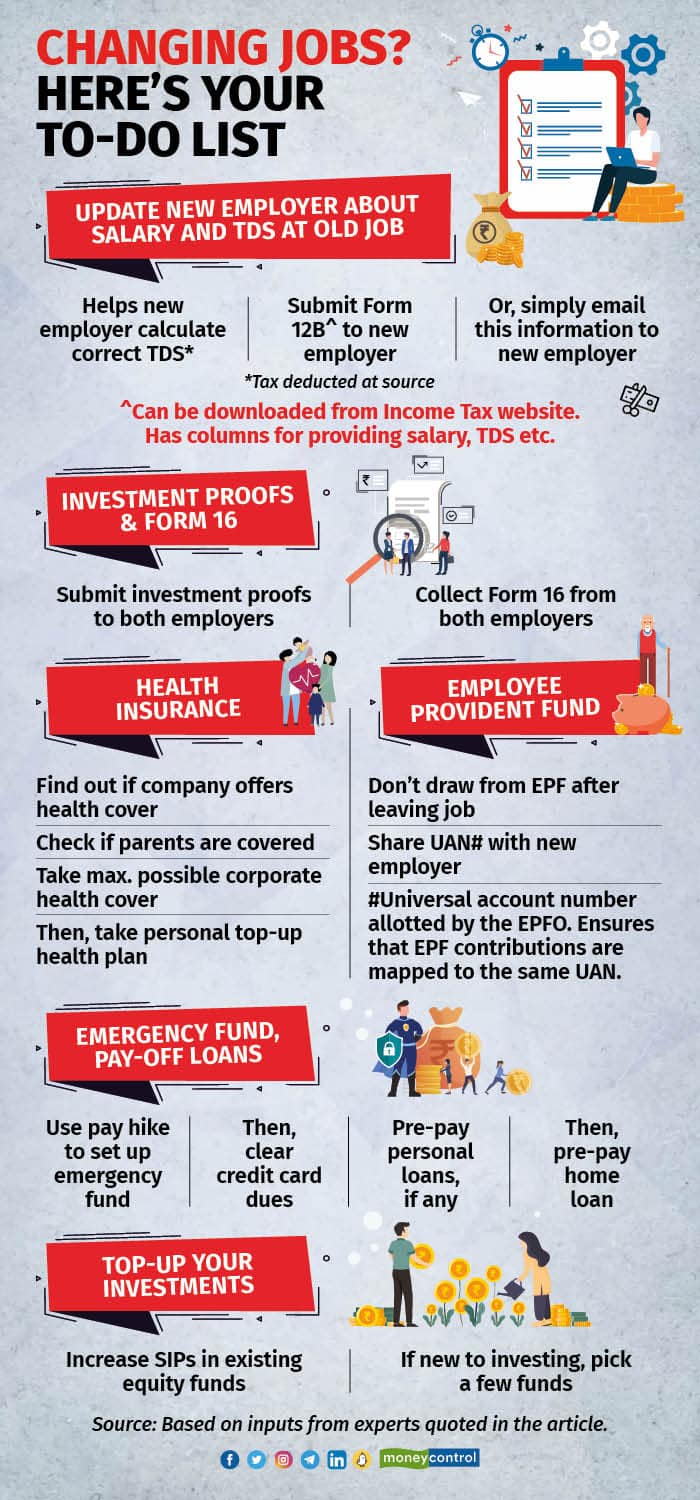

Moving to a new job can be exciting but it also entails adjusting to a new work environment. Even as you familiarise yourself with your new role, don’t forget to deal with your personal finance matters, especially those relating to tax. Here are a few points to keep in mind.

First of all, update your new employer on your earlier salary and tax deductions made until then. If not, be prepared for a tax outgo (including penal interest) at the time of filing tax returns. Ensure that you submit your investment proofs to and receive your Form 16s from both your employers.

Also, share your correct employee provident fund (EPF) details with your employer.

Do enquire about the company’s health insurance policy – who all are covered and what’s the coverage amount. And accordingly, plan out your personal health cover.

Finally, use the salary hike to pre-pay any high-interest loans that you have and then, earmark some amount for investments, too.

Ensure that you update your new employer about your income from your previous job. For example, what was the salary earned, the deductions claimed, and the amount of tax deducted at source (TDS) by your earlier employer? This is to ensure that the new employer deducts the appropriate TDS from your salary.

So, how to go about it? Mayur Shah, Partner, EY recommends that you fill and submit Form 12B to your new employer if you have changed jobs mid-year. The form has columns for providing information such as the employment period, salary earned, Section 80C deductions, TDS deducted at the previous job, etc. Submitting Form 12B is not mandatory but can be helpful. You can download it from the Income Tax Department website.

