoting Gandhi.

The central bank’s Monetary Policy Committee (MPC) on April 7 kept the repo rate unchanged at 4 percent and retained its ‘accommodative’ stance. The Marginal Standing Facility (4.25 percent), bank rate (4.25 percent) and reverse repo rate (3.35 percent) were also kept unchanged.

The Reserve Bank retained Gross Domestic Product (GDP) growth of 10.5 percent for the fiscal year 2022 and said global growth is gradually recovering from the pandemic-triggered slowdown, but remains uncertain.

The RBI governor said that retail inflation is likely to be at 5 percent in Q4 FY21, against 5.2 percent forecast earlier. The Consumer Price Index (CPI) inflation trajectory is likely to be subject to both upside and downside pressures, he said.

Das said that retail inflation for Q1 and Q2 FY22 was seen at 5.2 percent. CPI inflation for Q3 and Q4 FY22 is being seen at 4.4 percent and 5.1 percent, respectively, he added.

Follow this LIVE blog for latest updates on RBI Monetary Policy

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.