The average market capitalisation of listed companies in India rose by 18 percent in the second half of the year ended December 31, according to the classification list released by the Association of Mutual Funds of India (AMFI) on January 4.

Mutual funds have to adhere to the classification by market capitalisation, as per the guidelines laid down by the Securities and Exchange Board of India in 2017.

Large-caps are defined as those ranked 1 to 100 in terms of m-cap, mid-caps are those from 101 to 250, and small-caps from 251. The list is updated twice a year by AMFI.

Also read | Chasing multibaggers: 5 stocks that jumped from microcap to midcap in AMFI’s rejigThe classification is based on the average m-cap of listed companies on all exchanges – the BSE, the National Stock Exchange of India, and the Metropolitan Stock Exchange of India – during each six-month period.

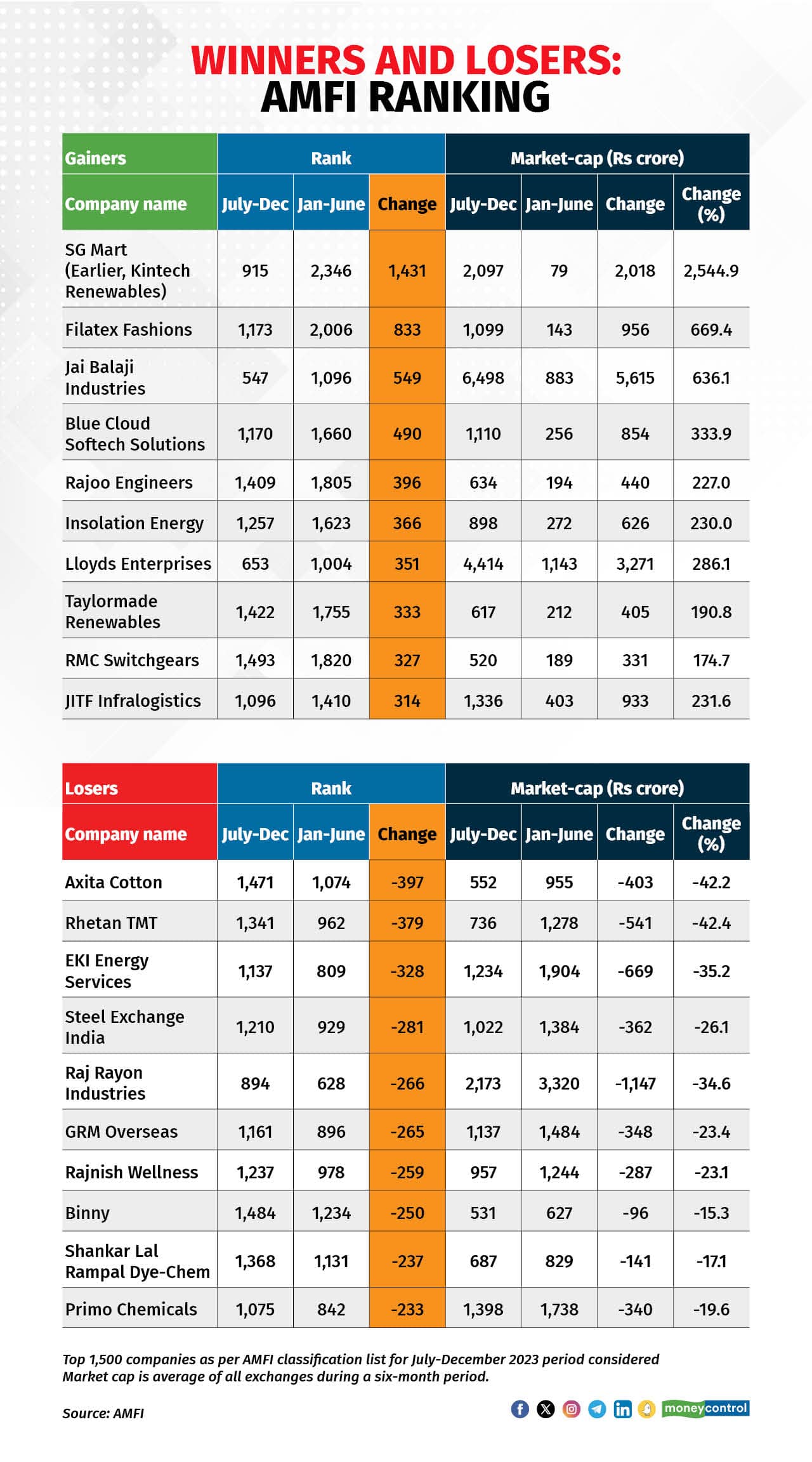

Here are the biggest winners and losers among the top 1,500 companies, as per the AMFI classification list of December 2023.

M-cap moversPrivate lender HDFC Bank posted the biggest jump. The bank’s average m-cap surged to Rs 11,79,522 crore from Rs 9,08,770 (January-June 2023), an absolute rise of Rs 2,70,752 crore. This was primarily due to the merger of HDFC with the lender, effective July 2023.

Larsen & Toubro’s m-cap rose by Rs 97,027 crore, while Bharti Airtel’s market-cap increased by Rs 82,975 crore.

In terms of losers, the m-cap of Adani Total Gas plunged by Rs 72,082 crore, while that of Adani Energy Solutions (earlier called Adani Transmission) eroded by Rs 40,822 crore.

Among large-cap stocks, Hindustan Unilever and Kotak Mahindra Bank’s average m-cap fell from the previous six-month period.

The latest classification showed that SG Mart (earlier Kintech Renewables), gained the most in percentage terms. The company’s average m-cap ballooned to Rs 2,097 crore during July-December from Rs 79 crore during January-June, a more than 26-fold increase (2,545 percent).

