Jitendra Kumar GuptaMoneycontrol Research

In a dull environment where investors worry about economic growth and industrial capex growth, JSW Steel reported its highest ever consolidated quarterly sales of 3.96 million tonnes, which is about 13 percent higher compared with June 2017 quarter. Companies like Tata Steel and JSW Steel are benefitting because of the consolidation in the sector as marginal players remain in stress.

Standalone business drive growth

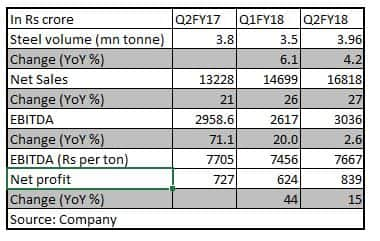

The other important aspect of consolidation phenomena is that companies like JSW Steel have gained marginal pricing power. JSW Steel’s standalone business, which accounts for 90 percent of the consolidated sales, saw close to 20 percent spurt in steel realisations to Rs 38153 per tonne as a result of higher domestic steel prices.

The standalone business reported a sequential improvement in EBIDTA margins by about 370 basis points led by lower coking coal prices. But EBIDTA margins dipped on a year-on-year basis by about 260 basis points to 19.6 percent in the September quarter.

Moreover, the other important profitability matrix, EBIDTA per tonne, has increased by Rs 390 per tonne compared to the corresponding quarter last year. Nevertheless, some reductions in the depreciation and interest cost on a year-on-year basis helped the company post decent 26 percent growth in net profits.

Subsidiaries drag profitability

Higher growth in standalone business was partly negated by subdued performance of subsidiaries. On a consolidated basis, JSW Steel reported a mere 15.5 percent year-on-year growth in net profits.

Coated product division’s profitability was impacted because of higher input cost and pricing pressure owing to imports. Its US plate and pipe business operated at 22 percent capacity utilisation. While speaking to analysts post the result, the management explained that the US business was hit because of the negative impact of hurricanes and the situation appears to be normalising with utilisation improving further.

Robust outlook

Barring short-term issues at subsidiaries, the management is hopeful of maintaining the profitability and growth in FY18 without a major setback to the guided numbers of 15.5 million tonnes steel sales in FY18.

While the run rate observed in the first half of this current fiscal year is slightly low, the company is expecting to recoup with higher production in the subsequent months.

The company has won five iron ore mines in Karnataka having estimated reserves of about 111 million tonnes to provide 4.7 million tonnes of iron ore annually. This will help in improving costs and providing raw material security for its upcoming facilities. It is augmenting its steel capacity at Dolvi from 5 million tonnes annually to 10 million tonnes by 2020. This is in addition to its expansion at Vijyanagar by about 1.5 million tonnes of steel annually.

Valuations factor in strong earnings growth

Accounting for these changes along with higher volumes and realisations as a result of increase in steel demand and prices, the earnings visibility is strong for the next two years. As against a net profit of Rs 3500 crore in FY17, the Street is expecting a net profit of close to Rs 5000 crore in FY19, which is a growth of 19.5 percent annually.

However, a large part of these earnings growth expectations are already built in the share price. At Rs 259 a share, the stock is trading at about 12 times its FY19 estimated earnings and 7 times EV/EBIDTA.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.