Chennai startups braved the funding winter to cross the USD 1-billion funding mark for the first time in a year in 2022, according to data from Tracxn, a platform that provides curated profiles of over 1,00,000 startups.

The city’s startups raised USD 1.5 billion this year, up 71 percent from USD 876 million in 2021, even as young companies in other major Indian cities struggled to attract investors amid a so-called funding winter.

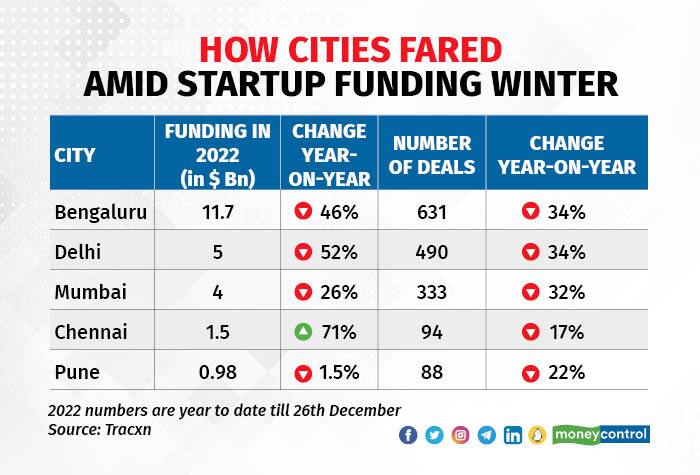

Delhi-NCR has been hit the hardest as its startups saw funding drop 52 percent to USD 5 billion in 2022. While Bengaluru retains its pole position as the most attractive destination in India for venture capital, with USD 11.7 billion, it is 46 percent lower, compared to the previous year, Tracxn data showed.

Meanwhile, funding for Mumbai startups dropped 26 percent to USD 4 billion in 2022 whereas Pune startups fared comparatively better as their cumulative funding during the year fell by just around 1.5 percent to USD 985 million.

According to the Tracxn, the funding winter of 2022 led to Bengaluru, Delhi-NCR and Mumbai seeing the fewest number of startup deals in the last five years.

Both Bengaluru and Delhi saw the number of startup funding deals dwindle by 34 percent to 631 and 490, respectively. Mumbai and Pune startups saw the deal count drop 32 percent to 333 and 22 percent to 88, respectively, this year.

Chennai again threw up a surprise as its deal count was the least hit among the top cities. Startups in the city secured 94 deals amidst the funding winter, dropping 17 percent from the 2021 level.

Although the city’s rise in funding this year, when peers saw a crunch, was on the back of a few massive rounds and also a comparatively lower base, the minimum hit to its deal count points to greater resilience in Chennai’s startup ecosystem.

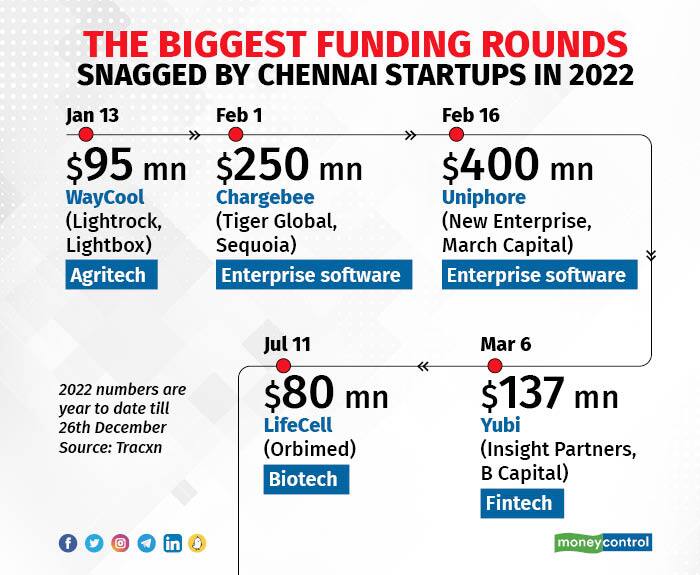

Most of the biggest deals for Chennai startups happened in the first half of the year — agritech startup WayCool’s USD 95 million round in January, enterprise software startups Chargebee and Uniphore’s USD 250 million and USD 400 million rounds, respectively, in February, and fintech company Yubi’s USD 137 million fundraise in March.

Also, the average cheque size of Chennai startups rose 105 percent to USD 16 million this year.

Moneycontrol had earlier reported that, compared to 44 unicorns minted in 2021, only 23 startups entered the billion-dollar-valuation club in India this year.

The decrease in the number of new unicorns minted this year highlighted how capital to the startup ecosystem has slowed. From April to December 2022, VC and PE (private equity) funding to India's startup ecosystem fell nearly 50 percent year on year (YoY) to USD 29.2 billion.

Between April and December 2021, PE/VC investors invested approximately USD 58.9 billion in the country's startup ecosystem, making it the world's third-largest.

The number of late-stage investments (Series C onwards), when unicorns typically get minted, has decreased significantly in 2022, as some of the nation's most active late-stage investors have scaled back their capital allocation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.