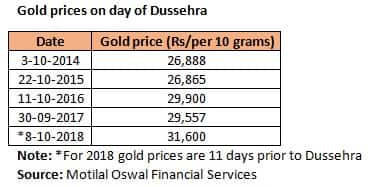

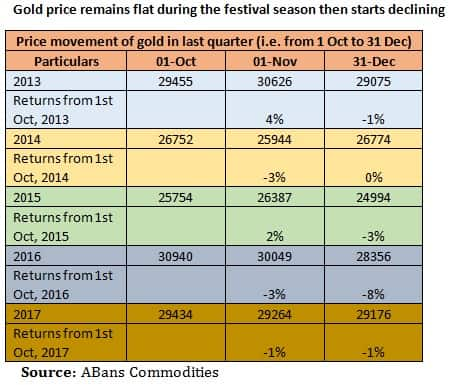

Dussehra is around the corner followed by Diwali in the first week of November 2018. People plan to invest in gold around the festivals and expect prices to rise in future.

Sunil Sharma, Chief Investment Officer, Sanctum Wealth Management cautioned, “A yearly Dussehra SIP into rupee denominated gold would have yielded an annualized 4 percent return (approx.) for an investor which would not even beat inflation. Thus, it highlights gold as more of a tactical asset allocation rather than a long-term wealth generator.”

Correlation between gold prices and equity market

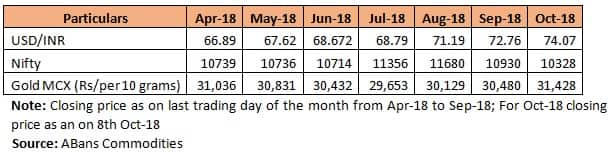

“There is a negative correlation of 0.72 between equity markets and gold prices in India in the last six months,” said Abhishek Bansal, Chairman & Managing Director of ABans Commodities.

Gold prices kept sliding from May 2018 to the end of August 2018 and equity market was on a rise.

Bansal added, “As Nifty was trading at lifetime highs in August then correction started from its peak of 11,751 to 10,203 in past months whereas gold was shining all around during the same period. This was when international gold prices were trading in the range of $1,180-$1,213 per ounce with a negative bias. In this year, domestic gold prices spiked from 29,268 per 10 grams to 31,645 per 10 grams, an 8 percent gain.”

Gold is always viewed as safe haven and investors rush to buy gold once they sense uncertainty or heightened volatility in equities. “But, this correlation between weaker equities, stronger gold and weak rupee seems to be fading off late,” said Navneet Damani, AVP- Commodity Research, Motilal Oswal Financial Services.

Sharma added, “Despite the rapid rupee depreciation recently, gold prices have remained within a narrow trading price band since 2016.”

Gold under pressure

Damani said, “Gold prices have been largely under pressure over the last few years and have underperformed most asset classes. The domestic demand for gold has been low and with 10 percent import duty, declaration of high value transaction, GST, and many other factors the demand for gold has suffered.”

Change in investor’s preference

Over the last seven years, gold demand has been nearly at average levels. Sharma said, “Investors have been slowly moving away from gold and preferring to invest in liquid assets such as equities. This may be due to a shift in demographics, with the younger generation preferring a shift away from gold due to the myriad risks associated with storing and reselling it.”

In case you keen to invest in gold this festive season then Sharma recommends investing into gold ETFs instead of physical gold since it’s easy to liquidate. Also, gold should be purchased as a part of a portfolio diversification strategy and a small allocation in your portfolio to gold is a prudent decision.

Outlook on gold

Damani said, “We believe that gold remains attractive as considerable uncertainties still exist globally. US monetary policy outlook for 2018 remains unclear with a new Fed Chairman taking charge. Global equity markets remain near record highs and most measures of volatility remain near record lows which means unexpected financial or geo-political shocks could lead to quick reversals of existing trends."

"While physical fundamentals are yet to catch up, sentiment drivers could still drive gold prices higher this year. From a medium to long-term perspective, we expect a gold price of Rs 35,500 to Rs 36,000 for 10 grams of gold.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.