Also read | ICICI Bank reduces benefits on 21 credit cards, imposes minimum card usage for airport lounge accessFilatex Fashions and Jai Balaji Industries jumped 669 percent and 636 percent, respectively, in their average m-caps.

On the losers’ side, Adani Total Gas posted the biggest fall in m-cap at 49 percent, followed by Rhetan TMT (-42.4 percent) and Axita Cotton (-42.2 percent). Adani Energy Solutions’ m-cap slumped 30.3 percent.

When it comes to ranking changes, SG Mart advanced the most, rising to the 915th spot after climbing 1,431 places. Notably, the stock has zoomed more than 2,000 percent on a one-year time frame.

Filatex Fashions moved up 833 spots to 1,173rd position and Jai Balaji Industries climbed 549 spots to 547 in the AMFI rankings.

In terms of major names, REC gained 68 places to 88th spot to become a large-cap stock, while Indian Railway Finance Corporation was up 58 places to take the 71st place.

Also read | Sundaram Multi Asset Allocation Fund new scheme launch: A Moneycontrol reviewWhen it comes to losers, Axita Cotton slid 397 places, while Rhetan TMT and EKI Energy Services were down 379 and 328 spots, respectively.

Adani Wilmar was among the biggest names to fall in the rankings, slipping 58 places to 143rd spot. UPL lost 54 places to fall out of the large-cap segment.

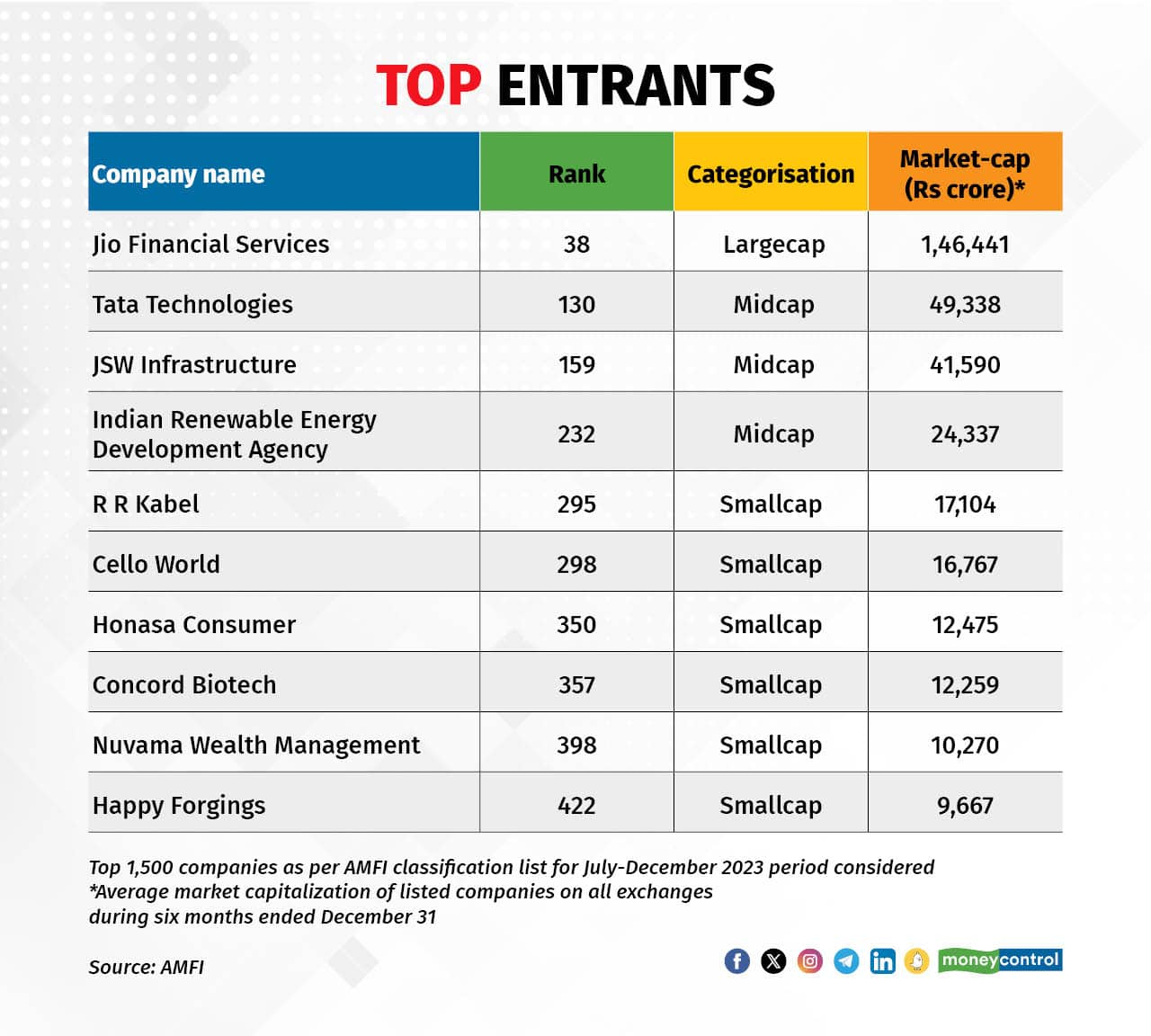

There were 63 new names in the top 1,500 companies. Jio Financial Servicesdebuted as a large-cap stock in the 38th spot with an average m-cap of Rs 1,46,441 crore. The top debutants were rounded off by three mid-cap companies and six small-cap companies.

Tata Technologies listed at the 130th spot, while Honasa Consumer was listed at the 350th spot.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.