Kunal Shah, one of India’s most prolific and powerful angel investors, became an emblem of the funding euphoria that lifted India’s startup ecosystem last year.

The lightning speed with which the serial entrepreneur committed money, often via WhatsApp and to founders who were complete strangers, became legendary.

Shah, 43, who’s also the founder and chief executive of fintech firm Cred, closed nearly 100 investments in 2021, when 44 startups in the country became unicorns, or companies with a $1 billion valuation or more, raising over $13 billion.

Overall, he has made close to 200 angel investments so far and is way ahead of his closest contenders, Snapdeal’s Kunal Bahl and former Google India head and Sequoia Capital India managing director Rajan Anandan.

Shah’s approach has been vastly different this year, according to data and anecdotal evidence shared by other entrepreneurs and investors. If Shah’s aggression last year signified the funding frenzy, his decision to cut back this year is perhaps the strongest barometer of the pain that’s gripped Indian startups.

Shah’s investments have dropped sharply in 2022 with the overall funding to India’s startup ecosystem, which is currently the world’s third-largest, slowing amid a correction in global financial markets.

According to data shared by data analytics firm Tracxn Technologies, Shah has closed only 26 rounds so far this year.

Moneycontrol spoke to five investors and founders, who said they noticed a visible change in Shah’s investing style compared to the previous year. They say the caution he has adopted is a reflection of overall market sentiment.

Turning conservative

“If there were 100 deals last year, you would see Kunal’s name pop up in at least 75-80 of them. But the total of number of deals itself is down this year,” one of the founders said.

A second founder, who is also an angel investor, said there were a few instances where Shah did not go ahead with investment proposals that came to him via WhatsApp, something that he wouldn’t have thought twice about last year.

“For Kunal, it wasn’t about diligence but a way of paying it forward or philanthropy as he calls it. Earlier he never used to think about saying yes to these deals. But there have been a few instances this year when he hasn’t gone ahead,” the person said.

Another angel investor said Shah seemed “concerned and bearish” about the current market, based on recent conversations, and expects the pain to last for at least 3-6 months. “He has turned conservative as a result,” the investor added.

“He hasn’t stopped; he is still doing angel deals. But the frequency has certainly come down,” a fourth person said.

Shah had upped his tech investing game in 2020, the first year of the pandemic, as demand for technology-based services jumped, with governments across the globe locking billions of people indoors to curb the spread of the disease. He invested in funding rounds worth nearly $200 million in 2020 against $55 million in 2019.

Cutting across sectors

Another angel investor who has co-invested with Shah in many rounds said Shah always had a great knack for picking and investing in the right startups.

Angel investors usually start investing in the business they know best—fintech in Shah’s case—but his portfolio encompasses companies from almost every sector including health and fitness, e-commerce, logistics, B2B marketplaces and mobility, among others.

He does however hold stakes in a number of top fintechs and unicorns, such as Razorpay, Rupeek, BharatPe, CoinSwitch Kuber, and Khatabook, among others.

“But I don’t think that (good returns) was ever his intention or in fact that’s not the intention of most founder investors, if you see. They just want to give it back to the ecosystem,” the angel investor cited above added.

A spokesperson for Shah had told Moneycontrol last year that Shah does angel investments in his personal capacity to give back to the ecosystem and to support founders. The spokesperson and Shah declined to comment for this story.

