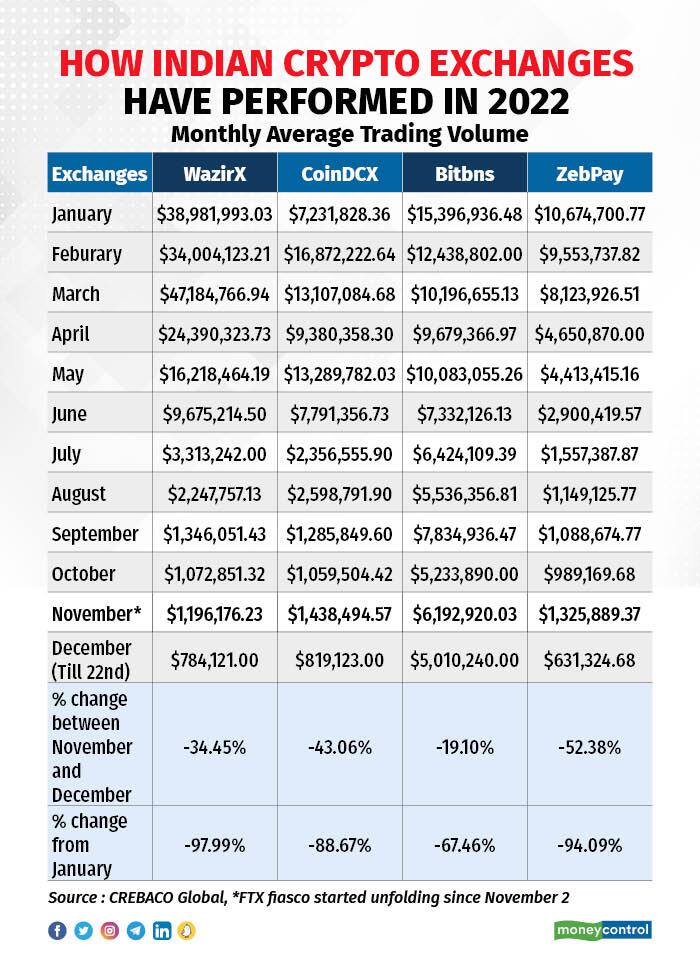

Trading volume on top Indian crypto exchanges such as WazirX, CoinDCX, ZebPay and Bitbns has plummeted 34-50% since the collapse of the world's third largest exchange, FTX, in the first week of November, according to data accessed by Moneycontrol from crypto research firm CREBACO.

This calls into question the survival of the exchanges, which have been already dealing with fallout from new taxes implemented this year, declining token prices and an overall slowdown in trading volume.

WazirX, which accounted for nearly 50% of crypto trading volumes in India at the start of this year, lost 97.99% of its trading volumes year-to-date (YTD) by December 22, 2022.

FTX and its founder Sam Bankman-Fried's fate took a turn for the worse when a CoinDesk report on November 2 revealed that the majority of its trading arm Alameda Research's assets worth $14.6 billion were found to be in FTX's own FTT tokens. Since then, FTX has filed for bankruptcy. Bankman-Fried has been arrested, and he was given bail on a $250 million bond, the largest bail amount ever paid.

Indian industry experts believe more than a direct impact on trading volumes, closer home the narrative was more about distrust and negative sentiments created by the FTX situation, taking the industry’s progress back by a few years.

“I don’t think a lot of this recent trading volume plunge was driven by FTX. The market in India has been dead since April 2022. What did get impacted is the sentiment across crypto tokens. FTX was the only American crypto competitor to Binance. What came out later on has pushed the crypto industry behind by a few years,” Sidharth Sogani, founder and CEO of CREBACO, told Moneycontrol.

He added, “I don’t expect any action or recovery for the sector in India in the next six months, until something major gets announced in the Union Budget. We are expecting a committee to be formed for crypto during the budget. But with the Bitcoin prices not supporting at the moment, I feel further discussions might get further pushed to the summer session.”

Rajagopal Menon, vice president of marketing at WazirX, concurred. “Unless something dramatic happens in the Budget this year, we don’t see a steady recovery in trading volumes anytime soon. It all comes down to the removing / reducing the TDS (Tax Deducted at Source) and capital gains without setoff for losses. No one is trading on Indian exchanges because of that,” Menon said.

“Unless the field is levelled for both Indian and foreign exchanges, it’s going to be a difficult year for Indian exchanges and a party for foreign exchanges,” he added.

In Budget 2022, the government mandated a 30% income tax on Virtual Digital Assets (VDAs) such as cryptos and Non-Fungible Tokens (NFTs) as well as a 1% TDS on all transactions of Rs. 10,000 or more. This TDS could only be recovered during the year-end tax claim filing, causing a large amount of capital to be stuck in the cycle on a daily basis.

A top executive at one of the key exchanges, who requested anonymity, said that more than FTX, Indian exchanges were impacted by investors moving to other global exchanges such as Binance and KuCoin.

“Indian investors, after TDS, have moved to Binance and not FTX because Binance had Peer-to-Peer (P2P) transactions, FTX doesn’t. If you have INR, the only foreign exchanges you can trade on are Binance and KuCoin. People have moved all their transactions to Binance. Indian users have not been too badly affected by FTX except for the sentiment. The negative sentiment around the sector got exaggerated by FTX,” the person cited above said.

Survival tactics

The situation appears to be bleak for crypto exchanges and startups. Most of them are trying to diversify and offer newer products in the hope of sustaining business and survival when all this is over.

A recent statement by Reserve Bank of India (RBI) Governor Shaktikanta Das at the BFSI Insight Summit 2022, hosted by Business Standard last week, has raised concern.

"I still hold the view that it (crypto) should be prohibited because if it is allowed to grow… then the next financial crisis will come from private crypto currencies," he said.

Crypto startups are focusing on long-term investors by offering products such as crypto-based loans, Systematic Investment Plans (SIPs), derivatives and even fixed deposits, to name a few.

Last week, crypto unicorn CoinSwitch announced its rebranding and transition from pure-play crypto offerings to a comprehensive wealth tech platform offering mutual funds, Exchange-Traded Funds (ETFs), bonds, stocks and so on.

WazirX co-founder and CEO Nischal Shetty has moved on to start a new blockchain venture called Shardeum.

In addition, CoinSwitch and its rival CoinDCX have established venture capital firms to support the development of blockchain- and Web3-based technologies as well as business use cases by other start-ups.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.