With election season kicking in state and central governments seem to be upping the ante by announcing populist schemes ranging from subsidies on cooking gas, income guarantee plans, to hikes in allowances. Such measures along with the ongoing festive season has experts betting on a pick-up in rural demand, which has been weak since the outbreak of the pandemic.

The fillip to consumption is expected to come in at the end of 2023 as demand is expected to improve on higher spending by political parties, ebbing inflation and increased manufacturing. Industrial activity was at a 14-month high in August and retail inflation came in at a three-month low in September.

Output of consumer durables rebounded in August after two months of contraction, while consumer non-durables held on to healthy growth, increasing by 9 percent in August sequentially. This augurs well for consumption.

However, rural demand remains on shaky ground. Stagnating incomes, aggravated by export curbs to limit inflation, and erratic monsoon could again hinder rural consumers during the festive season.

FMCG companies that were battling low rural demand for several quarters are cautiously hopeful.

“We are witnessing an upswing in rural demand over the last few quarters and the gap between rural and urban growth is continuously shrinking. The moderating inflation and improvement in infrastructure have helped the rural demand growth,” Mohit Malhotra, CEO of Dabur India, told Moneycontrol.

RS Sodhi, the president of the Indian Dairy Association, is also optimistic about rural demand. While he remains concerned about food inflation and stagnating incomes, he said the situation is much better than it was about six months ago.

Sodhi, former managing director of Amul, expects consumption for the dairy sector to be led by sales of branded products in metropolitan cities, especially the festive favourite “packed mithais.” He also expects good demand from tier 2 and tier 3 cities, as evident from the number of smaller and regional brands coming up of late.

Retailers expect 10-12 percent growth over the last year's sales this festive season as discretionary spending in consumer, automotive, banking, real estate, e-commerce and other sectors picks up, according to a Wright Research report.

While consumers may spend Rs 3 lakh crore in brick-and-mortar stores alone, market research firm Redseer estimates online purchases to touch Rs 90,000 crore this festive season, 20 percent higher than a year ago.

Godrej Appliances expects a 40 percent on-year jump this season in the sale of white goods such as air-conditioners and washing machines, led by premium category offerings. Even festive sales of smartphones could grow 7 percent this year, driven by a longer festive season, pent-up demand, financing and the Cricket World Cup pull, Counterpoint Technology Market Research told Moneycontrol. This would be a significant improvement from last year, when purchases declined 9 percent.

Urban demand has remained stronger than its rural counterpart since November 2021, after the latter suffered due to higher food prices and a volatile monsoon. However, rural demand is expected to improve gradually during the second half of FY24 as retail inflation eases with a drop in food prices.

While urban demand is expectedly holding up well – as seen in indicators such as goods and services tax collections, e-way bill generation, domestic passenger traffic, passenger vehicle sales and retail credit growth – rural demand, which could face headwinds from a skewed monsoon, is also improving, CareEdge said in a report on October 12.

As experts remain cautious of weather vagaries, early signs have propelled expectations of a pickup amid the festive season with rural demand for fast moving consumer goods swinging back to positive territory in August.

“The upcoming festive season could provide an impetus to the consumption scenario in the economy. The moderation in retail inflation is also comforting and could provide a boost to consumption, even though high inflation in some of the food items remains concerning,” CareEdge added.

Apart from inflation easing, anticipation of an increase in government spending ahead of the national elections in 2024 is expected to lift consumer sentiment.

Dabur, the fourth-largest FMCG company in India, expects “some fiscal stimulus” to be doled out for the rural sector as the polls approach, boosting the rural markets.

Deloitte agreed. “Prospective growth in rural demand will also be supported by the upcoming festive season and higher government spending prior to the general elections. Overall, we should expect gradual improvement in volume growth of consumer goods companies in the quarters ahead,” Anand Ramanathan, Partner at Deloitte India told Moneycontrol.

Recent reports suggested the central government is mulling an extension to the provision of free foodgrains beyond December. It may also increase its income assistance scheme for farmers as it looks to woo this key vote bank.

New Delhi has already taken populist steps in the past two months, including a reduction in LPG cylinder price – for both the average consumer as well as beneficiaries of its Ujwala scheme.

Luxury-mass divideThe optimism around festive demand comes with caveats. Some companies and experts expect a demand push from the premium segment, with purchases – ranging from cars to smartphones – set to be the driving force, while the consumption trend in entry-level products has been flashing warning signs.

