Many of India’s fintech non-banking finance companies (NBFCs) managed to grow in FY25 at the cost of shrinking margins, weighed down by costlier funding and compliance-related expenses, coupled with the fact that lending to riskier segments, all of which weighed on their performance. Now, improved underwriting and collections, along with GST cuts are expected to boost customer demand, which is driving hopes of a better year.

The rising delinquencies among the micro, small and medium enterprises (MSMEs), as well as the unsecured loans in FY24 forced many NBFCs to make higher provisioning for the non-performing assets in FY25, leading to lower profits.

“There was pressure from banks to make higher provisioning for bad loans for them to be comfortable lending to NBFCs in FY25 and FY26,” said a founder of a fintech firm working in the space, requesting anonymity.

Banks remain the key source of funding for NBFCs, and the higher credit cost and lower liquidity at banks remain a challenge for the companies, hurting their bottom line even more. For fintech NBFCs, some of the capital constraint was addressed by the venture capital and private equity funding they raised, but the core underlying issues remained.

However, many NBFCs are hopeful of recovery in FY26 after the central bank’s rate cut earlier this year and the recent GST rate cuts, that is expected to improve the fundamentals.

“Most of the structural stress is now well-recognised and provided for. The sector has absorbed a tough provisioning cycle, tightened risk practices, and recalibrated growth expectations,” said Gaurav Kumar, founder and CEO of Yubi told Moneycontrol.

Yubi is a credit marketplace that connects MSMEs with lenders. Kumar added that while challenges remain, the overhang of uncertainty is reducing.

“The sector looks better positioned than it did in the last 12 months barring MSME linked to the consumption sector,” he added.

Sarvagram, DMI Finance, Lendingkart Finance, Keertana Finserv, Neogrowth Credit, and Moneywise Financial Services are among the NBFCs that saw their net profit fall during the last fiscal.

According to credit rating agency ICRA, microfinance, personal loans, credit cards and unsecured business loans - accounting for 28% of retail NBFC credit in December 2024 - witnessed higher stress in FY25, leading to elevated delinquencies and write-offs.

For many lenders, expanding loan books and higher income have not translated into healthier bottom lines in FY25. Instead, higher credit costs, elevated employee expenses, and funding pressures have weighed on profitability.

