Year 2022 was marked by numerous "once-in-a-blue-moon" events — a war between Russia and Ukraine, the biggest conflict in Europe post World War II, consumer price inflation in developed markets at four-to-five-decade-high eclipsing emerging markets, an almost unprecedented pace of synchronised rate hikes by global central banks that decimated the bond markets, currency movements that made the US dollar almost the only winner, and a commodity boom and bust in the same year.

The Global Equity Markets

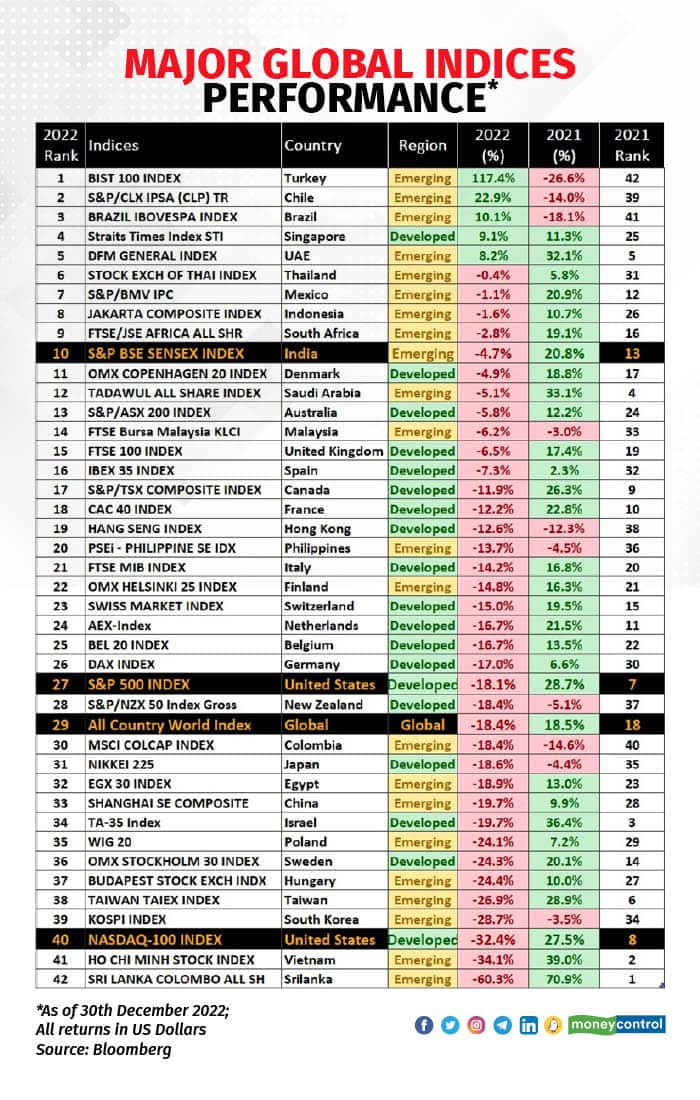

This is how the equity markets performed in US dollar terms. The picture isn't pretty.

India was down 4.7 percent in US dollar terms, but was a clear outperformer as we'd predicted at the beginning of the year.

In 2021, it came out of a long period of underperformance, both relative to other markets as well as to its own history, and it was clear that this outperformance would continue for the year.

Sure enough, it ranked Number 10 out of 42 country indices.

Aggregate global markets were down 18.4 percent, the S&P 500 was down 18.1 percent, and the Nasdaq was close to the bottom of the list, with a decline of 32.4 percent.

Many of the outperforming countries were those with a considerable contribution of commodities to their economies and stock indices.

The other key takeaway

The giant wheel always turns & Recency Bias misleads. Markets that do well in one or two periods or years, often tend to underperform thereafter and vice versa.

The best-performing markets of 2021 like Sri Lanka, Vietnam, Israel, NASDAQ and Taiwan turned out to be the worst-performing markets in 2022. Also, the worst-performing markets of 2021, such as Turkey, Brazil, Chile, and Hong Kong became the best-performing markets of 2022.

This was a point I made when there was a slew of NASDAQ funds at the peak of the market in 2021, but few were willing to listen in those euphoric times.

Global currency moves

Currency and asset market tables make it clear that the smartest investment decision at the beginning of 2022 would've been to keep your money in greenbacks or a US dollar current account!

The US dollar ruled during 2022, appreciating over every major currency. However, it gave up some of its gains in the last quarter as the Euro, and Yen, among others, regained some of their lost gloss.

While the US dollar had its best year since 2015, rising 8.2 percent, the real winners were Latin American currencies (especially, Brazilian and Mexican), which gave a total return (including interest) of 15-19 percent in 2022. Towards the end of the year, the Bank of Japan widened the trading band on the 10-year government bonds, which sparked a huge pent-up rally in the yen, allowing it to cut its losses from as much as 30 percent to just 12 percent on the year.

The Indian rupee was down 10 percent plus. Not surprising for us as I had been predicting this from the end of 2021, at a time when almost no one else had even focused on currency as a relevant variable. The writing was on the wall as the Reserve Bank of India (RBI) started its rate-hike cycle several quarters after many other emerging markets did. As I had predicted when the rupee was 74-75 to the dollar that 2022 will be when it would crack its range of 73-75.5 where it had been for the last few years. It played out exactly that way.

The All-Asset Picture

These turbulent times provided a humbling experience to multi-asset investors who have always been bailed out by bonds when equities crashed. Overall, the asset markets were a sea a red ― almost the only exception being energy and some agricultural commodities.

In 2022, global equities and bonds witnessed a more than 10 percent decline simultaneously, which was unprecedented in the last three decades.

Contrary to conventional wisdom, "cash was not trash" during this latest spurt of high inflation. The ‘There Is No Alternative’ (to equities/risk assets) or the TINA phenomenon, which was the characteristic of the markets due to years of declining interest rates (till they were even negative in several countries), is now no longer the case, as US treasury yields, the safest investment option out there, have seen dramatic surge, from less than 1 percent to more than 4 percent over the last one year.

Within equities, Latin American stocks held their ground (-1 percent) due to their resource-rich nature and the fact that the central banks of Emerging Markets were ahead of the curve relative to central banks of Developed Markets when it came to the rate-hike cycle.

Meanwhile, European equities wiped out the entire war risk premia and outperformed the US markets by about 1 percentage point by the year end, despite the tremendous rally in the US dollar (+8.2 percent).

Global bonds plunged 16 percent, their worst performance in decades, as inflation rocketed to unexpected levels, real yields (nominal yields minus expected inflation) rose amidst aggressive interest rate increases, and credit spreads widened, along with tepid risk sentiment and drying liquidity. Cash was king.

Looking at commodities, only energy managed to remain in the green for the calendar year, along with a few agricultural commodities.

Both precious and industrial metals gave up all gains after a great first half.

In FX, the theme was marked by a race to the top (in rate hikes) by central banks across the world, as a depreciating currency was bound to add fuel to the inflation fire.

In terms of synchronised bad news across asset classes, 2022 was among the worst years ever. As the wheel turns once again, there should be better days ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.