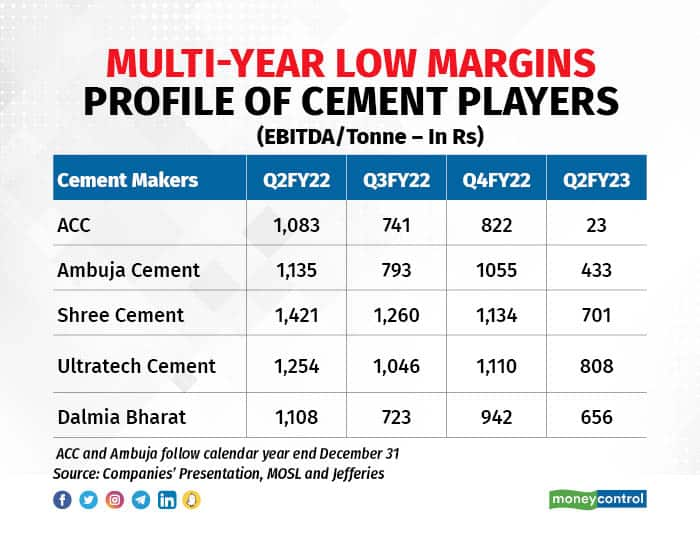

After the burden of high energy prices and lower realisations, most major cement companies reported multi-year low margins, in terms of EBITDA (earnings before interest, taxes, depreciation, and amortisation) per tonne, in the quarter ended September.

Except for ACC, the margin for all cement companies shrank to triple digits per tonne from four figures previously as demand for the building material waned, prices fell, and the cost of inputs including fuel and power climbed. ACC reported a double-digit margin.

The squeeze on margins has been evident over the past few quarters, and the question that analysts are asking is if the worst is now behind for the sector.

Also Read: Pain period likely over, cement makers set to deliver stronger in second half

September quarter earnings

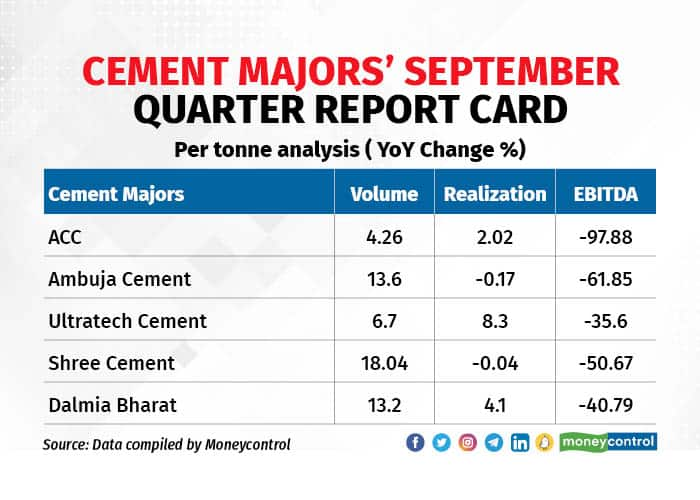

The September quarter was a washout for cement companies on all counts even though volume growth may have improved. Most companies reported multi-quarter low margins, muted realisations and escalated cost pressures.

ACC, now part of the Adani Group, reported a 98 percent year-on-year dip in EBITDA/tonne due to higher power and fuel costs and a 2 percent increase in realisations.

Ambuja Cement’s EBITDA/tonne declined 62 percent YoY and 53 percent sequentially.

Shree Cement succumbed to pressure, while Ultratech Cement fared relatively better than its peers.

Dalmia Bharat put up a relatively decent show as far as volumes and realisations were concerned, but reported a decline in unitary EBITDA performance.

Indian cement industry had been expected to report an eight-year low EBITDA/tonne, with the year-on-year decline being the steepest in 10 years, according to a report by Jefferies dated October 7. The actual numbers turned out to be more or less in line with the estimates, except for ACC and Ambuja.

A post-earnings note by Jefferies said EBITDA/tonne was the lowest in almost two decades for ACC and an 18-year low for Ambuja Cement. The margin was a seven-year low for Dalmia Bharat, a six-year low for Shree Cement, and a three-year low for Ultratech Cement, Jefferies said.