Shah’s investing pattern: What the numbers say

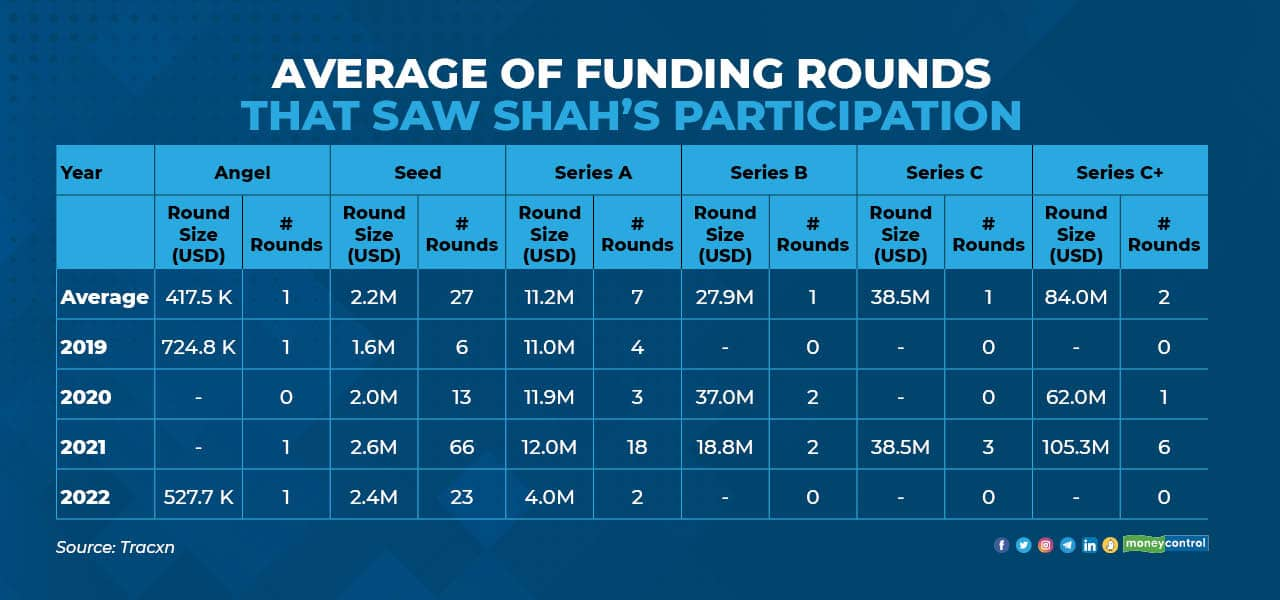

Shah has led funding rounds at least 16 times. Over the last three years, Shah has invested in rounds totalling $1.3 billion across startups. He invested in funding rounds totalling $1 billion in 2021 alone.

However, with the overall funding to Indian startups falling and rounds getting smaller, Shah’s participation has fallen to funding rounds amounting to $58.9 million in 2022 so far, the data by Tracxn showed.

Shah’s falling investment trajectory is in line with other aggressive tech investors, including some of the world’s biggest institutional investors such as New York-based Tiger Global and Japan’s SoftBank Group, going slow on investments, as easy money is drying up with central banks across the globe raising rates to tame inflation.

Shah also came back to doing an angel-level investment this year, for the first time since 2019. This, too, was in line with major private equity and venture capital firms, who have shifted to investing at early stages in a bid to slash cheque sizes.

For instance, Tiger Global told its investors in May that the hedge fund had increased early-stage investments in private companies through its newest and largest venture capital fund of $12.7 billion. The company said that more than half of its investments through the fund were in Series A or Series B rounds, typically the first or second big financing for tech companies.

Strategic shift

This was a shift in strategy for one of the world’s most prolific tech investors, which usually invests in larger rounds at later stages. Tiger Global also marked its first Seed-level investment in May.

SoftBank Group, meanwhile, told investors at its most recent earnings call that it will cut its investments to a fourth in 2022 from a year earlier after it recorded its highest-ever fiscal year loss of over $13 billion. The Group’s head Masayoshi Son also said that investment sizes will be smaller in the US and other major economies.

Interestingly, Shah also has not participated in Series-B, Series-C and later stage funding rounds this year. The billionaire investor had participated in rounds of $37.6 million and $74 million at Series B stages in 2021 and 2020, respectively. Shah had participated in rounds close to $116 million at Series C stages and in rounds of over $630 million at later stages in 2021.

Shah typically invests between $10,000 and $50,000. He usually lets the founder decide how much.

In one instance, an entrepreneur sent his pitch deck to Shah on WhatsApp, and said he’s raising a million dollars and Shah, who had never spoken to the founder before, committed $50,000 in a few minutes.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.