Whenever there is a sharp fall in the market, investors buy quality stocks at cheaper levels. To some extent, in the last couple of weeks, that opportunity presented itself as the benchmark indices corrected around 6 percent from record high levels.

The last day of the previous week was kind of a ‘Black Friday’ for the market as it corrected nearly 4 percent - the biggest fall in absolute terms on the Nifty since March 23, 2020.

The reason was obvious - rising bond yields and increasing inflationary expectations in the United States, the world's largest economy. This generally indicates the economy is on a gradual recovery path, and FII money moves from emerging markets like India to western markets, and they gradually invest in debt from equity.

FIIs have played a key role in pushing the market from an over-four-year lows in March 2020 to new highs in February (before the recent correction). In fact, the benchmark indices, as well as the broader markets, doubled from lows seen on March 23, 2020. FIIs have net bought Indian equities worth more than Rs 2 lakh crore since 2020.

A slew of measures by the Indian government and an accommodative policy by the RBI have been reflecting on the economy and the earnings season. A steep correction looks unlikely for the time being. If it happens, that would be the right time to pick fundamentally strong stocks and the right time for investors who missed the bus earlier to make their portfolio stronger, experts feel.

“The fear of overvaluation will always be in the investor's minds. In the last few months, they made a killing in the market, making it overvalued, compared to emerging economies," Prashanth Tapse, AVP, Research, Mehta Equities, told Moneycontrol.

"If we were to compare the relative attractiveness of equities among emerging economies, India is the only country where the equity index trades at a premium to the yield. In other economies, the equity indices trade at a discount to the 10-year risk-free government bonds," he said.

A major part of correction, considering the sudden rise in bond yields in the US and geo-political tensions, has already trimmed Indian markets from the Nifty 15,430 levels.

“It is the nature of the market. What goes up, must come down. So, one must take advantage of the price action or corrections now. The correction is happening now not because of changing fundamentals, but from a global money flow cycle and hunt for favourite fundamental stocks, which were missing in investors’ long-term portfolio," he said.

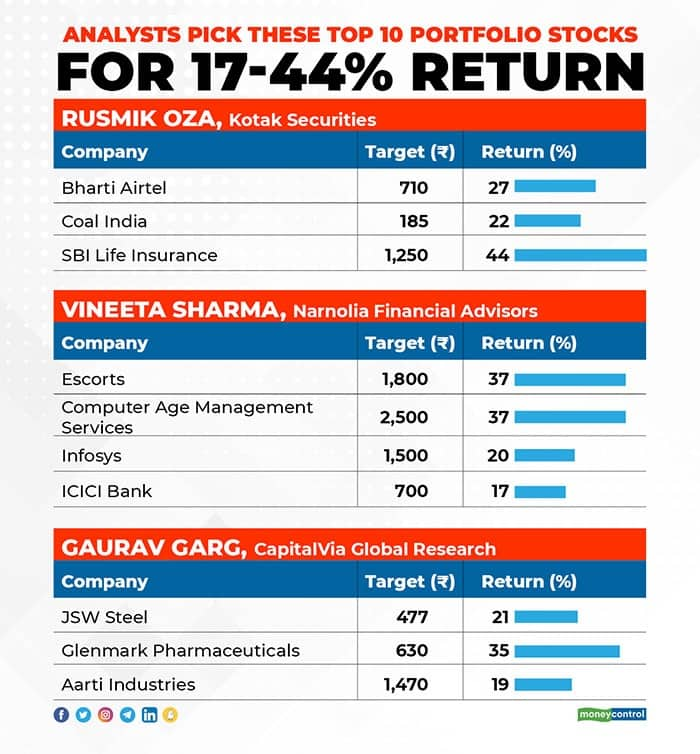

Here are the top 10 stock ideas picked by experts for Moneycontrol viewers to get a 17-44% return, if investors are willing to hold it at least for a year.

Expert: Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities:-

Bharti Airtel | Target: Rs 710

In Q3FY21, Bharti Airtel’s India wireless business was marked by a strong net subscriber addition of 14.2 million, well above our expectations and ahead of Jio’s reported 5.2 million.

Higher ARPUs (average revenue per user) at Rs 166 (7/11 percent QoQ increase in voice/data volumes), along with healthy subscriber additions, led to a 24 percent revenue growth and 38 percent EBITDA growth on a YoY basis.

Bharti’s performance, post the tariff hikes in December 2019, has been fairly strong on several parameters, as compared to Jio (and Vodafone Idea). The India wireless EBITDA margin, at 43.7 percent in Q3FY21, was the highest in many quarters.

Incremental EBITDA margins have remained high at 60-70 percent in the last two quarters. Bharti’s proposal to buy back a 20 percent stake in its DTH arm and form a Special Committee of Directors to reorganise businesses in its endeavour to renew focus on digital and non-telecom segments are steps in the right direction.

We like Bharti’s calibrated approach in shaping up its non-telecom digital service offerings, aligned with its homes and enterprise businesses. The SOTP (sum-of-the-parts) - based target works to Rs 710, in which we value the Indian wireless business at 9x on Mar’23E EV/EBITDA.

Coal India | Target: Rs 185

Strong e-auction volumes (up 177 percent YoY), despite weak premiums (25 percent in Q3FY21), continued to salvage earnings over the past few quarters.

