The rupee on Thursday hit a fresh record low of Rs 70.82 against the US Dollar. The INR has depreciated by over 10 percent against the greenback and that has typically aided India Inc’s earnings.

A 10% INR depreciation boosts Nifty EPS by 3–4% (ceteris paribus), however, this has not played out perfectly in the past. During 2014–16, INR fell but outperformed peers while global growth faltered – a double whammy for metals and exporters.

INR is a tailwind to Nifty earnings, but its gains are likely to be partially offset by appreciation against EMs and higher foreign debt servicing.

The current situation is somewhere in between — the INR is falling but outperforming its peers with global growth holding up. This should benefit IT companies, followed by pharma, and potentially hurt companies with high foreign debt.

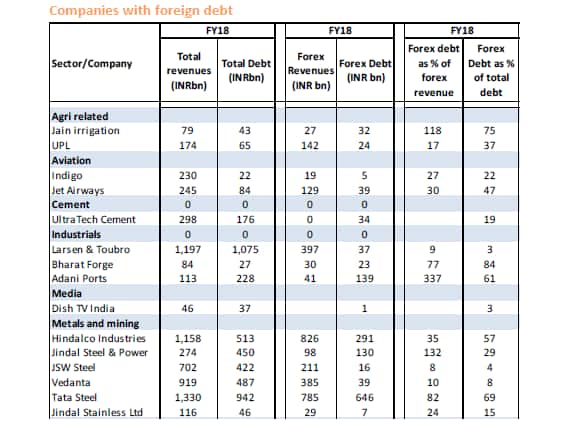

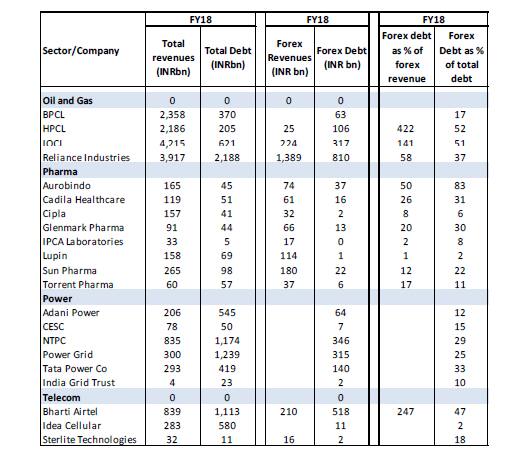

Companies with high foreign debt include names like Jain Irrigations, UPL, Indigo, Jet Airways, L&T, Bharat Forge, Adani Ports, Dish TV, Hindalco Industries, JSW Steel, Vedanta, Tata Steel, Cipla, Adani Power, CESC, Bharti Airtel, Sterlite Technologies, and Tata Power etc. among others.

In the last five-six years apart from the current one, there have been two notable episodes of INR depreciation:

A short-lived BoP shock with the INR being the worst-performing currency. Industrial metals and steel corrected by 15–20% while crude was largely stable.

The RBI put up an interest rate defence, thereby tightening domestic liquidity. Given that the shock was short-lived and the INR became competitive, it provided a boost to IT, pharma and commodity companies’ earnings.

Chinese yuan devaluation episode (2014–16):A big BoP shock for EMs while India witnessed sharp capital inflows. This resulted in INR outperforming peers and becoming uncompetitive. Delayed easing by the RBI resulted in a slowdown in nominal GDP/cash flows.

An uncompetitive INR along with a sharp global slowdown led to deflation and very little benefit to Indian IT, pharma and commodity companies.

Disclaimer: The views and investment tips expressed by Edelweiss Securities on moneycontrol.com are its own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.