Nitin AgrawalMoneycontrol Research

Rajratan Global Wire (“RGW”), the second largest manufacturer of tyre bead wire (“TBW”) in India, and the only manufacturer and a sole supplier of TBW to various global players in Thailand (through its wholly-owned subsidiary), has witnessed its return ratio improving in the past three years on the back of debt reduction and improvement in the utilization of its Thailand plant. With marquee clients in its kitty, favorable market conditions in India and Thailand, and more than one-third market share here, the company deserves the attention of investors.

The Business

RGW manufactures two products: TBW, which has applications in all kinds of automobile tyres, tyres of earth moving equipment and aircraft; and high carbon steel wire, which has applications in many industries from construction and automobile to engineering industries. TBW is the largest segment of the company and contributes 88 percent of its revenues.

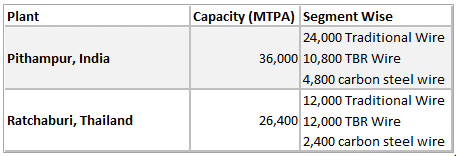

With a capacity of 36,000 MTPA, RGW is the second largest manufacturer (by capacity) of TBW in India. It along with its subsidiary in Thailand has close to 39 percent market share in Indian TBW market and supplies TBW to marquee clients - CEAT, Apollo, Balkrishna JK, MRF and Birla Tyres etc.

Favorable tailwinds

The company is well placed in the Indian market to capture the growth coming in the Indian automobile sector. The sector is currently facing tailwinds on the back of economic and political stability. Reforms such as demonetization, implementation of BS-IV norms and more recently the GST, had a short-term negative impact on the sector. However, the growth in the sector will kick in as re-monetization is now complete and companies have cleared their BS-III inventories and moved to BS-IV. Additionally, most of the companies have passed on the price benefit coming from the central tax regime - GST-- which is expected to fuel demand.

Thailand – A Catalyst for Growth

An important catalyst for growth is its Thailand subsidiary (Rajratan Thai Wire Company), where the company is the sole manufacturer of TBW in Thailand and captures around 20 percent domestic market share.

Thailand is one of the largest natural rubber producers and is expected to attract many global tyre players thereby increasing the size of the opportunity for RGW. Additionally, the probable imposition of anti-dumping duties against Chinese products may further increase market share of RGW in the local market.

Currently, RGW has 100 percent share in TBW supply to global players such as Otani Radial, ND Rubber, Siam Rubber, Hihero, Union, BKF & Camel. Additionally, RGW is preferred by many Japanese players and is the largest supplier of Sumitomo and caters to 40 percent of its bead wire requirement. It is also in the final stages of approvals to get into a similar agreement with Bridgestone.

Efficient sweating of assets

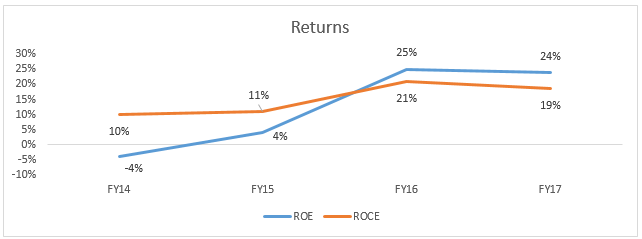

On the asset utilization front, the company has been able to consistently operate its Indian plant at an optimum utilization of around 82 percent and the utilization at Thailand plant has improved from 50.8 percent in FY14 to 77.8 percent in FY16. Additionally, the company has been able to improve its RoA (return on assets) from -0.9 percent in FY14 to 9.3 percent in FY17 on the back of improved utilisation.

Moreover, unutilised capacity gives the company the wherewithal to fulfill the demand for its product as the industry witnesses demand pick-up. To cater to the growing demand, the company has already chalked out capacity expansion plan. It has expanded the capacity in Thailand from 24,000 MTPA to 26,400 MTPA and has plans to expand it further by 9,600 MTPA over the next three years.

Ownership – Lends Comfort

Promoters have their skin in the game and hold around 62.28 percent of the total shares. Leading mutual funds also have invested in the company. SBI Small and Midcap Fund holds around 6.15 percent of the total shares and Sundaram Value Fund acquired 0.241 percent shares in the March 2017 quarter.

Strong Operating Financial Performance

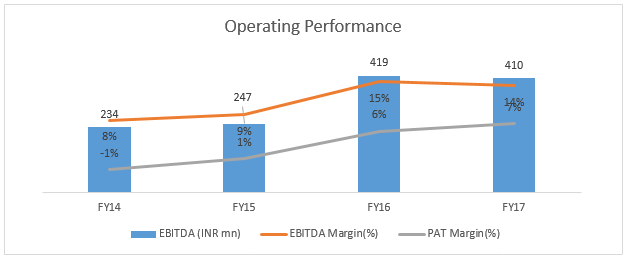

RGW has reported strong financial performance. EBITDA (earnings before interest, tax, depreciation, and amortization) margins and PAT (Profit After Tax) margins have improved from 8 percent and -1 percent in FY14 to 14 percent and 7 percent, respectively in FY17. The improvement has come on the back of lower raw material cost (58 percent of sales v/s 67 percent of sales) and reduction in finance cost. The company has been able to reduce its debt through internal accruals and brought down its debt-to-equity ratio to 1.0x in FY17 from 2.2x in FY14.

Moreover, return ratios have also shown significant improvement over the period of FY14 to FY17 on the back of operating performance and the improvement in the utilization of Thailand plant.

Raw material price remains the key risk to earnings

The key raw material for RGW’s product is steel wire rods and international demand and supply drives the prices of steel. Experts believe that prices of steel will remain at comfortable levels in near to medium-term on the back of abundant supply.

Comfortable Valuation

The company is currently trading at 13 times trailing earnings, which we believe is at discount to auto-ancillaries companies that are trading at multiples of 15-17 times. As per our estimates, the company is trading at 11 times its FY18 projected earnings. Should the raw material volatility result in slightly depressed numbers in the near term, investors can capitalise on such a decline to build up long-term positions in the stock.

We feel that growth in Indian automobile sector, favorable opportunities in Thailand coupled with operational efficiency, low debt and reasonable valuation make it a stock worth accumulating for a medium to long term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.