September series began on a positive note as the Nifty moved closer to the psychological 10,000-mark despite sluggish economic growth in Q1FY18, driven by autos (after strong August sales data) and pharma stocks. Positive global cues also led support to the market.

Analysts feel, historically, September has been a trending month for the market that is closer to its record high; hence, it will be an interesting month to watch for. They don't rule out new highs in the current month.

"The market will remain solid on a sustainable path, with minor corrections as investors believe in structural reforms being carried out in the country," Vikas Khemani, President and CEO, Edelweiss Securities, said in an interview to CNBC-TV18.

“The potential of the economy growing at 8-9 percent, inflation going down, other markets not giving good returns is all making the market ignore short-term pain. Plus, domestically, money is coming in from investors in terms of financial assets,” he reasoned.

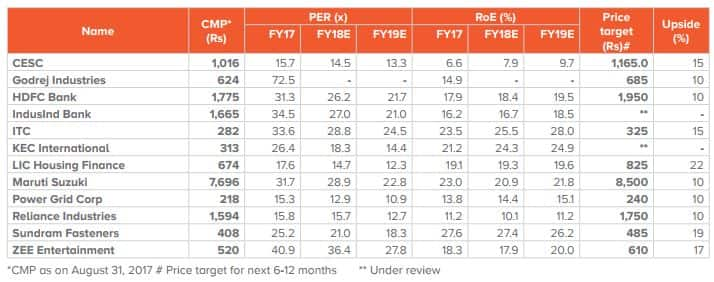

Meanwhile, brokerage house Sharekhan said that its top picks portfolio managed returns of around a percent against a fall in the overall market.

“This month, we are suggesting only one change in the folio. We are taking home profits in L&T Finance Holdings and replacing it with LIC Housing Finance,” it said in a report.

Here’s a look at top picks from the broking firm and its views on it.

1. CESC | Target: Rs 1,165 | Upside: 15%

The broking house said that given the steady and regulated business line of the company, it sees CESC posting 10% CAGR in profits for FY2017E-FY2019E. However, the recent diversification into unrelated businesses such as IPL franchisee would hurt its valuations.

Also, the rejig is “…a positive for minority shareholders, as it will unlock value in the cash flow-rich power distribution business and enable CESC to sell or bring in a strategic partner into the loss- making retail subsidiary (Spencer’s), which is on a recovery path,” it said in a report.

2. Godrej Industries | Target: Rs 685 | Upside: 10%

Sharekhan said that the company was one of the largest players in the oleo chemicals and surfactant segments. Additionally, Nature’s Basket is another emerging business under its portfolio.

“With businesses such as FMCG and real estate attaining a critical scale, GIL is expected to witness a strong earnings growth trajectory. The value unlocking in Godrej Agrovet will further enhance GIL’s overall market value,” it said in its report.

3. HDFC Bank | Target: Rs 1,950 | Upside: 10%

The brokerage house believes that going forward, economic recovery and improvement in consumer sentiment would be positive growth drivers for the bank’s loan growth, which will in turn drive its profitability.

Further, it said that the lender was well placed to tap growth opportunities on the back of strong capital ratios, healthy asset quality and steady revival in consumer spending. It also believes that HDFC Bank could maintain healthy RoE of 18-20% and RoA of 1.8% on a sustainable basis.

4. ITC | Target: Rs 325 | Upside: 15%

The stock, Sharekhan said, corrected sharply after the hike in cess rate and is currently trading at 24.5x its FY2019E. “We believe the discounted valuations have priced in all the near-term negatives and do not expect substantial fall in the stock price from the current level,” it said in its report.

Speaking on the cess hike, it said that the taxation could put pressure on cigarette sales volume in the short term, but price hikes would help maintain margins of the cigarette business on a YoY basis. On the other hand, non-cigarette FMCG business is expected to maintain good growth momentum, it added.

5. LIC Housing Finance | Target: Rs 825 | Upside: 22%

Sharekhan placed its bet on the government’s agenda of affordable housing by way of providing interest subsidy on small home loans. This, it said, could help the company to take up opportunities in this segment as well.

“We expect the stock to be among the better placed non-banking finance companies to grab a pie of the increased housing demand due to a favourable interest rate environment, the government’s push for housing for all and a strong pan India network,” the report added.

6. Maruti Suzuki | Target: Rs 8,500 | Upside: 10%

Citing its successful establishment in the big car segment, Sharekhan said that Maruti was its top bet in the space. The big car category was led by strong product features and success of its premium distribution network Nexa, which offers a unique buying experience.

Moreover, the recently-launched premium hatchback, Baleno, and upgrade of Dzire have received a strong response, which will help Maruti to expand its market share in the segment. The compact sports utility vehicle (SUV) Vitara Brezza has also received an encouraging response, it highlighted.

7. Power Grid | Target: Rs 240 | Upside: 10%

Power Grid has a very healthy balance sheet, sustainable earnings visibility, positive cash flow from operations and stable return ratios, Sharekhan said in the report.

In fact, after the infusion of equity through follow-on public offer in FY2014, PGCIL is now well capitalised to fund its equity side of the future capex. “Therefore, we do not see any dilution risk as of now. PGCIL’s stable, low-risk business model and healthy assured returns provide cushion to long-term investors,” the report added.

8. Reliance Industries | Target: Rs 1,750 | Upside: 10%

Reliance Industries, it said, commissioned the last crystallisation train (Train 3) of the paraxylene (PX) complex at Jamnagar. With this, RIL’s PX capacity has almost doubled to 3.7mmt (from 1.9mmt earlier). RIL has also fully commissioned its Ethane import

project and it expect the same to add $270 million to its EBITDA.

Going forward, it expects EBITDA/PAT CAGR of 23%/12% over FY2017-FY2019E, driven by the commissioning of core downstream projects in FY2018. “Any positive surprise in terms of better-than-expected financials of the telecom business would be an

important re-rating trigger for RIL going forward,” the report added.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

9. Sundaram Fasteners | Target: Rs 485 | Upside: 19%

Sharekhan said that the company substantially diversified its product portfolio over the past few years with the introduction of new products. This has helped the company to shield itself from over-dependence on fasteners, besides helping it to increase the

content per vehicle.

“A consistently strong performance and improved business prospects gives us ample confidence on the future prospects of SFL. We believe that sustained higher margins would result in the company’s return ratios remaining in excess of 25% going ahead,” the

report added.

10. Zee Entertainment | Target: Rs 610 | Upside: 17%

The brokerage house highlighted that the company expected domestic subscriptions market to grow at mid-teens for at least the next three years. The company plans to announce its strategy around digital in the coming quarter and will continue to invest in

over the top (OTT) content platform.

Moreover, for Q1FY2018, performance on both the advertisement and subscriptions revenue front was commendable, despite headwinds in the run up to GST rollout

It likes the company as it is a structural India consumption theme. Moreover, the company continues to invest across the media spectrum, including movies, music, events, digital and international markets, to maintain its high-growth trajectory.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.