Over the past decade, India’s electricity demand has grown from 135 gigawatt (GW) in 2013 to 240 GW in 2023 while the energy shortage reduced from 4.2 percent in FY14 to 0.2 percent in FY24.

However, the country’s power demand is likely to touch 335 GW, which will be a challenge for the government in terms of keeping electricity affordable and accessible.

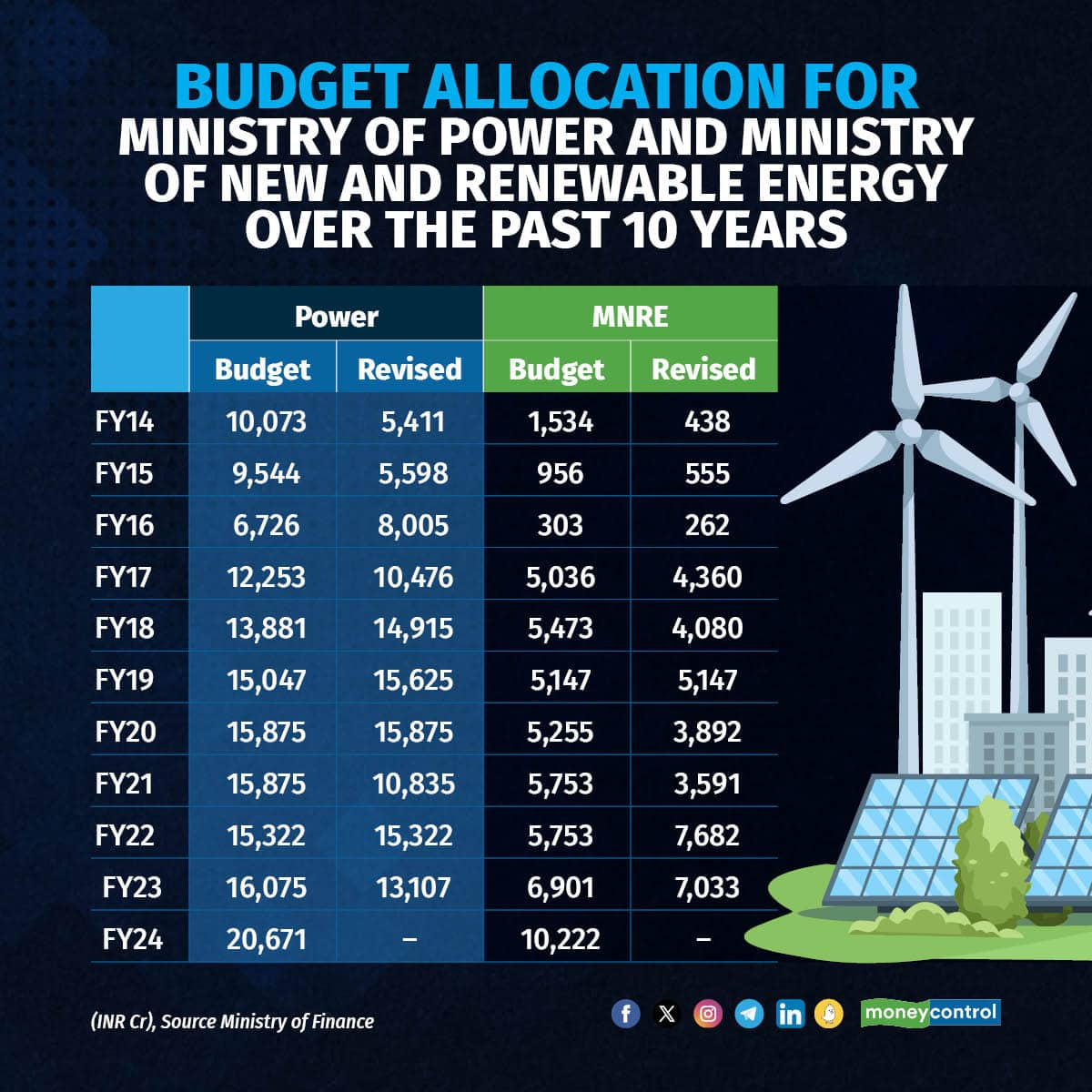

Budget allocation for the power sector in the past decade.

Budget allocation for the power sector in the past decade.

