A few years ago, the Indian stock markets used to dance to the tunes of foreign institutional investors. Their investments were subject to the vagaries of global conditions, resulting in a higher level of volatility in the Indian stock markets.

Domestic institutional investors – primarily mutual funds, the Employees' Provident Fund Organisation, and insurance companies acted as a stabiliser for the Indian markets when foreign inflows turned erratic over the past few years.

Flows into these – especially provident funds and mutual funds – and a part of them is now being invested in the stock markets. These fund managers increasingly have more money to deploy in stocks, making the market more vibrant.

The expectations are that this is the start of a long-term trend, given the low financialisation of savings in the country. With greater awareness, more money is expected to flow into mutual funds and pension funds, which in turn will pour into the stock markets.

Also read: Bullish on India | A pollution-free India by 2047 is not a Utopian dream

According to an analysis by BofA Securities, even on the conservative side, pension and retirement funds and systematic investment plans (SIPs) could contribute $20 billion of flows into India’s equity market every year. In rupee terms, that is Rs 1.65 lakh crore, or about Rs 13,800 crore a month.

What is remarkable about this is that there is not likely to be any net outflow in any year, given India’s demographics. Data from the National Securities Depository Ltd. shows that foreign investors sold an average of Rs 10,100 crore worth equities in a month in the past year, when FII turned net sellers for first time in four years. If this trend continues and offset it against expected inflow from domestic institutions, it comes out at Rs 3,700 crore of net inflow a month.

This kind of inflow gives confidence to analysts and investors to remain bullish on India for the long term. No wonder emerging market fund managers such as Chris Wood and Mark Mobius are overweight on India.

Savings rate

As per the latest available data, the gross domestic savings rate in India stood at 30.2 percent in FY22. This means households, the private corporate sector and the public sector tend to save about a third of their income.

So where does this income go? Traditionally, Indians have been known to invest their savings in physical assets such as gold and real estate. However, lately, the trend has been changing, with financial products like mutual funds gaining traction, especially among the young and salaried class.

Currently, 40 percent of savings is in financial assets while 60 percent continues to be in physical assets. Even with the surge in the popularity of equities after the pandemic, investments in equities are only 13 percent of total household savings in financial assets, compared with 41 percent in the US.

Moreover, the mandatory contribution to provident funds and tax-saving avenues are further preparing India for a population that’s growing older.

EPF - a goldmine

In 2015, the Employees' Provident Fund Organisation – which earlier used to allocate the entire fund into debt – started investing in equities as well. The allocation started with a limit of 5 percent of the funds, which is now 15 percent.

This is similar to how the 401(k) plan lifted the stock markets in the US in the 1980s. The 401(k) plan in the US is an employer-sponsored retirement plan that allows eligible employees to make contributions. It is like the US-equivalent of the EPFO in India.

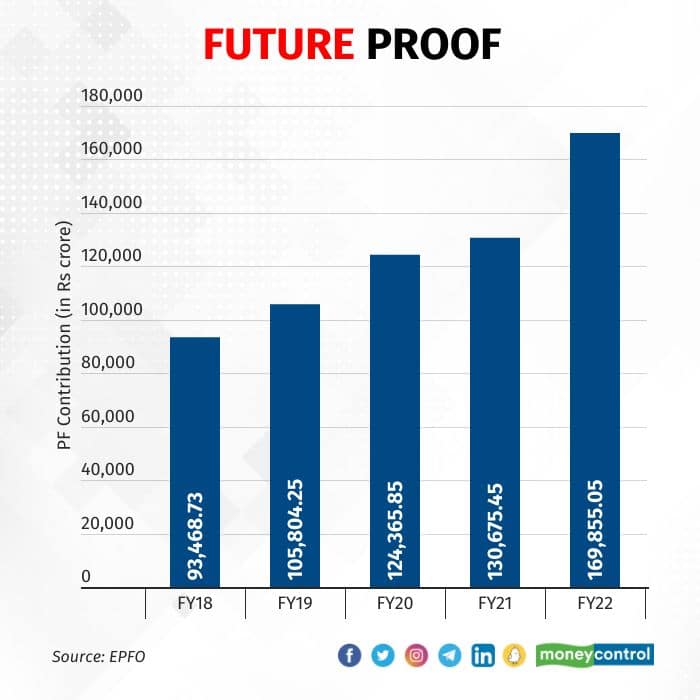

The EPFO invests in equities through exchange traded funds. However, the fund is yet to reach the 15 percent equity allocation limit. In FY22, for which the latest data is available, the fund had an allocation of Rs 1,59,299.46 crore in equities – 8.70 percent of its entire corpus.

