Larsen & Toubro share price hit fresh record high of Rs 1,467.85, rising as much as 3.6 percent in morning Thursday after better-than-expected earnings for October-December quarter..

The engineering and infrastructure major said consolidated net profit growth of 53.2 percent year-on-year at Rs 1,490 crore was ahead of CNBC-TV18 poll estimates of 1,443 crore for quarter ended December 2017.

Revenue from operations grew by 10.1 percent to Rs 28,747 crore for December quarter 2017 against Rs 26,110 crore in December quarter 2016.

Consolidated operating profit growth of 25.5 percent year-on-year at Rs 3,144 crore and 130 basis points expansion in margin at 10.9 percent in Q3FY18 came ahead of CNBC-TV18 estimates of Rs 2,954 crore and 10.2 percent, respectively.

Consolidated orderbook at Rs 2.71 lakh crore at the end of December 2017 registered a 4.7 percent growth compared to year-ago period.

The engineering major has won fresh orders worth Rs 48,130 crore during the quarter, increased 38 percent compared to same quarter last year.

Meanwhile, L&T has retained its full year order inflow growth guidance.

At 09:36 hours IST, the stock price was quoting at Rs 1,462.95, up Rs 46.35, or 3.27 percent on the BSE.

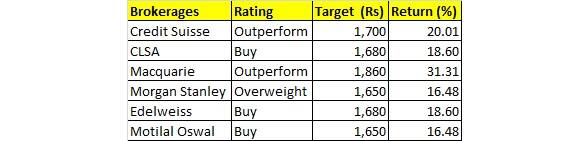

Brokerage houses remained positive on the stock post earnings and expect the stock to give up to 31 percent return over next 12 months.

Brokerage: Edelweiss | Rating: Buy | Target: Raised to Rs 1,680

"Despite stellar 50 percent returns in past 12 months, Larsen & Toubro (L&T) remains our best industrial play with around 20 percent upside expected over next 12-15 months given: a) gradual, but broader recovery in domestic market as seen in Q3/9MFY18 core infra execution growth of 20/15 percent, albeit with cyclically low operating profit margins; b) steady core infra business (except factories/buildings), with defence and oil & gas gaining strength – domestic heavy engineering & hydrocarbon segments registered robust 50 percent plus YoY growth; and c) management’s focus on working capital and RoE ramp up, which will gain greater prominence as private sector recovery gets broad based over next two-three years, potentially bolstering L&T’s return profile and average free cash flow of Rs 1,700 crore over FY18-20," Edelweiss said.

The research house has maintained Buy call on the stock with increased target price at Rs 1,680 (from Rs 1,350 earlier).

Brokerage: Credit Suisse | Rating: Outperform | Target: Raised to Rs 1,700

While maintaining Outperform call on the stock with increased target price at Rs 1,700 (from Rs 1,425 per share), Credit Suisse said the company posted very strong result and domestic firing can be an inflexion point.

Order inflows were strong, driven by domestic market. Domestic execution also picked up during the quarter.

Brokerage: CLSA | Rating: Buy | Target: Raised to Rs 1,680

The brokerage said that the firm ticked all the right boxes in Q3. It is a good proxy for domestic capex and added that the company has a credible strategy to improve growth and return on equity.

It has reported surprise across the board, with orders and execution bouncing back along with infra segment growth, CLSA said while maintaining Buy call on the stock with increased target price at Rs 1,680 (from Rs 1,565).

Hydro-carbon segment is emerging star business of L&T and turn in power IPP & conservative accounting also drove beat, it said.

Working capital, which rose on GST & lower advances, will normalise going ahead, CLSA feels.

Brokerage: Macquarie | Rating: Outperform | Target: Raised to Rs 1,860

The brokerage house said that the firm is set for continued earnings upgrades.

Macquarie also maintained its Outperform call with increased target price at Rs 1,860 from Rs 1,594 per share.

Brokerage: Morgan Stanley | Rating: Overweight | Target: Raised to Rs 1,650

Morgan Stanley said that the firm is the best proxy for coming construction boom in India.

The research house has Overweight call on the stock with increased target price at Rs 1,650 from Rs 1,539 per share.

Brokerage: Edelweiss | Rating: Buy | Target: Raised to Rs 1,650

Motilal Oswal raised its estimates by 2/1/2 percent for FY18/19/20 to factor in higher engineering and construction execution, but maintained order estimates (Rs 1.5 lakh crore, up 5 percent YoY).

The research house has maintained its Buy rating with a target price at Rs 1,650.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.