The Reserve Bank of India's (RBI) decision to retain the repo rate at 6.5 percent on April 6 caught almost everyone off-guard. The central bank, though, has insisted that it is merely a pause and not a policy pivot.

As such, the repo rate could be increased again in future meetings, although economists think the hiking cycle has ended.

Whatever current expectations, the Monetary Policy Committee will take cues from incoming data on inflation and growth. The problem with data, however, is that it is published with a delay of 1-2 months. Considering monetary policy must be forward-looking, the image in the rear-view mirror should not be the sole driver. This makes the RBI's surveys, where people and firms express their expectations for the future, a key input for policy making.

On April 6, the RBI released the results of its forward-looking surveys. Here, Moneycontrol takes a look at what they are saying about households, services, and the manufacturing sector, among other areas.

Household perspective

Despite all the difficulties the average consumer is facing from high prices, the best news seems to be coming from them.

As per the RBI's Consumer Confidence Survey, the Current Situation Index continued its upward journey in March, rising to 87.0 from 84.8 in January. Meanwhile, the Future Expectations Index edged down slightly to 115.5 from 116.2.

The 100-mark separates the pessimism zone from optimism.

Source: Reserve Bank of India

Source: Reserve Bank of India

"With an uptick in current perception, the sentiments on employment are nearing the levels seen around mid-2019; consumers are also optimistic about the employment outlook as more than half of the respondents expect the employment scenario to improve over the next one year," the RBI noted.

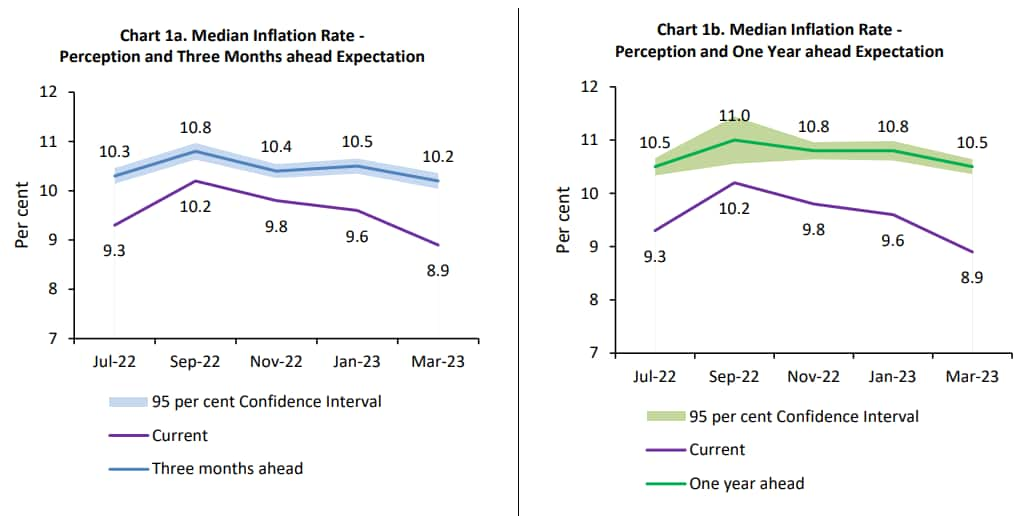

The Households' Inflation Expectations Survey brought forth more positivity, with three-months and one-year ahead inflation expectations declining by 30 basis points each to 10.2 percent and 10.5 percent, respectively, in March from January.

One basis is one-hundredth of a percentage point.

Source: Reserve Bank of India

Source: Reserve Bank of India

Inflation expectations are keenly eyed by policymakers as anchoring them is critical to ensuring price stability.

Services and industry

The services sector has been the brightest spot for the Indian economy. While the services Purchasing Managers' Index may have declined to 57.8 in March, it was from a 12-year high of 59.4 in February. Moreover, the latest GDP data showed the services sector continued to cruise along in October-December, growing by 6.2 percent.

The RBI's Services and Infrastructure Outlook Survey for January-March adds to the gloss, with service providers "upbeat" about what April-June might bring. Encouragingly, companies see demand for services growing sequentially till the end of 2023.

As far as the infrastructure sector is concerned, respondents were positive about employment in January-March and see the situation improving sequentially as we progress deeper in 2023.

"Firms expressed high optimism on the overall business situation and turnover till October-December," the RBI said, although it added that infrastructure companies were less optimistic than before about growth in selling prices and profit margin in April-June.

Manufacturing companies, meanwhile, were less optimistic about demand conditions during April-June, with the Business Expectations Index falling to 126.4 from 132.9 in January-March.

However, manufacturers remain "highly optimistic" on production, order books, employment, capacity utilisation and the overall business situation, as per the latest Industrial Outlook Survey of the Manufacturing Sector, with the overall business situation "likely to improve further" in July-September and October-December.

Capacity and lending

The economic picture gets a bit murky when one considers the Order Books, Inventories, and Capacity Utilisation Survey. As per the survey, the manufacturing sector's capacity utilisation, on a seasonally adjusted basis, declined to 74.1 percent in October-December as against 74.5 percent in the previous quarter.

Generally, fresh investments are expected to be forthcoming when capacity utilisation is more than 75 percent.

Source: Reserve Bank of India

Source: Reserve Bank of India

What may be more worrying is that the pace of annual growth in new orders of manufacturing companies cooled for the second consecutive quarter in the last quarter of 2022.

In terms of credit, the Bank Lending Survey for January-March said bankers were highly optimistic with regard to overall loan demand during April-June and "upbeat" about it for the subsequent two quarters. Further, loan terms and conditions are anticipated to get easier in July-September and October-December.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.