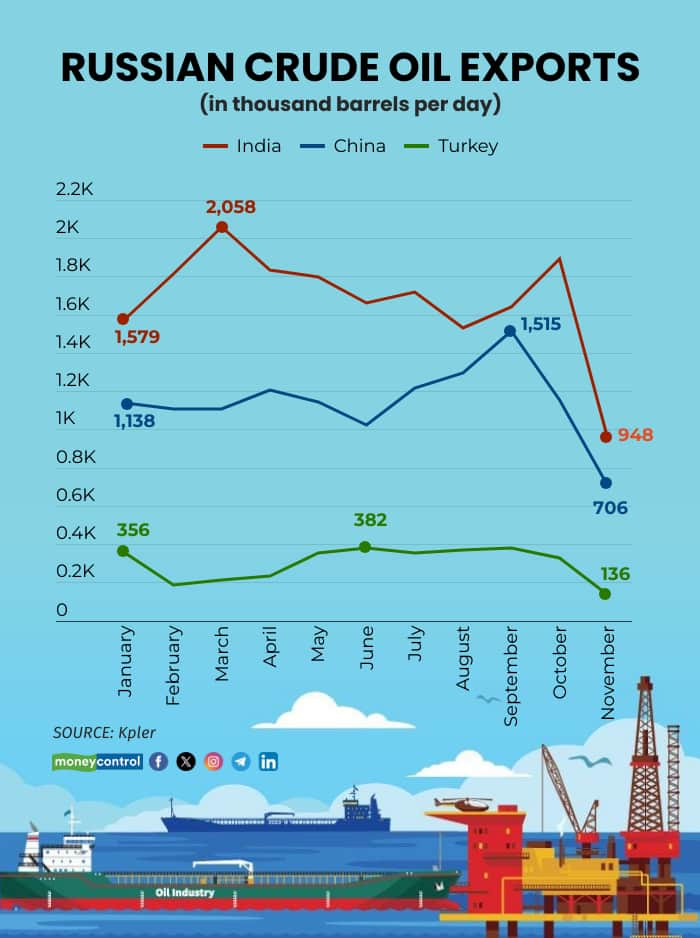

Russian crude oil shipments to India have dropped significantly in November to around 948,000 barrels per day (bpd) in November so far, 50 percent down from 1.89 million bpd in October, data from global real-time data and analytics firm Kpler showed.

The key reason for the sharp drop is the recent US sanctions on Rosneft and Lukoil, which is likely to temporarily reshape India’s crude import flows—even if they do not alter New Delhi’s long-term strategy of maintaining diversified, cost-advantaged supply, experts say.

In October, the US Treasury Department's Office of Foreign Assets Control (OFAC) sanctioned Russia's two largest oil companies to pressure its energy sector and force it to retreat from Ukraine. These sanctions kick in from November 21.

The OFAC announcement came with an explicit warning that secondary sanctions—targeting those buyers of Russian crude oil from these companies that continue to do so—could be considered in the near future. This threat is precisely why India, Turkey and China have reduced supplies from Russia, as shown in the data.

As per Kpler, Russia has exported 706,000 bpd of crude oil to China between November 1-19, 39 percent down on month. And to Turkey, the exports were down by 59 percent to 136,000 bpd during the same period this month.

Chinese notable state-owned companies, including Sinopec and PetroChina, have suspended purchases of certain batches of oil from the Russian Federation to avoid the secondary sanctions.

Turkey’s largest refineries have favored alternative suppliers. SOCAR Turkey Refinery, earlier this month, purchased four batches of crude oil from Iraq, Kazakhstan, and other countries.

Near-term outlook for IndiaIn FY25, Rosnet and Lukoil accounted for about 60% of Russia's total oil exports to India of 88 million tonne.

“We have been in compliance with US sanctions on Venezuela and Iran. Going forward, we will buy crude from Russia, but from entities that are not sanctioned,” Prashant Vasisht, senior vice-president and co-group head, corporate ratings, Icra.

“The sanctioned volume will probably shift to Middle East and the US now,” he added.

In November so far, India has imported 566,000 bpd of crude oil from US. In October, this figure 568,000 bpd. November and December have seen a major uptick in imports from US, as prior to these months, the figure didn’t cross the 400,000-bpd mark.

In August and September, India imported 230,000 bpd and 207,000 bpd, of crude oil from US.

“India is importing more US oil, because it wants the 25 percent tariffs (penal tariffs on importing Russia oil) to be slashed,” one industry executive said.

Sumit Ritolia, Lead Research Analyst, Refining & Modeling, Kpler expects a noticeable drop in Russian crude flows to India in the near term, particularly through December and January. “Loadings have already slowed since 21 October, though it is still early for definitive conclusions given Russia’s agility in deploying intermediaries, shadow fleets, and workaround financing,” said Ritolia.

Despite near-term declines, a complete halt to Russian imports is unlikely, experts feel. Discounted Russian barrels remain attractive for margins, and India’s energy policy continues to prioritise affordability and security over geopolitical pressure, they say.

As of today, price of brent crude stands at $64.2 per barrel. And Russia provides a discount of around $1.5-4 per barrel. But in the past few days, this discount has risen to about $6 per barrel, industry executives said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.