If some taxpayers find it challenging to submit Form 12B, Archit Gupta, Founder and CEO, Clear, suggests that they simply take this information from their salary slips or take the tax computation from their previous employer and email it to their new employer.

So what can possibly go wrong if you fail to furnish this information?

Here’s a simple example. One, both your old and new employer may land up calculating your TDS after taking into account the basic exemption limit though only one of them should do so. The basic exemption limits (income of up to this amount is not taxed) are Rs 2.5 lakh and Rs 3 lakh under the old and the new tax regimes, respectively. Similarly, it is possible that both employers assume Rs 1.5 lakh of section 80C deductions while arriving at your TDS.

The result: your tax liability may get underestimated and the TDS deducted may be lower than what it should have been. You have to pay the remaining tax at the time of filing your tax return. Not only that, as Gupta points out, you will also have to pay a penal interest (1 percent monthly) on the tax dues. This is because the tax on the salary which was earned during the year had to be paid at regular intervals (according to the advance tax rules) and not just at the time of filing tax returns. Advance tax has to be paid in four instalments by the 15th of June, September, December and March of each financial year.

Also read: Finance Bill amendment offers marginal relief for income of slightly over Rs 7 lakhInvestment proofs and Form 16You must also ensure that in the year of job changes, you receive Form 16 from each of your employers. You will need them at the time of return filing.

Gupta highly recommends that those with a job change file their tax returns well on time. Such people end up seeing tax dues (when they combine the two salaries) and tend to have many queries around 2 Form 16s at return filing time.

When it comes to investment proofs, should those be submitted to the old or the new employer? According to Shah, it’s best to submit them to both employers. Then, either employer will be able to produce them to the IT department, if needed.

Also read: Financial year just got over. Where do I throw these tax documents now?Take care of your healthNext, you must look into your insurance-related matters. Shantala Kumble, Principal Officer, International Money Matters, says that you must find out about your employer’s corporate health cover. Does the policy cover only you and your spouse and children or can you also include your parents or parents-in-law (both may not be allowed at the same time), too?

In fact, this is something worth checking even before you accept the job offer.

Once you quit your job, you lose the health cover provided by your old employer. Now, depending on whether your new employer provides health insurance or not, this is how you can go about taking adequate cover.

Given that corporate insurance is always better (comes at no / relatively lower cost, and is more comprehensive), if you have this option, go for the maximum possible cover that you can. Abhishek Bondia, Principal Officer and Managing Director, SecureNow.in, elaborates on this point with an example.

Also see: Moneycontrol SecureNow Health Insurance RatingsMost companies generally provide cover of Rs 2 lakh to Rs 5 lakh with the option of top-up of Rs 5 lakh to Rs 10 lakh. He says once you have exhausted this limit, take a personal top-up plan to meet your balance requirement for health insurance.

On the other hand, if you are moving to a company that does not provide a health cover, here’s what you can possibly do. Assume you had Rs 2 lakh corporate cover at your old job and Rs 8 lakh personal health cover (with a deductible of Rs 2 lakh). On moving to the new job, you can convert the deductible from Rs 2 lakh to nil (at an additional premium) to ensure that you retain your overall health cover at Rs 10 lakh as before. Deductible is the amount that you have to pay from your pocket before the insurance company starts covering your expenses.

Also read: How to optimise premium for a personal health insurance when an employer-sponsored plan existsDealing with employee provident fundAs regards EPF, Dev Ashish, a SEBI-registered Investment Advisor and Founder, StableInvestor.com, says that make sure you do not withdraw money from your EPF account when leaving a job. This will eat away into your retirement corpus.

You can provide your existing EPF account number and UAN (universal account number) to the next employer to enable them to create another PF account mapped to the same UAN rather than creating a new UAN. This can make it easy for you and your family to keep track of your EPF investments.

Prepay your home loan, pay off other debtsFinally, a new job comes with a pay hike. How can you put it to good use? “This depends on your financial profile,” says Ashish. He says start by asking yourself if you have an emergency fund or not. Next, what about credit card debt or other high-interest loans? And then, you can come to investing.

If you don’t have an emergency fund, he suggests that you use the pay hike to build one by starting a recurring deposit. Then, if you have credit card dues, pay those off quickly given that it’s high-cost debt. Then coming to other loans, start by paying off your personal loans, if any, and then, pre-paying your home loan.

Top up your investmentsOnce this is taken care of, you can start setting aside some money for SIPs (systematic investment plans) in a few equity funds if you are new to equity investing. Or, you can consider increasing the SIPs in your existing equity funds for the long term.

Also see: MC30 List of FundsAshish suggests that one can also contribute to the voluntary provident fund (VPF) to the extent that it earns a tax-free return (article link). You need to enquire with your new organisation about how to go about this. “You may be allowed to make this contribution only when the VPF investment window is open and not all through the year,” says Ashish.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.