Sustained improvement in dispatch volumes continues to remain the key earnings driver. The management, over the past two quarters, has increased dispatches to non-regulated sector through higher e-auction volumes.

The management expects e-auction volumes to continue on a positive trajectory in Q4FY21, with a target of 92 million tonnes for FY21E (out of a total output of around 660 million tonnes).

Coal India is looking to diversify into new businesses, but they are at the due diligence stage. As per the management, dividend in FY21E will be similar to a payout of around Rs 7,400 crore (Rs 13 per share) in FY20. Coal India declared interim dividend of Rs 7.5 per share in November 2020. CIL remains attractively valued at 7.8x P/E and 5.9x EV/EBITDA on adjusted earnings for FY23E. The Fair Value of Rs 185 per share is based on March 2023E earnings.

SBI Life Insurance | Target: Rs 1,250

SBI Life reported an 85 percent YoY growth in net cash flows in Q3FY21, led by strong growth in net premium and steep decline in claim payouts (down 25 percent YoY).

PAT, however, declined 40 percent. A strong 14 percent YoY growth in Value of New Business (VNB), with expansion in VNB margin to 20 percent, was seen in Q3FY21. The overall share of protection and non-par savings has increased 7.15 percent YoY to around 20 percent.

SBI Life has significantly reduced cost ratios in 9MFY21. It is impressive as the company has been able to manage overheads.

SBI Life's solvency ratio moderated marginally during the quarter to 234 percent from 245 percent in Q2FY21 (230 percent in Q3FY20). Solvency ratios remain higher than the regulatory requirement of 150 percent and internal threshold of 180 percent. The Annual Premium Equivalent (APE) growth will likely remain strong at 20 percent YoY in FY22E, and moderate to around 16 percent CAGR over FY23-24.

We expect 21-22 percent medium-term VNB margin and 17-18 percent operating Return on Embedded Value. We continue to build in secular APE growth and find VNB tailwinds. SBI Life's premium gap to its peers has narrowed and trades at 2.0X Price/Embedded Value on FY23E. We are valuing SBI Life at 2.8x Embedded Value on March 2023E.

Expert: Vineeta Sharma, Head of Research at Narnolia Financial Advisors

These companies are fundamentally strong and near-term expected earnings are also robust

Escorts | Target: Rs 1,800

The company is seeing good traction in demand. Significant growth in exports is expected as it is targeting higher numbers in FY22, considering strong Kubota sales. In the next 7-8 years, the company is targeting to triple exports from the current level. The company is currently running at full capacity, and is hoping to reach a capacity of 12,000-13,000 tractors a month from the middle of FY22.

Computer Age Management Services | Target: Rs 2,500

CAMS has 16 AMCs, with a market share of 70 percent. The company is currently engaged in several automation projects, including automation of subscription reconciliation, purchase and SIP processes, document receipts and storage, which should help margins improve further.

Infosys | Target: Rs 1,500

We expect market share gain, along with an increase in the speed of digital transformation. On account of healthy pipeline and large, robust deal wins in Q3, including exceptionally high wins with the highest ever total contract value (TCV) of $7.13 billion, we remain positive on the stock.

ICICI Bank | Target: Rs 700

ICICI Bank saw a strong quarter with steady improvement in NII, led by healthy advance growth, and pre-provisioning profit, supported by lower cost-to- income ratio and gains from subsidiary stake sale.

Advance growth, led by retail and MSME segments, was strong during the quarter. Deposit traction was also healthy. On the asset quality front, pro-forma GNPA and NNPA did not witness a big increase QoQ and on the provisioning front. The bank is holding a contingency provision of Rs 9,984 crore and believes it should act as a cushion against future shocks and thus expect normalisation of credit cost in FY22.

Expert: Gaurav Garg, Head of Research at CapitalVia Global Research

JSW Steel | Target: Rs 477

The company produces and distributes iron and steel products. With its recent win of iron ore mines in Odisha, it is better placed in the long term, regarding raw-material security. Any sharp increase in iron-ore prices, like the one witnessed in Q3, would add to its margins when captive mines get operational. The company saw QoQ revenue growth of 62.97 percent -- the highest in three years.

Glenmark Pharmaceuticals | Target: Rs 630

Glenmark Pharmaceuticals has received the final approval from the United States Food and Drug Administration (USFDA) for Tadalafil tablets USP in the strengths of 2.5 mg, 5 mg, 10 mg, and 20 mg, the company said in a regulatory filing.

We witness robust growth across regions/segments, improving cash flows, controlled debts, and several cost-efficiency measures. Glenmark Pharma delivered better-than-expected earnings growth, led by the Domestic Formulation (DF), ROW, EU, and API segments. DF growth was partly aided by higher off-take of COVID-related medicine. Lower operating expenses further supported better profitability for the quarter.

Aarti Industries | Target: Rs 1,470

The demand from end-user industries has picked up, post lockdown. Q3FY21 revenue grew by 10 percent YoY, as revenue from specialty chemicals grew by 3 percent and the pharma business grew by 32 percent YoY. The pharma segment demonstrates strong momentum as supply disruptions have eased out, while better volumes from regulated markets aided overall revenue growth.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Reliance Industries Ltd, which also owns Jio, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.