For most busy people across the globe, a lockdown has meant that they are finally spending time at home, doing all the things that they never had a chance to do. However, as the lockdown extends, the desire to meet friends physically, travel and go back to office is starting to nibble, and therefore staying at home is not as alluring any more.

Gold prices going up sharply has probably had a similar effect, with many investors wanting to ensure that they have more and more of the yellow metal in their portfolio. Before loading up on gold in your portfolio, keep the following things in mind.

Avoid recency bias

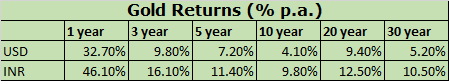

Recency bias is very evident in the current preference for gold as an investment option, when one sees the performance of gold over the last one year or so. Clearly, gold has done very well in shorter periods of time, but when you stretch the investment horizon to longer horizons, you find that gold returns range from 4-9 per cent in USD terms, and 9-12 per cent in INR terms. That’s not bad, but you need to remember that interest rates and inflation during this period were much higher than where they are today.

Rupee weakness drives gold returns

As you would have noticed from the data on the returns of gold in USD versus the returns of gold in INR, a large portion of returns for gold investors in India comes from a weaker rupee against the US dollar, and not just from the performance of gold alone. NRIs buying gold overseas would find the returns from gold to be much lower. Thus, investing in gold for residents in India is often a hedge against the weakness of the Indian rupee against the US dollar. On the contrary, any dollar weakness could also lower returns for Indian investors in gold. Bearing this relationship in mind is critical for gold investors.

Lower interest rates do not equal higher gold prices

At certain points, when interest rates head downwards, one does find that gold prices move up, and thus there is a belief that lower interest rates make gold more attractive as an alternative asset class to invest in, because returns from fixed income investments reduce. However, at certain other times, like at the start of the decade, one has also seen gold prices moving up even though interest rates were moving up at the same time. Thus the relationship between low interest rates and high gold prices is hard to prove over long periods of time.

Crude oil and gold prices may not move in tandem

One has often seen gold prices and crude move up at the same time. This is possibly due to the fact that high oil prices have been accompanied by geo-political concerns in the Middle East, and thus gold has taken on its role as a safe haven asset. However, there are also periods like we are currently experiencing with gold close to record highs in terms of prices and oil prices at record lows. The entry of shale and its impact on oil prices has also made this relationship with gold prices more complex.

Demand and supply truly matter

Gold is used both as an investment and consumption asset in the form of jewellery in large economies such as China and India. Demand and supply have a critical role to play for gold. Central Banks are also buyers and sellers of gold at different points, and could have their own impact on prices of gold.

Negative correlation with equities

Gold has traditionally tended to do well when there is fear or anxiety in other asset classes such as equity. Thus, it is a good hedge in an equity portfolio and really finds its place in investment portfolios as a safe haven asset more than anything else. Having an allocation of gold in your investment portfolio of between 5-10 per cent is a good idea as a safe haven asset and due to its negative correlation with equities on most occasions.

Therefore, when you think of buying gold as an investment this Akshaya Tritiya, keep your overall exposure to gold in your investment portfolio to between 5 per cent and 10 per cent, first and foremost. Only after that, decide on whether it should be physical gold, a gold ETF, a gold fund or a Sovereign Gold Bond.

The fallacy of too much of a good thing applies to gold as well.

(The writer is a certified financial planner and founder of Plan Ahead Wealth Advisors, a SEBI registered investment advisory firm)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!