This means the fund can almost double its investment in equities. If utilised entirely, this will lead to huge flow into top listed companies.

Suresh Sadagopan, MD of Ladder7 Wealth Planners, said that since provident fund is a long-term product, higher allocation to equities is not a bad idea. An increase in allocation will not just be good news for investors and the markets, but also for the EPFO itself.

“Consistently doling out 8 percent-plus returns to investors is not easy if you are entirely invested in debt. Investments in equities will help EPFO pare down deficit,” Sadagopan said.

Apart from lower utilisation, contributions to the EPFO have been rising over the past several years thanks to formalisation of the economy, better compliance by companies and relatively higher returns. This means the fund has increasingly more money to invest in equities every year.

Mutual funds - backbone already?

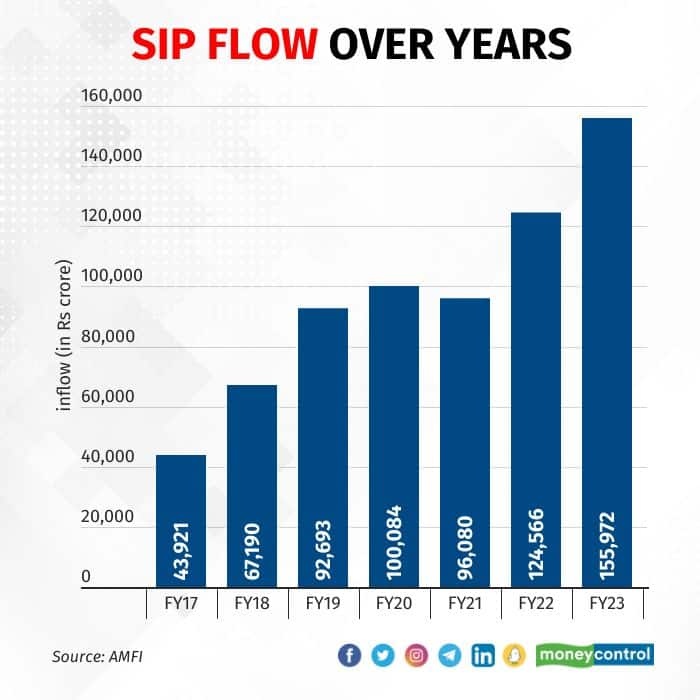

A similar story is being played out in mutual funds, which pool public money to invest in a variety of securities, largely debt and equities. And, the most favourite mode of investment, especially into equities, has been SIPs.

“Domestic households have supplemented this with systematic investment plans – an outcome of low equity exposure on household balance sheets, constant education by the mutual fund industry participants on the merits of systematic investing, major regulatory reforms, which have made the markets less prone to fraud, and improving equity returns,” said Ridham Desai, managing director of Morgan Stanley India.

Assets managed by Indian mutual fund houses have grown from Rs 8.11 lakh crore on June 30, 2013, to Rs 44.4 lakh crore on June 30, 2023 – a more than fivefold increase in a span of 10 years, according to data from the Association of Mutual Funds in India.

Currently, a large chunk of the flow comes via SIPs, a trend that is growing.

“Households continue to be least exposed to equities relative to other asset classes such as property, gold and fixed income securities, and we see the domestic bid on stocks sustaining for a long time like it did in the US from 1980 to 2000 until the NASDAQ bubble,” Desai said.

In this 20-year period, the S&P 500 index multiplied almost six times. If a similar trend holds for the Indian market, investors are in for a sweet ride.

“As of now, what used to be the total purchase of FPIs in a year three decades ago is the monthly SIP by domestic investors. This large SIP flows makes the market more resilient as it’s not driven by the decisions of a few, while making AMC (asset management companies) as business more sustainable,” said Abhishek Banerjee, founder of Lotusdew Wealth and Investment Advisors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.