To meet the growing demand, the government has announced to continue relying on coal with nearly 80 GW of new coal-fired capacity planned by 2030. This will be done simultaneously as India’s renewable energy and hydropower capacities grow. The government has announced an ambitious target of having 500 GW installed capacity from renewable sources alone.

“The Indian power sector has come a long way in the past decade, transforming India from a power deficit to a power surplus nation. During the period from 2014-15 till now, we have added 97,501.2 MW in the conventional power sector and 96,282.9 MW of renewable energy capacity in the country. We have increased the generation capacity by 70 percent from 248,554 MW in March 2014 to 425,536 MW in October 2023,” said Union Minister for Power and New and Renewable Energy RK Singh in a statement to Moneycontrol.

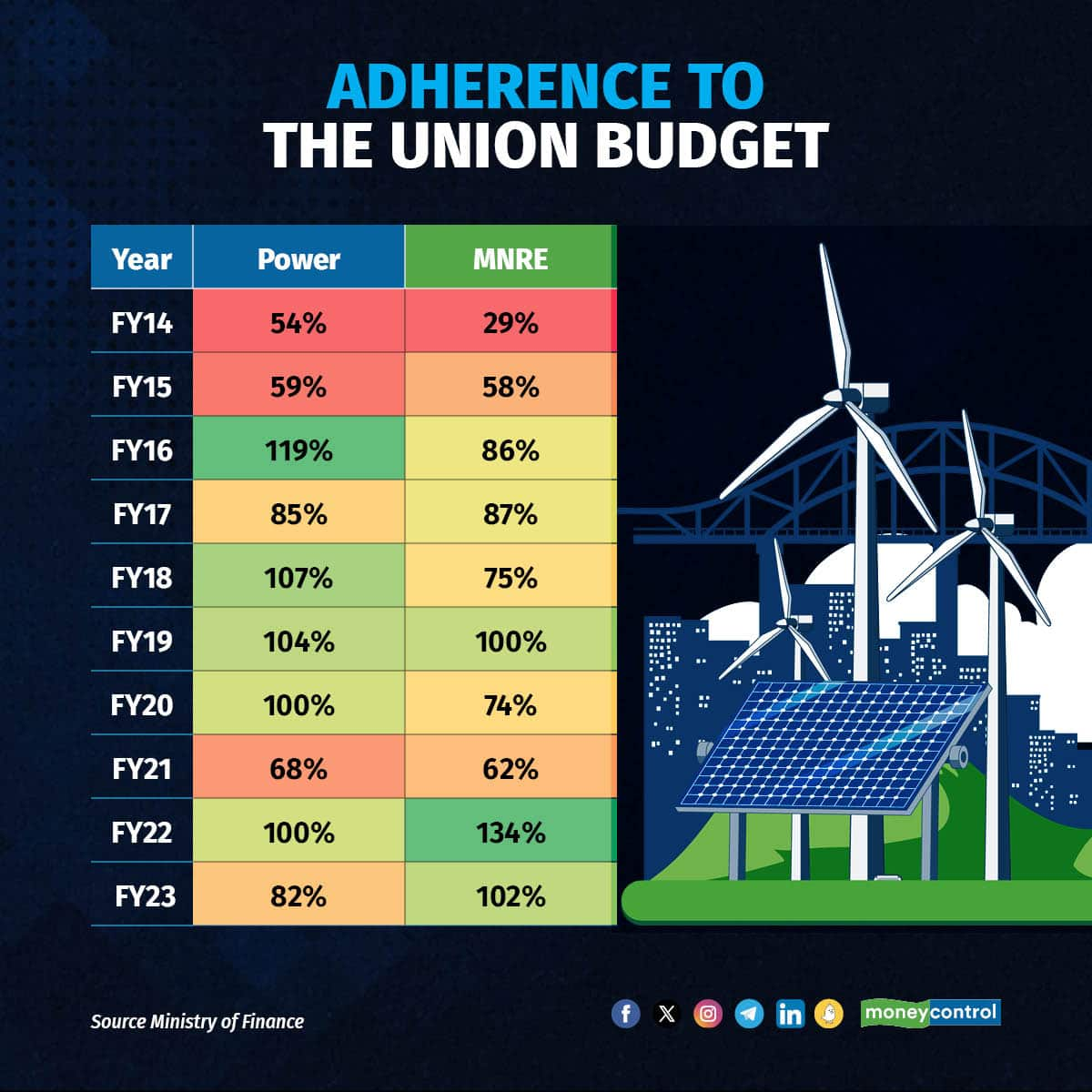

Budget utilisation in the power sector in the past decade.

