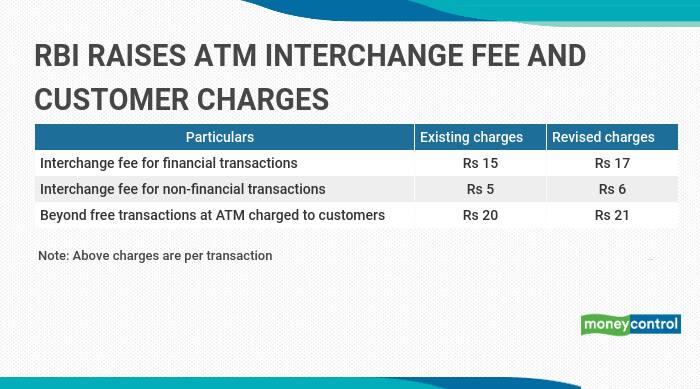

The Reserve Bank of India (RBI) has allowed banks to increase the interchange fees for financial and non-financial transactions. The revised charges will be effective from August 1, 2021. Financial transactions at ATMs are mainly cash withdrawals. Transfer of funds between accounts, change of user details, balance inquiry, mini statement printing, PIN change, applying for a cheque book, etc. are a the non-financial transactions.

This decision was taken after reviewing the recommendations submitted by the committee set up by the RBI in 2019. The committee involved all stakeholders, under the chairmanship of Chief Executive Officers (CEOs) and the Indian Banks’ Association (IBA).

What is interchange fee?

Let’s say you have a savings account with State Bank of India (SBI) and use debit card for cash withdrawal from ATMs. Now, when you use the SBI debit card for a transaction at an ATM deployed by, say, HDFC Bank, SBI pays a fee to HDFC Bank. This charge is called the interchange fee.

As a customer, you will have to bear the cost of using another bank’s ATMs beyond the free limit allowed by your bank. Customers are eligible for five free transactions (inclusive of financial and non-financial transactions) every month from their own bank ATMs. You are also eligible for free transactions (inclusive of financial and non-financial transactions) from other bank ATMs – three transactions in metro centres and five transactions in non-metro centres. Beyond free transactions, the customer has to pay charges to the bank. The RBI has hiked these charges to Rs 21 from Rs 20 per transaction, effective from January 1, 2022.

Mandar Agashe, Founder and Vice President of Sarvatra Technologies says, “Overall there isn’t much of an impact due to the revised charges announced on bank customers.”

Also read: Do you know how much your bank charges and penalises you? Read on

A review of charges was long overdue

The last change in interchange fee structure for ATM transactions was in August 2012, while the charges payable by customers were last revised in August 2014. “It was a long-standing demand from all ATM operators and that’s why there has been a 13 percent increase in the financial transaction fee and 20 percent increase in non-financial transaction fee. The increase in interchange fee structure will support the ATM industry,” says Agashe.

A CEO of payments and ATM operating firm, requesting anonymity, says, “We welcome the ATM interchange increase announced by the RBI. This was long overdue. White-label ATM operators are operating in losses and have been complaining for quite a while about the current fee structure, which is not affordable.”

“An increase in the interchange rate will help us not only serve customers better, but also allow us to deploy additional ATMs that are needed in semi-urban and rural locations to provide financial access and enable financial inclusion. It will also give much-needed relief to the ATM industry,” says Rustom Irani, MD & CEO, Hitachi Payment Services.

Given the increasing cost of ATM deployment and expenses towards maintenance incurred by banks/white label operators, as also considering the need to balance expectations of stakeholder entities and customer convenience, the RBI had decided to revise the charges.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!