“Overall, the premium urban-led segment continues to demonstrate a good run, whereas upmarket territories and mass segment remains sluggish. With festivities spanning across a longer period this year till November, we are cautiously optimistic about good growth,” according to Kamal Nandi, executive vice president of Godrej Appliances.

Haier, another consumer durable goods company, agreed that premiumisation has been a consistent trend in consumer electronics.

“We anticipate premium segments will continue to lead festive sales,” the company told Moneycontrol.

It is not surprising that some sectors are less optimistic about the sales of entry-level products since inflation and uneven rainfall have dented rural incomes. Steps by the government to check food inflation and supply disruptions, including a ban on exports of a certain variety of rice, have also had an impact.

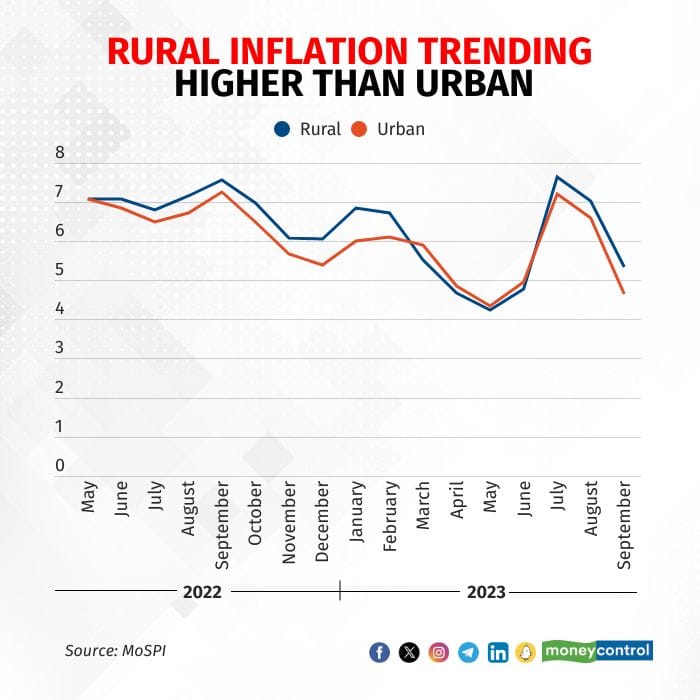

High food prices impact the mass segment more as households in the lower-income brackets spend a larger proportion of their income on food. Retail food inflation has been higher for rural India – 6.4 percent in the first nine months of 2023 versus 6 percent for urban areas. The difference was similar in 2022, with retail food inflation for rural areas at 6.9 percent as opposed to 6.6 percent for urban areas, according to data from the statistics ministry.

The premiumisation of Indian consumer demand has been evident for a while. Take the sales of two-wheelers, a vehicle used more commonly in the villages. Dispatches declined 1.6 percent in July-September from the same period last year even as passenger vehicle sales hit an all-time high.

“More people are migrating towards utility vehicles,” Vinod Aggarwal, president of the Society of Indian Automobile Manufacturers, told reporters on October 16. “The other possibility is that rural consumers’ income is still at a lower level, which is also indicative of the degrowth of the scooter segment.”

Pricier sports utility vehicles are posting record sales, whereas purchases of entry-level cars nosedived 75 percent year-on-year in the second quarter of FY24. The trend is not limited to the automobile sector.

Godrej Appliances’ sales of side-by-side refrigerators, priced, on average, at more than Rs 50,000, jumped about 200 percent. On the other hand, sales growth for the cheaper, direct cool variant has been flat this festive season.

The story is no different when it comes to another popular festive buy – smartphones.

“Festive season demand is now driven by the 5G and premiumisation trend… As per our latest pre-festive season smartphone consumer survey, premiumisation is on the rise this festive season as 42 percent planned to purchase a premium smartphone worth Rs 30,000 or more,” said Shilpi Jain, a senior analyst at Counterpoint.

This trend is in line with what economists call a ‘K-shaped’ recovery in India’s economy after the pandemic, with the high-income segment of the population spending heavily.

Despite the persistent risks from deficient rainfall and stagnating incomes, the outlook is bullish, not only for overall festive demand in 2023 but also on a significant recovery in rural consumption, encouraged by easing inflation and hopes of doles ahead of key elections.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.