Nitin Agrawal

Moneycontrol Research

With all domestic regulatory headwinds waning and pickup seen in demand for Class 8 trucks in the North American (NA) market, Ramkrishna Forgings (“RMKF”) is in a sweet spot as is evident from the strong set of numbers posted by the company for the second quarter of the current fiscal year. With the new press line, new products, increase in the market share, a revival in Class 8 trucks demand in NA, the company beckons investors’ attention.

Quarter in a nutshell

Strong volume and ASP growth

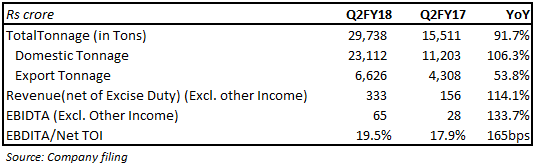

RMKF's volumes grew 91.7 percent (YoY) with domestic and export business recording a growth of 106.3 percent and 53.8 percent, respectively. The growth in the domestic business was mainly because of reduced regulatory headwinds and pick-up in the commercial vehicle demand after GST. The demand for the exports business was driven by uptick in demand for Class 8 trucks in North America.

Continuous enrichment of the product mix with leading OEM customers led to the 14 percent (YoY) rise in domestic and 17.5 (YoY) percent in exports realization. The management indicated that the export volume was on the lower side, sequentially, on the back of capacity bottleneck which it believes would be sorted out from the next quarter as they are focusing on automation and improving efficiency, which will free up 5-7 percent of the capacity.

Net operating revenues registered a very strong growth of 114.1 percent (YoY) on the back of rising substantial volumes and an increase in average realization.

Improved EBITDA margin

RMKF posted an expansion of 165 bps (YoY) points after it passed on raw material prices to the customer. Raw material prices as percentage of net operating revenues fell by 683 bps (YoY). This got partially offset due to lower inventory gains for the quarter as compared to the same quarter last year.

Is it an attractive investment proposition at the current valuation?

New products

RMKF develops over 150 new products per year as is evident from its track record over the last five years. Its focus is on increasing the content per vehicle and increasing its share in key OEMs. In Q2 FY18, the company received sample approvals for 133 new items, out of which 77 are for leading OEMs in India and 56 are for export. Additionally, it initiated development of 66 items in Q2, out of which 36 are for leading OEMs in India and 30 for export.

Strong tailwinds in domestic market

With many of the headwinds largely behind it, volume pick-up is happening, riding on the positive impact of GST rollout and government’s increased focus on infrastructure spending. With its new heavy‐tonnage press, the company is well-positioned to manufacture heavy‐ and critical‐forged products. Given its long-standing relationships with leading OEMs such as Tata Motors and Ashok Leyland, it continues to win fresh orders on the back of increasing content per vehicle and growth in demand in the commercial vehicle space.

Strong demand pickup in Class‐8 trucks in North America

After witnessing a sharp drop of 36 percent in Class‐8 truck orders in CY16, there is a strong demand pick-up. The demand for Class‐8 truck clocked a strong growth of 42 percent till date in calendar year 2017, which has augured well for the company as is evident from its quarterly results. As per Phillips Capital’s estimates, the demand for Class‐8 trucks would witness double-digit growth rates till 2019.

New press line – huge opportunity

RMKF has spent around Rs 700 million in setting up four new heavy presses with an aggregate capacity of 12,500-tonne per annum. This makes RMKF the only company after Bharat Forge to have such heavy press capacity. With the capacity utilization level of sub-30 percent in FY17, this free capacity provides a strong opportunity for the company. As per the management, the company is running on full capacity utilization.

Immune to EV

As per the management, the company is not affected by the move towards electric vehicles (EV). This is due to the fact that the products of RMKF are immune to EVs. In fact, the management indicated that it plans to work on aluminum forging for EVs.

Valuation leaves little room for comfortThe run-up in the stock price after the strong result for Q2 FY18 has made the business little expensive to buy at current levels. RMKF currently trades at 48 times FY18, 25.7 times FY19 and 16.7 times FY20 projected earnings. We would advise investors to capitalise on dips to build positions in the stock for the long-haul.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.