Budget utilisation in the power sector in the past decade.

However, there were segments which slowed India’s power sector growth. Moneycontrol looks at the key hits and misses in the power and new and renewable energy sectors over the past 10 years.

Hits

Rights of Consumers: The government notified the Electricity (Right of Consumers) Rules, 2020, which for the first time included distribution companies (discoms) compensating consumers for any unscheduled power cuts. The rules lay down time limits within which discoms are supposed to provide services to the consumers.

Making Power Sector Viable: Policies such as the Electricity (Late Payment Surcharge and Related Matters) Rules, 2022 and the Revamped Distribution Sector Scheme (RDSS) have addressed the issue of mounting dues of state power utilities and reduced aggregate technical and commercial (AT&C) losses. Legacy dues owed by discoms to gencos have come down by 63 percent from Rs 1.396 lakh crore to Rs 51,268 crore. AT&C losses of discoms came down from 22.62 percent in 2013-14 to about 14 percent in FY23, according to provisional data prepared by the Ministry of Power.

Scaling up renewable energy: The allocation to the new and renewable energy sector increased 99 percent to Rs 10,222 crore in 2023 from Rs 956 crore in 2014-15. Between 2013-14 and now, India’s installed pure renewable energy capacity (excluding hydropower) has almost quadrupled to reach 132 GW from 28 GW in 2013-14.

National Green Hydrogen Mission (NGHM): Since renewable energy alone would not be enough to meet India’s energy needs, the central government has attempted to get into new energy sources such as green hydrogen. The Union Cabinet approved the NGHM on January 4, 2023, with an initial outlay of Rs 19,744 crore, including Rs 17,490 crore for incentives. The government’s aim to produce at least 5 MMT of green hydrogen annually by 2030 under the NGHM would require 60-100 GW electrolyser capacity and 125 GW renewable energy.

Misses

Transmission lines to keep up with mass RE generation: The government had planned to augment transmission networks for the evacuation of power from major upcoming renewable energy projects. But over the years, these projects comprising 3200 circuit kilometres of inter-state transmission corridor and 9,700 ckm intra-state transmission corridor have languished. It was only in December 2022 and in 2023 that the government announced creating Green Energy Corridors for the evacuation of RE.

Delayed focus on creating manufacturing capacities: Everything from solar cells, modules, wafers, ingots, and polysilicon used in solar projects was being imported, primarily from China, until a steep basic customs duty was imposed from April 2022. But even after the duty and the government introducing PLI schemes to boost solar manufacturing, there are only a few fully integrated solar module manufacturing units in India. There remains a huge gap in domestically produced parts for solar modules amid demand to set up solar plants.

Lack of R&D: The government has lacked in pushing for R&D. There are no incentive schemes or funding for R&D – be it in the renewable energy sector, emerging energy storage or green hydrogen space. It has mostly left it to the private sector.

PM KUSUM, Rooftop Solar and Solar Parks: The past decade also saw a number of central government schemes which did not do well. The progress of the Rs 1.4 trillion Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan Yojana (PM-KUSUM) scheme has been marred by the pandemic, lack of required funds, and awareness. As a result, the government is planning to end the scheme in FY25 with no budgetary grant. For the Solar Parks scheme, the government had targeted 40 GW of capacity, but only 10 GW has been achieved so far. The Rooftop Solar programme is also far behind the government’s target of achieving 40 GW installation by 2022. The installed capacity of residential rooftop solar is only 11 GW so far.

What should the government do?

Disha Agarwal, Senior Programme Lead, Council on Energy, Environment and Water (CEEW) said future budgets must increase allocations for upskilling workforces to match industry requirements and R&D initiatives, government-backed credit enhancement schemes to attract increased investments in new clean energy projects.

“The government’s agenda should also include fiscal and financial incentives for making decentralised energy solutions and energy storage products affordable for end-consumers, she said.

Deepak Chowdhury, Partner, IndusLaw, said India’s dependency on import of majority renewable equipment has to be reduced. “The government should increase its focus on the development of R&D of all major equipment, give tax incentives for local manufactures, easy access to financing at competitive interest rates,” he said, adding that there also has to be an increased focus on the growth of evacuation infrastructure.

Rationalising power tariff based on market intelligence is another aspect which the government must focus on,” Chowdhury said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.