It’s that time of the year when fresh graduates are looking for their first dream job and experienced workers aim for better, higher-paying jobs or a big career jump.

But layoffs are a harsh reality that has plagued some sectors this year, especially among startups and information technology companies. According to data compiled by Moneycontrol Research, about 41 Indian startups have laid off almost 6,000 employees in the first four months of 2023. Even global companies including Amazon, Alphabet, LinkedIn, Meta, and Microsoft are letting people go.

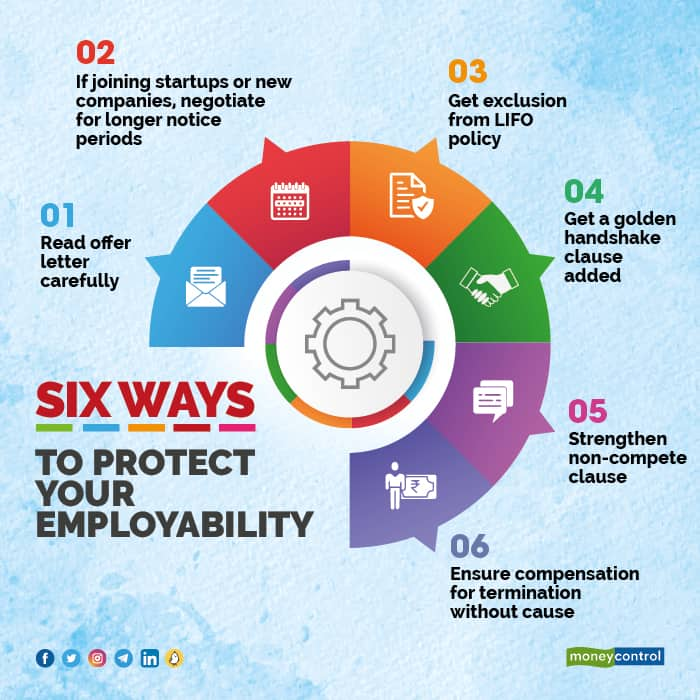

Still, some opportunities are floating around, and while no one can predict the future and it’s impossible to anticipate a bad turn in a company, there are some things that you could look at when searching for your dream job to minimise the chances of being laid off.

Company history

This is the most basic thing to do – check how old or new the company is and how it took care of employees during the tough times.

“Look for job stability by targeting companies with a track record of stability and growth,” said Hariom Seth, founder of Find.Inc., a job search platform.

If it’s a new startup, the company won’t have a track record of survival through business cycles. Such companies can offer sweeteners such as higher-than-average salaries.

Seth added that employees should also focus on diversifying their skills to remain adaptable in different roles and sectors.

Once an offer letter is received, go through it with a fine toothcomb. Understand the clauses. Most employees tend to sign the contract after just reading through the cost to company (CTC) offer, leave policy, incentives and other terms, without focussing on key sections.

“An offer letter is an important document while joining the organisation and you should read the fine print in detail because that would determine your ability to stay with the organisation for a longer term,” said Vihang Virkar, a partner at Lumiere Law Partners.

Reach out to the human resource department if more clarity is needed on any provision.

Also read: Switching jobs? 6 tasks that require your immediate attention

Longer notice period

In your contract, there should be an adequate notice period. A one-month notice period means the company can lay you off at short notice, which is hardly enough to look for a new job these days. Experts advise getting a longer notice period.

“You should negotiate for a notice period of at least three months,” said Virkar. Once you have a longer notice period, the company will try to first lay off employees with shorter notice periods, he added.

While a longer notice period might give you slightly more job security, the flipside is that it can hold you back when you get a good job offer and wish to leave sooner.

Applicants must be aware of the risks of probation. According to Kunal Sharma, a partner at Singhania & Co., prospective employees should negotiate for a no-probation period “because during such a period, the organisation generally has the right to terminate with very short or no notice period.”

LIFO policy

The last-in-first-out (LIFO) method is an approach where employees who joined an organisation most recently are the first to be laid off during downsizing.

“While it may not be possible to completely exclude oneself from the LIFO policy, employees can discuss their concerns with the HR department and explore possibilities for alternative arrangements that align with the organisation's policies,” said Kartik Narayan, CEO of staffing at TeamLease Services.

It’s always a good idea to communicate your preferences to the HR department openly.

“You might talk about your desire to take on more responsibility or move to another position within the company if it helps you keep your job,” said Navneet Singh, founder of Avsar.

“This year, there are instances wherein some companies visiting campuses for hiring at premium B-schools and IITs have stated that the graduates joining the organisation will not be subject to LIFO policy in case of a layoff,” said Virkar.

Also read: Got your first job? Here's how you can make tax-saving investments

Golden handshake

A golden handshake clause, or severance agreement, grants cash rewards and stock options in some instances to an employee in the case of termination, layoffs, or a change in ownership of the firm.

“It is meant to give the employee a financial safety net or a reward during challenging times,” said Singh. Entry-level or lower-level employees are less likely to receive it than high-level executives and those in crucial roles, he said.

“The organisation could award employees with a severance package in the form of a golden handshake, as per the clause in the offer letter, even if the company is going through a financially lean phase,” said Virkar. The organisation may structure the cash rewards to be disbursed in parts over a period of time if it is not performing well.

You should get a clear understanding of the golden handshake terms in the offer letter by speaking to a legal expert or employment specialist.

“Employees can negotiate the inclusion of this clause in their offer letter, although companies may or may not agree to it, depending on their policies and seniority,” said Narayan.

The offer letter should clearly outline the terms and conditions of severance packages in the case of layoffs.

“This should include details about the duration of the severance pay, benefits continuation, or any other relevant compensation,” said Sharma.

Sachin Alug, CEO of NLB Services, a talent solutions company, said that by agreeing to give a golden handshake to an employee, an employer not only helps them in the situation of job loss but also motivates them to work harder.

Also read | 23% of salaried people aren’t prepared for financial emergencies: Survey

Non-compete clause

Restrictions on joining a rival company, commonly known as a non-compete clause, can vary, depending on the organisation.

“While some companies may be willing to lift the restrictions after a few years of experience, it ultimately depends on factors such as industry norms, job position, and the employee's value to the organisation,” said Seth. It is advisable to discuss such matters during the offer stage or at a relevant time.

Employees should negotiate to limit the non-compete clause to four or five core competitors, said Virkar.

“This is legal and some companies do it for certain employees,” said Heena Bhatia, founder of Team Recruit Consultancies. She said that joining a direct competitor by violating the terms in the offer letter can result in the company sending a notice to you.

Termination without cause

Termination can only occur if you have breached company policy. So, without a cause, there shouldn’t be any termination.

“In case of termination without a cause, you must get adequate compensation, at least a three-month notice period or salary for three months,” said Virkar.

Look out for this clause in the contract and if it’s not mentioned, one should negotiate for its inclusion in the offer letter.

Customised clauses

While adding customised clauses such as longer notice periods, excluding from LIFO policy, golden handshakes, etc. to protect employability can have advantages such as providing additional security, although there can be drawbacks, too.

“These include the possibility of negotiations breaking down, resulting in no job offer, or the employer perceiving the inclusion of such clauses as overly demanding or lacking commitment,” said Narayan.

“Customised clauses can create ambiguity and confusion, especially if they deviate significantly from standard employment terms,” said Seth.

This can lead to disputes between the employer and employee regarding the interpretation and implementation of these clauses.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.