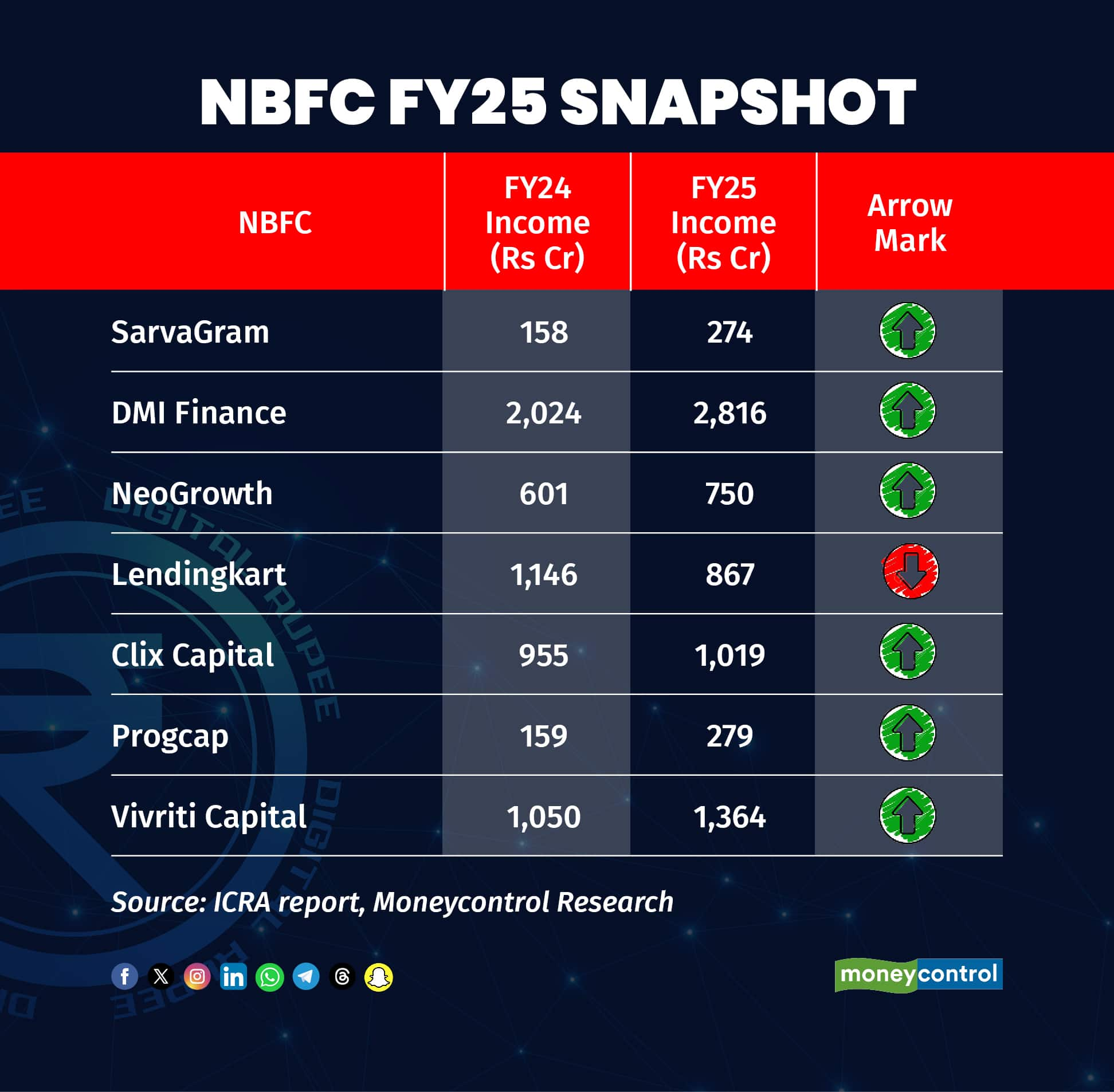

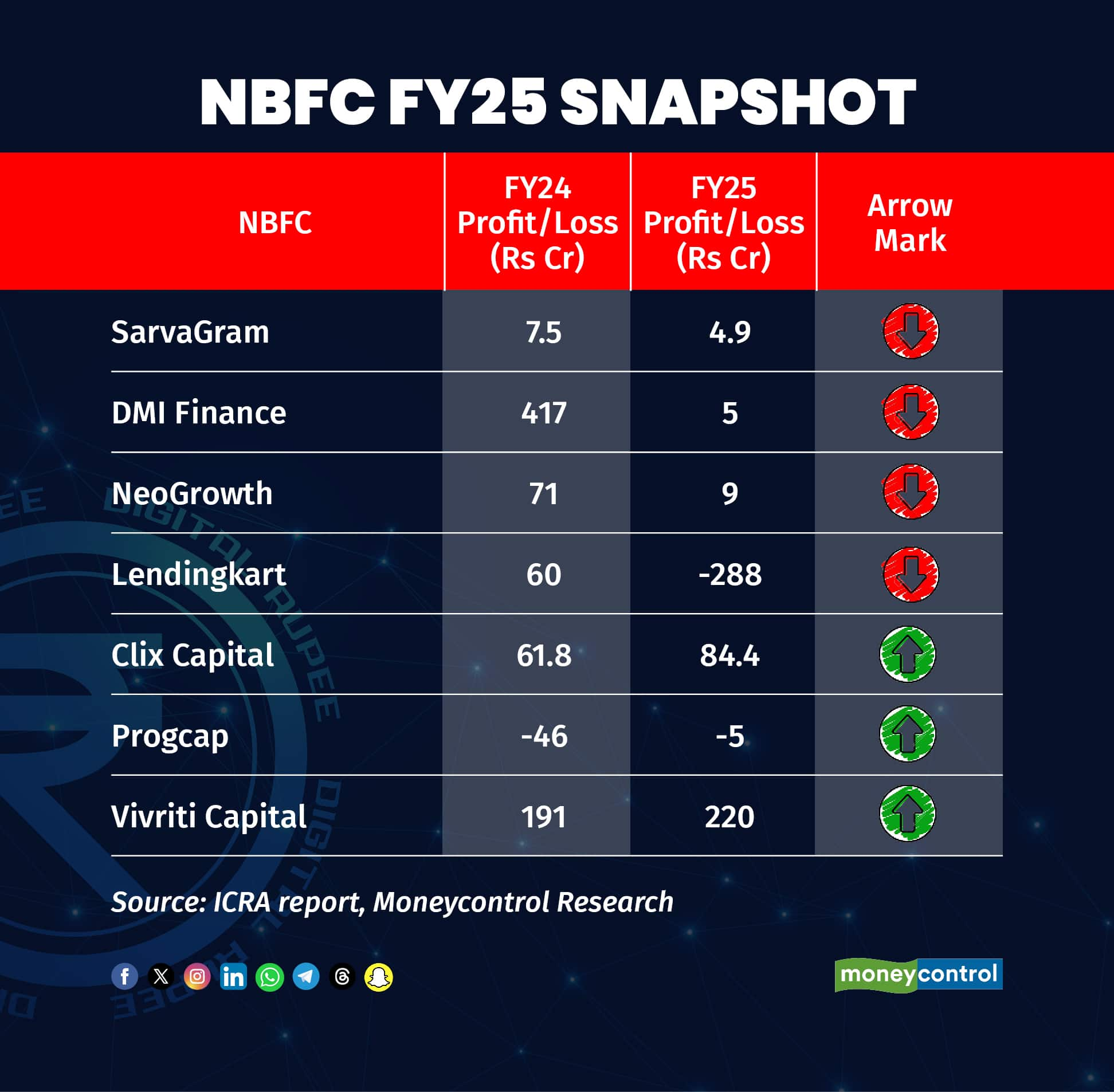

Rural fintech lender SarvaGram Fincare’s total income jumped 74 percent on year to Rs 274 crore in FY25, supported by a 60 percent rise in managed assets to Rs 2,136 crore. Yet, standalone net profit fell to Rs 4.89 crore from Rs 7.56 crore in FY24 as higher employee costs and provisioning dragged earnings lower.

