Banking industry experts on June 25 warned that the Telangana government's recent announcement of a farm loan waiver could lead to asset quality issues and hit the credit culture of a wider section in other states who may make similar demands. A loan waiver simply means the government asking banks to write off the dues of a large number of borrowers at one go, with the promise of compensating the lenders from its own coffers.

On June 21, Telangana chief minister A Revanth Reddy announced that up to Rs 2 lakh each owed to banks by farmers in the state would be forgiven. Following this, farmers in states like Punjab and Maharashtra too have raised similar demands.

Also read: Farmers' Protest: Why was farm loans waived only twice since Independence? Experts see a vicious cycle

Explaining the effects of such a move on the larger credit culture, Prabhakaran S, business head, business banking group - micro small and medium enterprises (MSME), agriculture and priority sector lending, RBL Bank, said that the direction farm loan waiver schemes move is not good in the long term. “Knowing that the government will announce loan waivers pre-elections, some farmers would delay the payment, which could affect the credit cycle. This hurt the repayment structure too,” Prabhakaran said.

Karthik Srinivasan, group head, financial sector ratings, ICRA, expanded on this. “There are concerns on the collection side where borrowers wrongly interpret the waiver schemes. This results in delay and hence creates near-term challenges,” Srinivasan said.

How do loan waivers work?

Farm loan waivers are good for politics, but they make a dent in economics. They spawn dreams for ambitious leaders but are no less than a nightmare for banks. Such debt cancellations severely impact the credit culture of a large geography, encouraging even borrowers who regularly meet repayment commitments to hope for a waiver of their liability. Besides mounting liabilities on the government's books, there is an inevitable impact on the credit culture both for the borrower as well as for the bank.

Also read: Loan waiver neither good for borrowers, nor for banks, but a big bait in polls

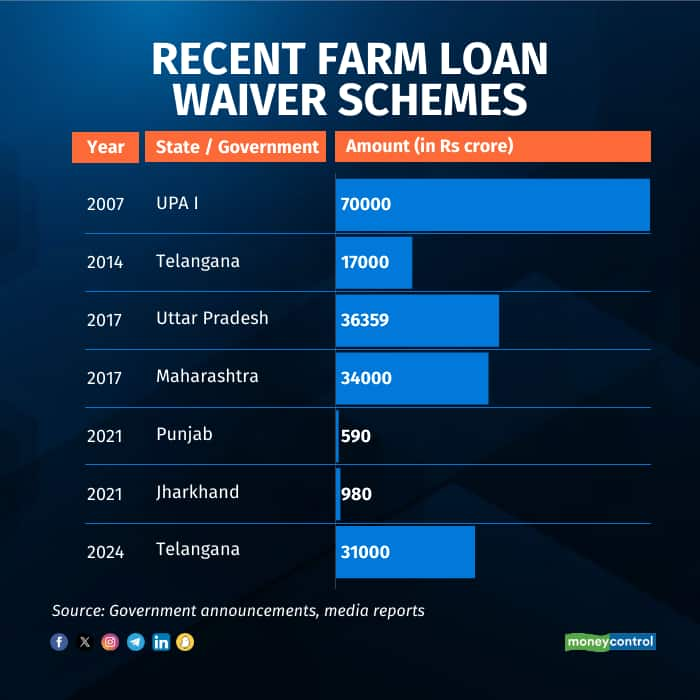

One of the largest such exercises was in 2007, when the then United Progressive Alliance (UPA) government announced a Rs 70,000-crore agricultural loan waiver across the country. This is over and above periodic waivers declared by several state governments.

In 2014, Telangana waived Rs 17,000 crore in farm loans to 36 lakh beneficiaries. In 2017, the government in Uttar Pradesh announced a Rs 36,359-crore loan waiver for small and marginal farmers for loans of up to Rs 1 lakh. In the same year, the Bharatiya Janata Party (BJP)-led government in Maharashtra announced a Rs 34,000-crore farm loan waiver, titled the Chhatrapati Shivaji Maharaj Shetkari Sanman Yojana, which wrote down loans up to Rs 1.5 lakh.

In the wake of the latest such instance by Telangana, farmers in Punjab and Maharashtra have demanded they be given a similar deal. Farmer forum Kisan Mazdoor Morcha convener Sarvan Singh Pandher said: “We welcome the waiver by Telangana govt and urge central and Punjab governments to waive farm loans of Punjab farmers.” Punjab had such a scheme in 2018 but only 5.63 lakh farmers could avail of the Rs 4,610-crore waiver, Pandher said.

Maharashtra state Congress unit president Nana Patole demanded the Shiv Sena-BJP government declare a loan waiver for farmers in the legislature session beginning in Mumbai on June 27 along the lines of Telangana.

What is the impact on banks?

In 2019, some of the biggest state lender’s saw a massive spike in their gross non-performing assets (GNPAs). State Bank of India’s GNPA ratio spiked from 5 percent in 2016-17 to almost 14 percent in September 2019. Bank of India's agricultural NPA touched 17 percent and IDBI Bank’s GNPA reached 15 percent over the same period. At the same time, a Reserve Bank of India (RBI) internal working group report to review agricultural credit said that the NPA level has increased for all states that had announced farm loan waiver schemes in 2017-18 and 2018-19.

Also read: Jharkhand govt to waive farm loans up to Rs 2 lakh

The RBI's sectoral credit data, which shows the total amount lent by banks to different sectors, showed that banks’ lending to agriculture grew by 19.7 percent on a year-on-year basis. As of April 2024, banks' total credit to agriculture stood at Rs 21.14 lakh crore versus Rs 17.65 lakh crore last year.

Prabhakaran highlighted another fallout on banks. “The delay in payments by farmers affects lenders’ recovery cycle as well,” he said.

However, Srinivasan pointed out that there is a caveat. “Banks don't end up on losses as the government pays them. But there is some delay,” he said.

Moneycontrol reached out to some top lenders for their comments. The story will be updated with their comments.

Caution from regulators

The RBI in December last year cautioned against misleading advertisements on loan waivers. The central bank said that some entities were promoting campaigns in the print media as well as social media platforms and charging a service fee for issuing debt waiver certificates without any authority.

Goverdhan S Rawat, the deputy chairman of National Bank for Agriculture and Rural Development or NABARD, the apex body of regional rural banks, state cooperative banks and district central cooperative banks, had earlier warned about the impact of loan waivers. Rawat, while citing a report titled ‘Farm Loan Waivers in India: Assessing Motives, Challenges and Impact on Farmers in Selected States’ conducted by Bharat Krishak Samaj in 2021, stressed the indirect effects of farm loan waivers on agricultural credit targets and lower lending in the subsequent years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.