Groww, India’s largest investment platform by active users, is preparing to go public at a valuation of around Rs 80,000 crore ($9 billion), according to people familiar with the matter.

When will Groww list?

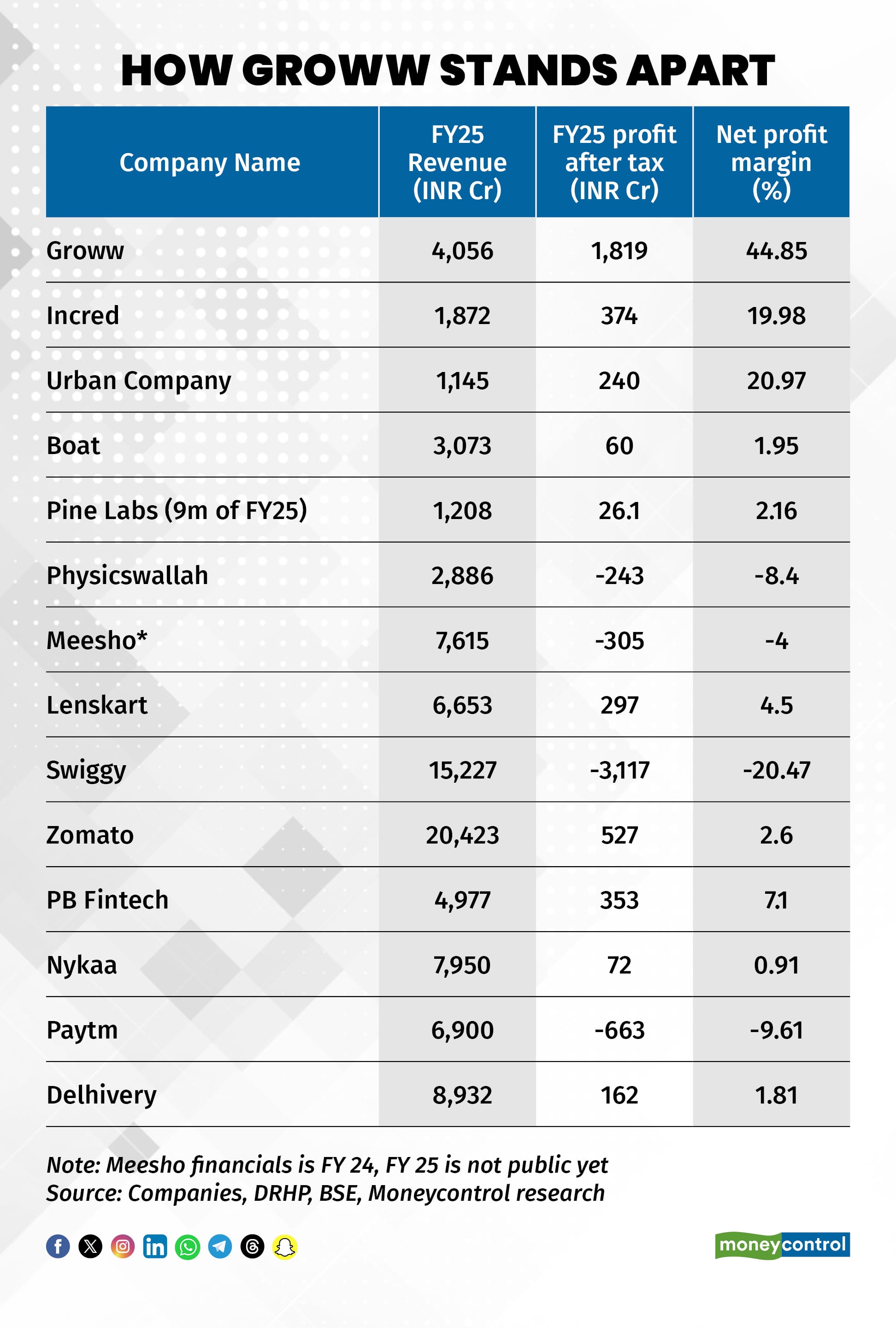

The company plans to file its updated draft red herring prospectus (DRHP) this week and is eyeing a November listing, positioning itself as one of the few highly profitable tech startups in India’s IPO pipeline, with a projected FY25 net margin of 44.85 percent.

Initially, Groww was targeting a valuation of $7-8 billion. However, strong FY25 results and a strong performance in the first quarter of FY 26 could result in a higher valuation.

Why Groww's valuation is being upsized?

Groww reported a three-fold growth in profit at Rs 1,819 crore in FY25, while its revenue grew 31 percent to Rs 4,056 crore, Moneycontrol has reported.

According to one of the sources cited above, the company clocked year-on-year growth in profits during Q1, FY 26, even as most other industry players faced declining revenue and profitability following multiple regulatory changes over the last 12 months.

Based on the valuation, a 10 percent equity dilution could imply an IPO size of around $800 million-1 billion. Most of this is likely to be an offer for sale by existing investors, with a small primary component that will fund the company's investment in tech and new products.

Who's selling in the Groww IPO?

Early investors Peak XV, Y Combinator, Ribbit Capital, and Tiger Global are likely to sell shares in the IPO even as the founder holding will be the highest among all the IPO-bound new economy companies currently, earning them the promoter tag.

One of the largest new-economy IPOs

The valuation pegs Groww close to that of Paytm, which is currently the highest valued fintech company in the country’s public market. Angel One, a listed brokerage firm, is valued at around $2.5 billion.

Groww has around 15 million active users as per the company’s internal estimates. Ahead of its IPO, Groww had raised $200 million from Iconiq Capital and GIC at $7 billion post-money valuation

Groww's new growth engines

The company recently signed an agreement to acquire Fisdom to expand its wealth product offering. It also recently launched commodities for select users. The company is expected to grow its margin trading facility (MTF) lending product over the next couple of years. Together, these verticals are expected to contribute to the company’s revenue and profit growth.

Why broking firms are facing headwinds

Broking firms are facing higher taxes on trading during the current fiscal year, have been earning lower exchange rebates since the middle of the last financial year, and are facing stricter restrictions on retail Futures & Options (F&O) trading since late last year.

This has resulted in players like Zerodha and Angel One seeing a 20-30 percent drop in revenues and profitability since Q4 of FY 25.

Most top brokers have lost customers for eight consecutive months in 2025, though Groww’s wide range of products and wealth offerings is expected to cushion the firm from any setbacks because of the market sentiment or regulatory changes.

Started in 2016 by Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal, all former employees of Flipkart, the company has one of the highest profit margins of almost 45 percent among all listed and IPO-bound new-age companies in India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!