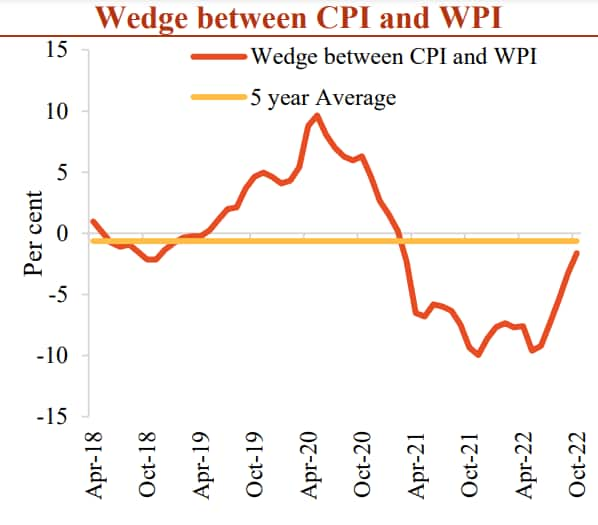

The narrowing of the gap between wholesale and retail inflation in recent months indicates that the pass-through of higher input prices to consumer prices is "nearly complete", the Union Ministry of Finance said.

"…the gap has narrowed to -1.6 percent in October 2022, signalling that higher input prices pass-through is near completion. The magnitude of the pass-through of input cost to retail inflation is likely to be lower in the coming months," the ministry said in its monthly economic review report for October, which was released on November 24.

According to the finance ministry, the fall in the difference between wholesale and retail inflation has been driven by both -- a moderation in international commodity prices, which has helped lower wholesale inflation, and producers passing on higher costs to consumers, which has pushed up headline retail inflation.

As per data released earlier this month, the wholesale price index (WPI) inflation fell to a 19-month low of 8.39 percent in October. Meanwhile, the consumer price index (CPI) inflation came in at 6.77 percent, resulting in a difference of 162 basis points.

Source: Finance Ministry

Source: Finance Ministry

A sharp rise in global commodity prices following Russia's invasion of Ukraine rapidly pushed up inflation globally. For a large energy importer such as India, the rise in inflation has been such that average CPI inflation has been outside the tolerance band of two to six percent in each of the first three quarters of 2022. This has resulted in the Reserve Bank of India (RBI) failing to meet its mandate.

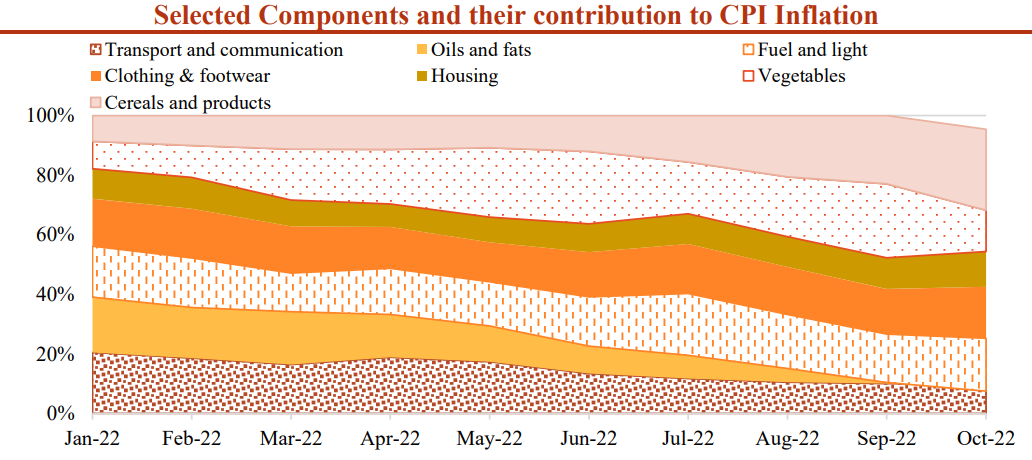

However, according to the finance ministry's report, India's inflation dynamics "have shifted from imported inflation to domestically driven inflation now".

So far in 2022, CPI inflation has been primarily driven by food inflation, which has had a contribution of 48.3 percent, due to imported food items like oil and fats.

"Since June 2022 however, domestic seasonal factors have increased the inflation of vegetables, cereals and their products, which have contributed to elevating food inflation," the report added.

Source: Finance Ministry

Speaking about growth, the report said the global slowdown could dampen the outlook for India's exports. However, with domestic demand resilient, investment cycle reinvigorating, a strong financial system, and structural reforms will spur growth going ahead and India looked "well-placed to grow at a moderately brisk rate in the coming years".

"In times such as this, the best contribution that governments make to economic growth is through policies that prioritise economic and financial stability, as India has demonstrated in the last two and half years," the report said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!