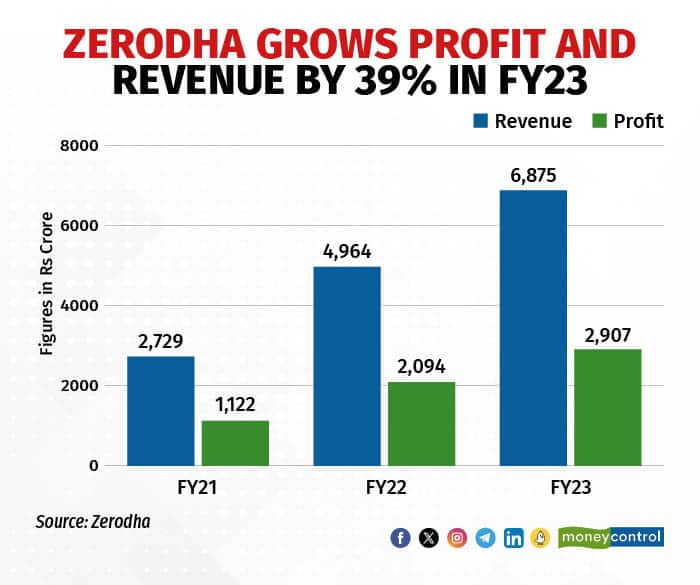

Zerodha on September 26 reported a 38.5 percent growth in revenue for the financial year 2022-23 at Rs 6,875 crore compared with the previous financial year. It also reported a 39 percent growth in profits, which stood at Rs 2,907 crore in FY23. The Bengaluru-based online stock trading platform reported a revenue of Rs 4,964 crore and a profit of Rs 2,094 crore in FY22.

The largest retail broking firm in the country has an active client base of around 64 lakh as of August this year. However, the figures have stagnated over the last 18 months and there is an apprehension that its topline and profit could be flat in the current financial year.

One of its competitors and venture capital-backed Groww had crossed 62 lakh active customers in August and could surpass Zerodha over the next couple of months if the trends hold, according to a report in The Economic Times earlier this week.

On September 26, the company's co-founder and CEO Nithin Kamath in a blog post wrote that despite intense competition from newer discount broking firms, the company will continue to charge onboarding and maintenance charges.

"Trading the markets is a serious business with serious risks involved. Collecting an account opening fee right at the start also, in a way, helps set this expectation with a potential customer, filtering out users who may not be serious about trading or investing with us," Kamath wrote.

Ahead of competitionThe profit figure is one of the highest for technology startups and more than double than that of its nearest competitor and discount broker Angel One, which had reported a consolidated revenue of Rs 3,021 crore for FY23 and a net profit of Rs 1,192 crore.

The revenue numbers of Groww and Upstox are unavailable for FY23. In FY22, the companies had reported revenue of Rs 427 crore and Rs 766 crore, respectively, indicating a large gap between user base and revenue.

Zerodha also acknowledged that the business has plateaued for the firm during the current fiscal despite heavy interest from the trading community.

"There’s still phenomenal interest in the markets, especially in futures and options. This has been the primary reason for the increase in revenue and profitability over the last three years. We continued to see phenomenal growth even in FY 22/23. That said, the business has plateaued in terms of revenue and profitability this financial year until now," Kamath added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.