What happens if you do not pay your credit card bills on time? Your card company imposes a late-payment fee and an exorbitant interest charge. Now comes a new pay later card that allows you to simply divide your monthly bill into three equal parts, which you can pay over the next three months, at absolutely no extra cost. The UNI Pay 1/3rd card has been launched by Uniorbit Technologies (UNI), in partnership with RBL Bank, State Bank of Mauritius (SBM) and Liquiloans.

On the face of it, the card looks convenient. In traditional credit cards, your interest clock starts ticking from the first billing cycle’s payment date. But this card allows you to postpone your payments for three months at no extra charges. But there are caveats to this facility. Here is what you must be aware of.

How does the UNI Pay 1/3rd card work?

Say, your monthly bill is Rs 30,000. Just like any other credit card, you could pay your bill in full. But, if you are short on cash, you can opt for a postponement of dues. So, you can divide your bill into three equal parts and pay Rs 10,000 each at the end of the first, second and third months.

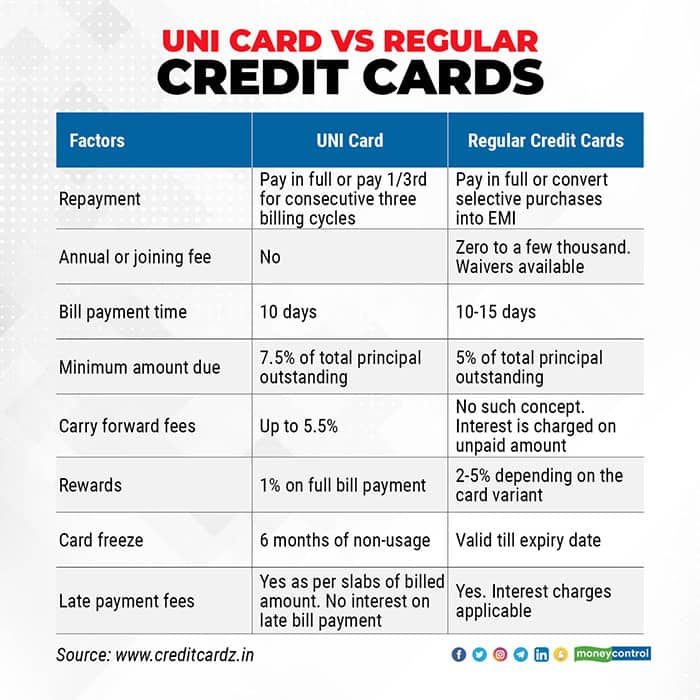

Like all credit cards and pay later card, this card also has a credit limit. If you opt for the 1/3rd payment, your credit limit for the next month gets reduced to the extent of your unpaid bills. As you keep clearing your monthly bills, your credit limit gets reinstated. There are no joining fees or annual charges for now.

“It is currently free for lifetime until Jan 31, 2022. After that, charges will be introduced. So, customers who download the UNI app until Jan 31 2022 will have lifetime free and post that the new customers will be charged. Also, this is subject to changes and we may also extend the timeline,” says Nitin Gupta, Founder and CEO of UNI. With the UNI Pay 1/3rd card, we aim to solve the short-term liquidity issues for consumers without the burden of interest fees, he adds.

Also read: 4 factors that may hurt your credit score despite the loan moratorium

You can apply for the card through the firm’s app – available on Android and iOS. Only those aged between 25 and 60 are eligible. You will get a virtual card minutes after filling your online application. A physical card would take some time to be delivered. “UNI Pay 1/3rd card seems to be targeting customers who do not have a credit card or are using only one credit card,” says Parijat Garg, a digital lending consultant.

What works

If you pay your bills in full, you get 1 percent cashback. You can adjust this against the unbilled amount in the statement, in the following months. The app also allows you to keep track of spending patterns in real time, get a breakup of spends made across categories and receive repayment alerts.

“Purchases made on other credit cards only get you 30 to 45 days' credit period to repay. On the Pay 1/3rd card, you get 90 days' credit period to repay the full amount,” says Garg.

What doesn’t work

Although the card allows you to split your monthly bills into three interest-free and cost-free installments, it could softly lead you into a debt trap, if your spending goes on unchecked. If you fail to meet your payment deadlines, the charges are high.

Although the card doesn’t charge interest for the billing amount within the 1/3rd payment window, it charges a late fee, if you miss any of the three installments. As per the chart available on the websites of Uni Cards and HDFC Bank (for comparison), an unbilled amount of Rs 40,000 with UNI card would attract a late payment charge of Rs 3,000. HDFC Bank credit card will impose Rs 1,100 as late fees.

There is a minimum amount due every month that is 7.5 per cent of total principal outstanding. If you pay less than this minimum amount, a carry forward fees of up to 5.5 percent a month would be charged in the next billing cycle. The carry forward fee varies with the customer’s credit profile and past repayment record. It will be communicated at the time of repayment. Assuming that a customer is charged 5.5 percent a month (i.e., 66 percent a year) as carry forward fees, UNI Pay 1/3rd Card turns out to be more expensive than other credit cards for those who miss their payments. “If you do not pay that minimum due amount, then you are a delinquent customer and are accordingly reported to the bureau,” says Gupta.

Raj Khosla, founder and MD of MyMoneyMantra.com adds, “There is no co-branding with UNI pay 1/3rd card, so a particular segment of customers may feel that there are no rewards for using this card.”

Should you apply?

This card is reasonable for those who are new-to-credit (NTC) customers and may not be eligible for traditional credit cards due to low salaries or infrequent income. But make sure you do not overspend or do not extend repayment beyond the free credit period. “The key value that a customer gets is two months extra to pay off the bill compared to regular credit cards, without interest cost,” says Khosla.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.