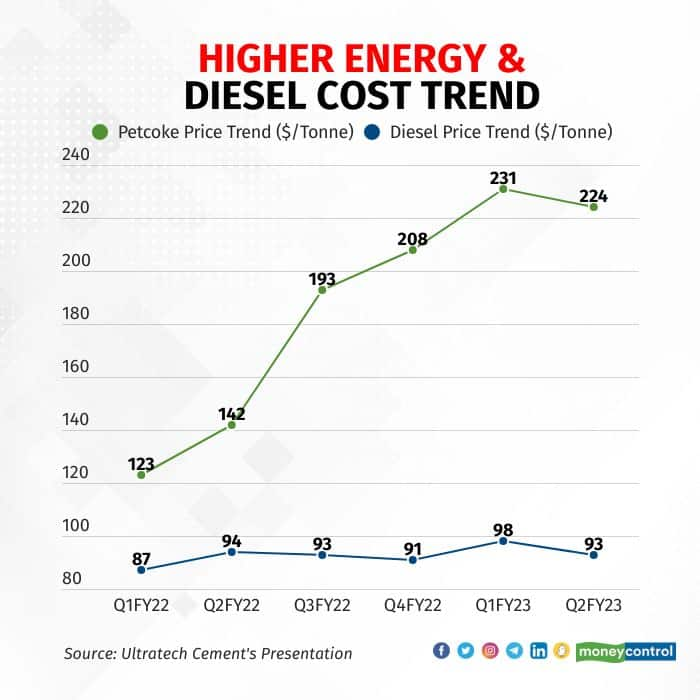

Higher energy costs

The cement companies were hurt by the increase in input costs. A sharp rise in prices of pet coke, a by-product of oil refining that is used in cement kilns, and freight costs that escalated due to higher diesel prices weighed on the financials of most cement companies.

Pet coke prices rose as much as 57.8 percent from a year earlier, while diesel prices climbed 1.1 percent, according to a presentation by UltraTech Cement. Sequentially, both diesel and pet coke prices declined.

“We have had significant cost pressures in the recent past due to steep fuel price rise. However, the recent cooling off in energy costs will impact us positively in the coming quarters,” B Sridhar, CEO of ACC, said in its earnings statement.

Peaked out?

Most cement companies expect the second half of FY23 to be better as demand picks up from November as construction resumes after the monsoon and the industry increases prices to ward off cost pressures.

“The July-September quarter was the peak cost and we should start seeing a marginal reduction in our consumption costs in the next two quarters,” Atul Daga, chief financial officer of UltraTech Cement, said on an earnings call. A price hike due to margin pressure is also expected.

“In the next six months, as volumes go up and as the cost of purchase of fuel stabilises, the company’s working capital will go back into the negative working capital zone, before the end of this fiscal year,” Daga added. “There is no reason why the industry will not take prices up since margins are continuously under pressure.”

However, the key question is whether the worst is really behind the industry, which has faced continuous margin erosion.

“Overall operational profitability is set to see a marginal improvement on a sequential basis in the next two quarters on the back of recent price hikes taken over September and October,” Hetal Gandhi, director of research at CRISIL Market Intelligence and Analytics, told Moneycontrol. “Prices are likely to increase in the near term on the back of a demand uptick post the festive season, along with increased cost pressure.”

However, Gandhi said this would not be enough to cover the increase in power and fuel costs, as thermal coal prices remain high, with International Coal (FOB Australia) crossing $430/tonne in October.

Domestic pet coke prices increased by 15-20 percent in October after cooling in August and September, he said. Thus, although margins are expected to recover marginally on a sequential basis, they are likely to remain well below fiscal 2022 levels, shrinking overall margins by 300-400 basis points for fiscal 2023, he added.

Jefferies, in a report dated November 1, suggested that cement prices increased 2 percent in October on a month-on-month basis, above the Q2 average. Pet coke prices were stable compared to the previous month, it said. South Africa coal prices still remain elevated on a year-on-year basis.

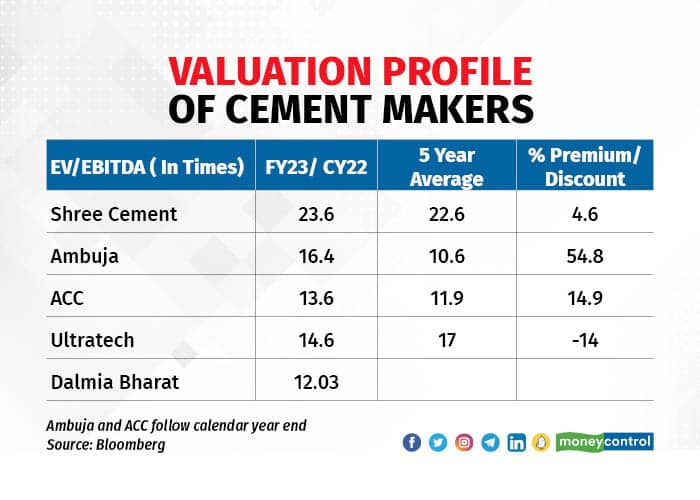

Valuation levels

Even as the Q2 financials of Ambuja Cements and ACC, the two Holcim group companies that Adani acquired, disappointed analysts, both companies commanded a premium over their five-year valuation average.

The premium was the highest for Ambuja Cement, followed by ACC. The valuation premium for Shree Cement disappeared, while UltraTech Cement is at a discount.

Following the acquisitions of ACC and Ambuja, Adani became India’s second-largest cement manufacturer with their combined capacity of 67.5 million tonnes per annum.

“The new combined entity is best placed to play industry fundamentals given its scale and growth optionality along with cost curve placement, which has led to the premium of these cement majors,” said Ritesh Shah, a research head mid-market coverage at Investec Capital Services (India).

Shree Cement’s valuations narrowed due to its declining RoE even as its UAE venture remains a drag. For UltraTech Cement, the multiples stand explained by the reset on lower growth multiple with the entry of Adani in the marketplace, he said.

Investec downgraded Shree Cement to a ‘sell’ rating and prefers large caps – Ambuja Cement and Ultratech Cement – that are aligned with long-term themes of consolidation, sustainability and ESG (environmental, social and governance) norms.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.