For DMI Finance, which has pivoted from builder loans to digital retail lending, FY25 was equally challenging. Operating income rose to Rs 2,816 crore from Rs 2,024 crore in FY24, but profit after tax plunged to just Rs 5 crore from Rs 417 crore. Its total managed assets also slipped to Rs 12,239 crore from Rs 14,520 crore, reflecting tighter balance sheet conditions.

NeoGrowth Credit saw income rise to Rs 750 crore in FY25 from Rs 601 crore a year earlier, but profits shrank to Rs 9 crore from Rs 71 crore.

Lendingkart Finance, which focuses on unsecured SME loans, reported one of the sharpest reversals, with a net loss of Rs 288 crore in FY25 compared to a profit of Rs 60 crore in FY24. The income too dropped to Rs 867 crore from Rs 1,146 crore, underscoring the pressure in MSME segment.

Moneywise Financial Services, part of SMC Global, reported a profit of Rs 46 crore in FY25 compared to Rs 56 crore in the previous year despite a rise in income.

New segments, higher risk“NBFCs are expanding into riskier segments like rural credit and unsecured SME loans, and that means provisioning is higher. At the same time, employee and compliance costs are climbing as companies scale. It’s not surprising that profits are under pressure,” said one founder requesting anonymity.

Funding cost was one of the key factors for many NBFCs, even though the RBI reversed its credit risk weight ratio in FY25. The interest rates remain elevated as banks struggle to attract deposits, as several consumers choose to put their savings in equity markets and mutual funds.

With banks aggressively targeting the same customer segments, the digital-first NBFCs saw technology investments adding to operating expenses, further compressing spreads or margins.

Venture investors, who have backed many of the new-age fintech NBFCs, admit that the sector is at an inflection point.

“Growth capital alone is not enough anymore. Investors are looking closely at unit economics and profitability. The last year has shown us that revenue growth without strong credit governance is not sustainable,” said a partner at a venture capital fund that has invested in SME lenders.

Silver lining, new learningsA few lenders have managed to grow profitably.

Clix Capital managed to improve profitability, with income rising to Rs 1,019 crore in FY25 from Rs 955 crore and net profit increasing to Rs 84.4 crore from Rs 61.8 crore. Similarly, Aye Finance have managed to keep the net profit stable even as they grew the topline by 40 percent.

Progcap, which finances retailers and distributors, narrowed its consolidated loss to Rs 5 crore from Rs 46 crore while income grew to Rs 279 crore from Rs 159 crore. Its lending arm even turned profitable with a PAT of Rs 12 crore.

Among the larger names, Vivriti Capital saw its income rise to Rs 1,364 crore in FY25 from Rs 1,050 crore, while profit after tax climbed to Rs 220 crore from Rs 191 crore. Assets under management expanded to Rs 11,003 crore from Rs 9,521 crore.

“It is difficult to say that a lot of them are struggling. Some of these fintechs were experimenting with new lending and underwriting models using technology, as that is their strength. It was their call to test market with newer segments and models. Some of which have worked,” said Shyam Srinivasan, senior advisor to TVS Capital, an investment fund.

Srinivasan, who earlier worked with private sector lender Federal Bank as its managing director for 14 years, said that the results have helped companies make calls to alter their path, stop and even correct the direction based on the evidence.

NBFCs can no longer rely solely on rapid AUM growth to impress stakeholders. Profitability, asset quality, and prudent provisioning are now being seen as more reliable markers of resilience, say venture capital investors in the segment.

The GST boostThe recent GST rate cuts set to take effect from September 22 are likely to boost the sector’s prospects.

“The combination of improved underwriting discipline, better collection efficiency, and relatively benign macro indicators should translate into a stronger second half during FY26. The changes to the GST should leave more in the hands of customers in this segment,” said Kumar of Yubi.

Industry watchers expect a phase of consolidation, where stronger players with healthier balance sheets and access to capital markets will pull ahead, while smaller or weaker NBFCs, especially those focused on unsecured lending, may be forced to rethink their strategy or seek partnerships.

“Sometimes everyone chases the same segments but faces pricing issues. Some had different outcomes. But this cycle happens in lending. A few big-ticket lenders entered small-ticket lending and vice versa. The lending model changes and evolves with their experience,” Srinivasan added.

Improved collection infrastructure, sharper risk filters, and the benefit of tightened origination practices over the last 18–24 months are expected to show results.

While stress pockets remain in certain unsecured SME and consumption-linked segments, most fintech NBFCs expect this will turn around after the GST cuts improve customer confidence.

“Some of the microfinance stress is also on account of consumption, which has definitely moderated demand, especially in discretionary and capex-driven SME segments,” Kumar of Yubi added.

While MSMEs are cautious, with many adopting a wait-and-watch approach before committing to expansion, the underlying credit appetite is intact and should revive as consumption cycles turn, the companies said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.