Taking Stock: Nifty Ends Lower For 2nd Straight Day Amid Profit-booking; Metal, Bank Stocks Underperform

BSE Midcap ended 0.4 percent lower, while Smallcap index ended flat.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,102.69 | -609.68 | -0.71% |

| Nifty 50 | 25,960.55 | -225.90 | -0.86% |

| Nifty Bank | 59,238.55 | -538.65 | -0.90% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Tech Mahindra | 1,591.80 | 21.00 | +1.34% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 4,923.50 | -447.00 | -8.32% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 38590.70 | -113.00 | -0.29% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8146.10 | -235.65 | -2.81% |

Domestic markets remained weak in line with Asian markets as investors were concerned with the more infectious delta variant of the coronavirus and the re-imposition of restrictions in parts of Asia, Europe, South Africa, and South America. Besides, geopolitical risks also weighed as India deployed additional 50,000 troops along the China border.

The Centre announced eight new schemes to give a boost to the sectors reeling under the Covid-19 induced restrictions, however barring pharma and FMCG, all other sectors remained in the red.

Indian rupeeended marginallylower at 74.23per dollar, amid sellingsawin the domestic equity market.It opened lower by 9 paise at 74.28 per dollar against previous close of 74.19 and traded in the range of 74.19-74.29.

The market witnessed a correction after a failed attempt to hold the support level around the Nifty 50 Index level of 15800. The market suggests, 15650 will be an important support level from a short-term perspective. Sustaining above 15620-15650 levels, the market expects to bounce back, and trade in the range of 15650-15900. The technical indicator suggests, a volatile movement in the market in the range of 15650-15900.

Benchmark indices ended lower in the second consecutive session on June 29 with Nifty below 15,750.

The Sensex was down 185.93 points or 0.35% at 52,549.66, and the Nifty was down 66.20 points or 0.42% at 15,748.50. About 1440 shares have advanced, 1536 shares declined, and 87 shares are unchanged.

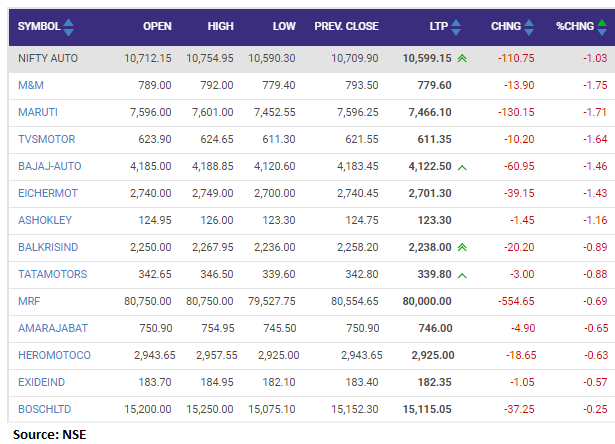

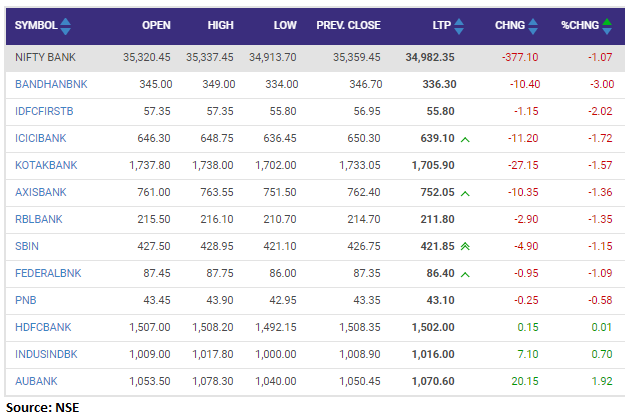

Among sectors, except FMCG and Pharma, all other indices ended in the red with Nifty Bank, metal, auto and PSU Bank shed 1 percent each. BSE Midcap ended 0.4 percent lower, while Smallcap index ended flat.

IOC, ONGC, Hindalco, Kotak Mahindra Bank and Coal India were among major losers on the Nifty. Top gainers included Power Grid Corp, Cipla, HUL, NTPC and Divis Labs.

Cipla share price touched a 52-week high of Rs 988.80, gaining 2.5 percentafter pharma major filed an application with the Drugs Controller General of India seeking permission to import Moderna's COVID-19 vaccine in India.

The firm submitted its application to the drugs regulator on June 28, sources told CNBC TV-18.

People aware of the development also said that DCGI is likely to take up the application soon and may even grant permission to import the COVID-19 vaccine today.

Indian Railway Finance Corporation (IRFC) has posted net profit of Rs 1,482.5 crore in the Q4FY1 against Rs 654.6 crore and revenue was up 39% at Rs 4,455 crore against Rs 3,205 crore, YoY.

Indian Railway Finance Corporation was quoting at Rs 25.30, up Rs 0.55, or 2.22 percent on the BSE.

Indian rupee is trading lower at 74.27 per dollar, amid selling seen in the domestic equity market.It opened lower by 9 paise at 74.28 per dollar against previous close of 74.19

Benchmark indices were trading lower in the volatile session with Nifty around 15750

The Sensex was down 138.72 points or 0.26% at 52596.87, and the Nifty was down 53.40 points or 0.34% at 15761.30. About 1442 shares have advanced, 1512 shares declined, and 100 shares are unchanged.

Subros has posted 57 percent jump in its March quarter consolidated net profit at Rs 26.2 crore versus Rs 16.6 crore and revenue was up 43.9% at Rs 659.93 crore versus Rs 458.47 crore, YoY.

Subros board has recommended a dividend of Rs 0.70 (35%) per equity share of Rs 2 each for the year ended March 31, 2021. The dividend is subject to approval of shareholders at the ensuing annual general meeting of the company.

Subros was quoting at Rs 313.40, up Rs 1.95, or 0.63 percent on the BSE.