It was the best of times, it was the worst of times. While a so-called funding winter gripped the country’s startup ecosystem this year and resulted in thousands of layoffs, several of its top honchos were able to buy properties at prime locations in Bengaluru, Delhi, Mumbai and Pune, showed a report by property data platform Zapkey.

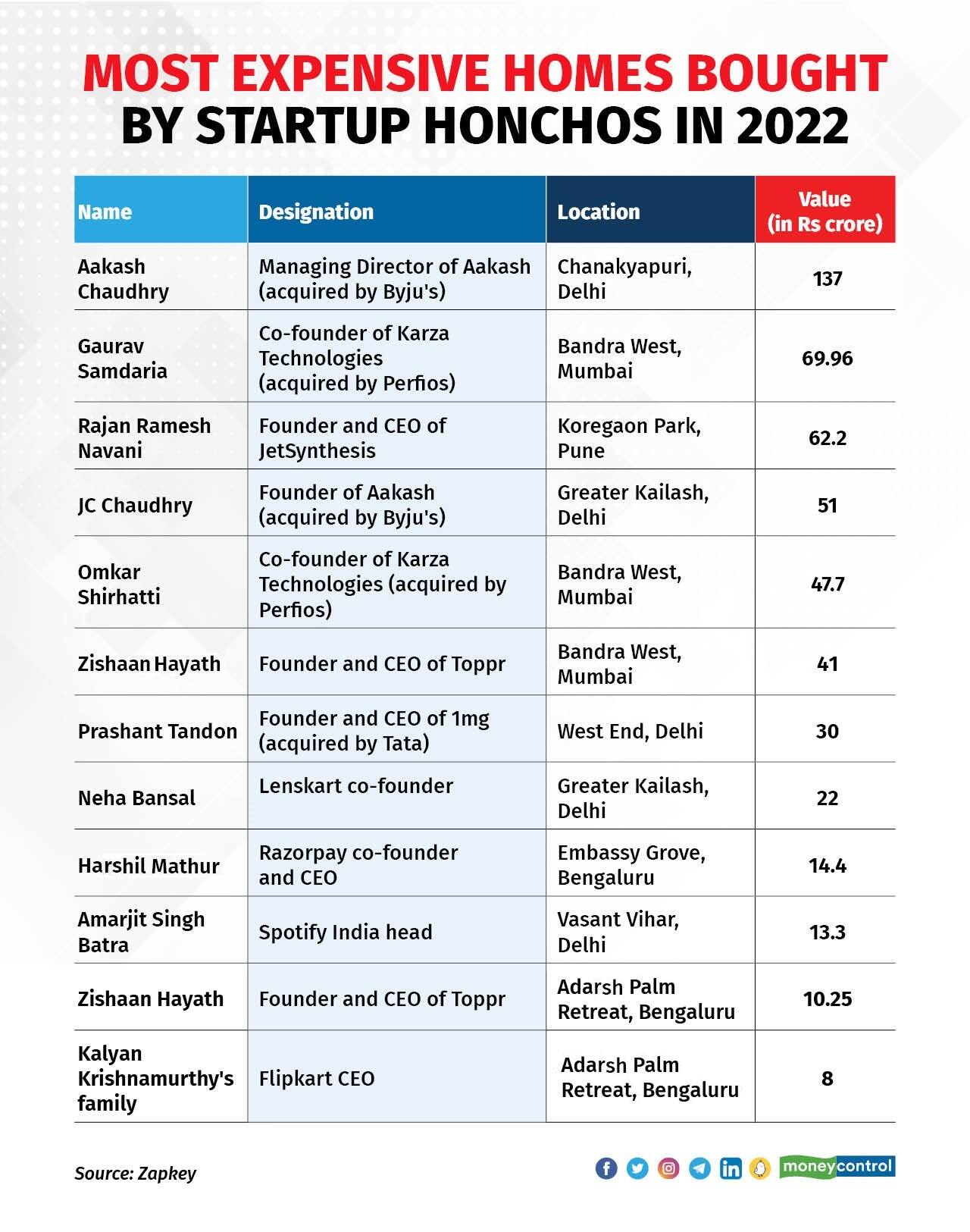

Aakash Chaudhry, the managing director of coaching institute Aakash, which was acquired by edtech unicorn Byju’s last year in a billion-dollar deal, topped the table with the purchase of a Rs 137 crore bungalow in Delhi’s posh Chanakyapuri area, according to the Zapkey report.

Meanwhile, Aakash founder JC Chaudhry also featured in the list with his Rs 51 crore purchase of a home in the Greater Kailash area of the national capital.

The founder of another edtech company that was acquired by Byju’s in 2021 bought two pieces of prime real estate. Zishaan Hayath, the founder of edtech startup Toppr which was snagged by the edtech unicorn in a $150 million deal last year, bought a property worth Rs 41 crore in Bandra West and another house worth Rs 10.25 crore in the tony Adarsh Palm Retreat locality of Bengaluru.

According to an earlier report of Moneycontrol, Byju’s laid off hundreds of employees from Toppr this year.

The Zapkey report showed that 12 of the 141 most expensive homes bought in India this year belonged to startup executives or startups acquired recently by other companies. These 12 homes were bought for a total of Rs 507 crore in prime locations of metros such as Bandra, Adarsh Palm Retreat, Chanakyapuri and Greater Kailash.

For instance, the founder duo of Gaurav Samdaria and Gaurav Shirhatti of Karza Technologies, which was acquired by fintech startup Perfios in a Rs 600 crore deal earlier this year, bought properties worth Rs 69.96 crore and Rs 47.7 crore, respectively, in the Bandra West region of Mumbai.

But the good fortune was not just limited to founders. Flipkart CEO Kalyan Krishnamurthy’s family bought a Rs 8 crore house in Adarsh Palm Retreat, while former OLX India head and current Spotify India head Amarjit Singh Batra bought a Rs 13.3 crore property in Delhi’s Vasant Vihar.

Moneycontrol reported earlier this week that Delhi-NCR has been hit the hardest as its startups saw funding drop 52 percent to $5 billion in 2022. While Bengaluru retains its pole position as the most attractive destination in India for venture capital, with $11.7 billion, it is 46 percent lower, compared to the previous year, Tracxn data showed.

Meanwhile, funding for Mumbai startups dropped 26 percent to $4 billion in 2022 whereas Pune startups fared comparatively better as their cumulative funding during the year fell by just around 1.5 percent to $985 million.

Venture capital funding to India's startups fell by 35 percent this year to $25 billion, according to a Tracxn report.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.