IndiGo, the country’s largest carrier by fleet and domestic market share, declared its Q3 FY23 results today. The airline has reported a profit of Rs 1,422 crore on the back of a record-breaking revenue of Rs 15,410 crore — the highest in the history of the airline. This is the first time the airline has crossed the Rs 15,000 crore mark in revenues, and also beat its previous quarterly profit of Rs 1,203 crore recorded in Q1 FY20, the quarter when Jet Airways went down.

Compared to the corresponding quarter last year, the capacity and passenger numbers have gone up by 25 percent. The profit was on the back of increased revenue and decreased expenditure, sequentially. There was a significant decrease in fuel costs, while airline rentals, employee costs, and finance costs went up.

The airline has refused to divulge specifics around the grounding of its aircraft due to engine issues, and the compensation which has been obtained or is likely to be obtained from the OEM.

The airline had planned to discontinue the A320ceo by this time, but the supply chain situation has led to the airline continuing with these old aircraft. It does not have guidance on when it will phase out the A320ceo.

The airline took delivery of 11 A320neos, 10 A321neos, four ATR 72-600s, and one A321 freighter in the previous quarter, while returning three A320ceos. The A320neos which were scheduled for return have been re-inducted to tide over the crunch due to delays in getting the grounded aircraft back in air.

The market has accepted the higher fares

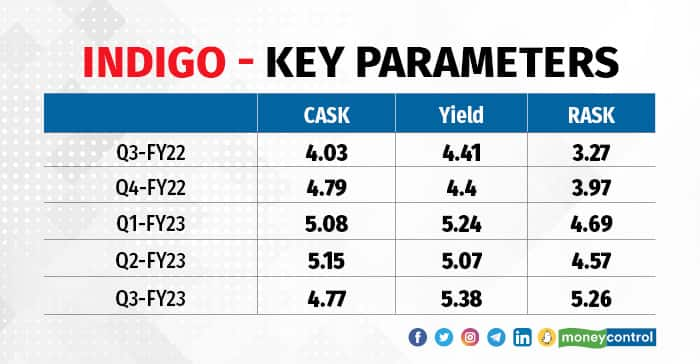

The airline also recorded yields of Rs 5.38 on the back of an equally high RASK (revenue per available seat-kilometre) of Rs 5.26. The massive increase in both comes on the back of international expansion, where the competition is not as cut-throat as in the domestic sector, along with higher average fares due to strong domestic demand in the previous quarter. Irrespective of the higher yields, the airline saw higher load factors due to market conditions.

While RASK is calculated for the available capacity of the airline, yield is calculated only for the booked capacity. In a nutshell, the yield is always higher than RASK, and if the yield is very high compared to RASK, it indicates empty seats, i.e., lower load factors.

The market seems to have accepted the higher pricing due to a mix of revenge travel and a lack of capacity in the market. Having over 50 percent of the capacity in the market, with a monopoly on close to 40 percent of the routes, has finally helped the airline price itself higher and command a premium.

The airline seems to have opted for a strategy where it will chase yield, not revenue. This translates into fewer passengers flying at higher fares, rather than having full flights at lower fares. While the revenue might be the same in both cases, ferrying fewer passengers at higher fares helps with quicker turnaround, having additional space to carry commercial cargo, better service during the flight, and flying with lesser weight — all of which contribute to a better customer experience and savings.

The management admitted that the yield has fallen in January 2023, compared to Q3 FY23.

Unhindered growth, but a word of caution

The airline has given a guidance of a 45 percent increase in ASK (available seat kilometres) in the current quarter compared to the Jan-Mar quarter of the previous financial year. However, sequentially, that translates to just 6 percent more capacity over Q3. The CEO also said that Nashik and Dharamshala would be added to IndiGo’s network in the next few weeks.

While IndiGo may have recorded its best-ever quarter in terms of just about every parameter, starting with passenger numbers, revenues, and profits, overall, it is still operating at a loss for the period from April to December. The airline will need a profit of Rs 1,227 crore in the current quarter to ensure that it breaks even at the end of FY23.

The management expects that the growth of international traffic will be more than the growth of domestic traffic. Partly, this will be because of the large base which it has built in the domestic sector, where even a 20 percent growth would mean adding a new airline the size of SpiceJet or Go FIRST.

Tail Note

IndiGo will try to strengthen its position in both the domestic and international markets in 2023. A resurgent Air India is already making changes to its network, transferring routes from AirAsia India to Air India, and vice versa. The four airlines from the Tata stable will become two large airlines by March 2024, when Akasa Air will also have a presence in the international market. Further, new airports will open up new opportunities, and IndiGo will have to be on its toes to grab those.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.