The Indian stock market is trading on a cautious note following weak Asian cues amid concerns over the Delta variant of coronavirus. Sensex is down 131.23 points or 0.25% at 52604.36, and the Nifty shed 51.40 points or 0.33% at 15763.30 at the time of writing this copy.

Among sectors, Bank Nifty shed almost a percent as private banks came under pressure. The share price of Bandhan Bank was down 3 percent followed by ICICI Bank, Kotak Mahindra Bank and RBL Bank shed over a percent each while HDFC Bank, State Bank of India, IDFC First Bank and Federal Bank were among other losers.

Research firm ICICI Direct, in its report, said that Nifty has undergone time-wise consolidation wherein, it oscillated in the narrow range of 15900-15600 over the past five weeks, highlighting higher base formation around 15600 zone.

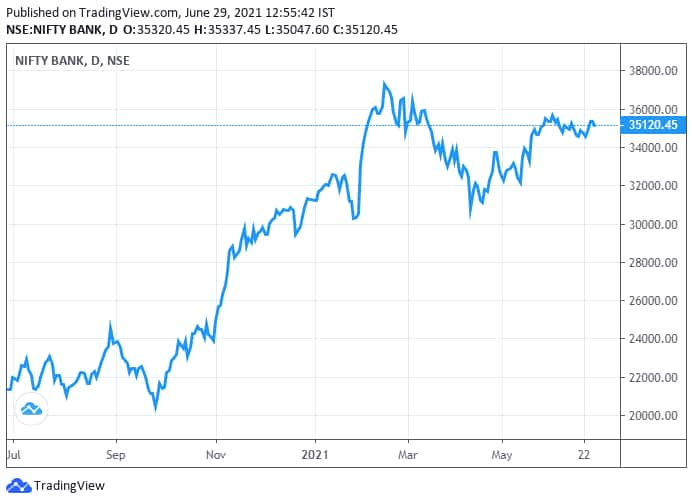

Bank Nifty movement since last 1 year

Bank Nifty movement since last 1 year

"We do not expect the Nifty to breach its strong demand zone of 15600-15500. Hence, a temporary breather from here on should be capitalised to as an incremental buying opportunity in quality largecap and midcaps," it said.

"Bank Nifty largely remained range-bound on June 28 as it closed almost flat. Largecap private banks witnessed selling pressure from higher levels while PSU banks witnessed healthy buying. According to options data, 35500 Call option witnessed significant OI addition, which should act as resistance," the brokerage firm added.

Catch all the market action on our live blog

"Going ahead, we expect the index to trade with a positive bias and head towards 36,200 levels in coming weeks as it is the confluence of the 80 percent retracement of the entire last three months corrective decline and the price parity with the previous up move as projected from the recent trough of 32115 signals upside towards 36200 levels," it said.

Kotak Mahindra Bank share is among the most active stocks in terms of value on NSE with 83,23,513 shares being traded, while 42,48,507 shares were traded of HDFC Bank. In terms of volumes, 10,51,81,218 shares were traded of PNB followed by Bank of Baroda (5,13,59,635) and YES Bank (5,03,50,207).

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.