The Reserve Bank of India (RBI) on February 7 announced a 25-basis point cut in the repo rate, bringing it down to 6.25 percent. This rate reduction, the first in close to five years, will provide much-needed relief to those who have taken out loans, particularly for homes.

All retail floating-rate loans sanctioned after October 1, 2019, are linked to an external benchmark, which is the repo rate in the case of most banks.

This means banks will have to pass on the benefit of the entire rate cut to borrowers. According to RBI rules, banks have to reset their interest rates at least once every quarter. Depending on your loan contract terms, your bank’s rate transmission could be even sooner.

Home loans linked with MCLR or base rate? Then switch and save

Consider refinancing your home loan to take advantage of lower interest rates. With some leading banks offering repo-linked home loans starting at 8.35 percent, borrowers may be able to secure better terms. If your existing loan is tied to older benchmarks like MCLR (marginal cost of funds based lending rate) or base rate (the RBI's pre-MCLR lower limit of interest rate), reassess your interest outgo and loan terms. You may be paying more interest than necessary.

Transferring your loan to a lender offering repo rate-linked loans could help you capitalise on the lower interest rates and reduce your overall interest burden.

Also read | Explained: What the RBI rate cut means for fixed income investors

Repo-linked loan? Here's how to reduce your interest burden

“Repo-linked home loan borrowers can consider switching to lenders that offer more competitive interest rates and narrower spreads, which can help reduce their overall interest burden," advises Adhil Shetty, CEO of BankBazaar.com. Even if you have a repo-linked loan with a relatively small rate difference of 35-50 basis points, it's still worth exploring refinancing options to switch to a more competitive loan, he adds.

Proactively monitoring market rates and negotiating with your lender can lead to substantial savings on interest expenses. While banks may not have a formal process for converting loans, they may be willing to lower rates during negotiations, especially if you indicate an intention to switch.

Alternatively, non-banking financial companies (NBFCs) and housing finance companies (HFCs) often provide official conversion options, enabling you to switch to lower rates for a nominal fee.

Also read | RBI cuts repo rate by 25 bps: Home loan borrowers set to save big from lower interest payout, EMIs

How existing home loan borrowers can benefit from rate cut

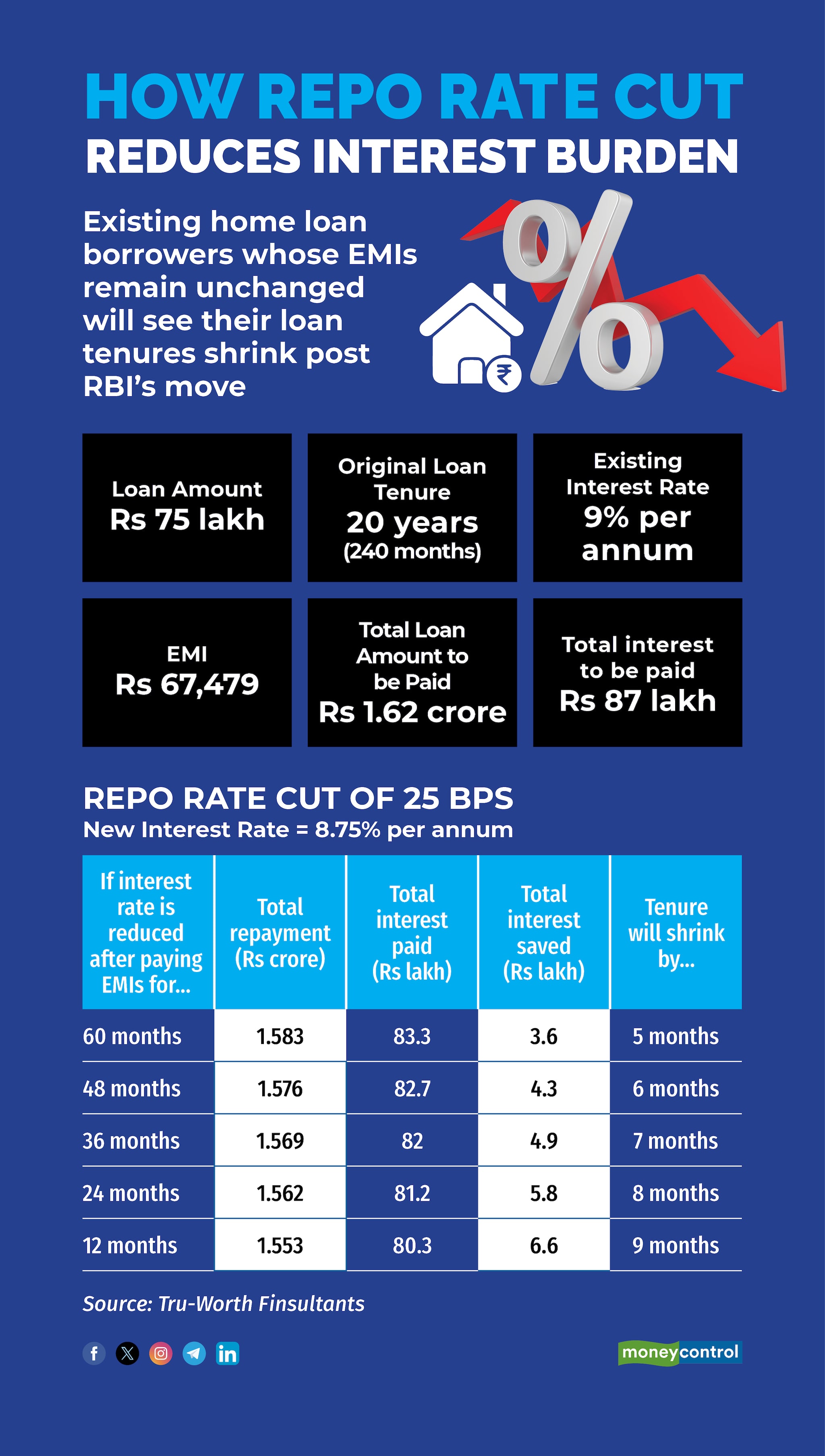

For existing home loan customers, the interest rate reduction benefit varies based on the loan tenure already completed. To illustrate, consider a borrower with a Rs 75-lakh home loan repayable over 20 years. If the interest rate drops from 9 percent to 8.75 percent after 36 months (of having taken the loan), the total repayment amount over the remaining tenure decreases from Rs 1.62 crore to Rs 1.57 crore, resulting in a savings of Rs 4.97 lakh and a loan closure seven months earlier.

Similarly, if the interest rate reduction occurs after 24 months, the borrower can save Rs 5.8 lakh (Rs 1.56 crore vs Rs 1.62 crore) in interest outgo and close the loan eight months earlier.

How partial prepayments can help you save big

The repo rate cut, combined with the tax rate cuts under the new income tax regime announced earlier this month in Budget 2025, has provided a boost to salaried and middle-class individuals, helping them combat inflation and increase their household savings.

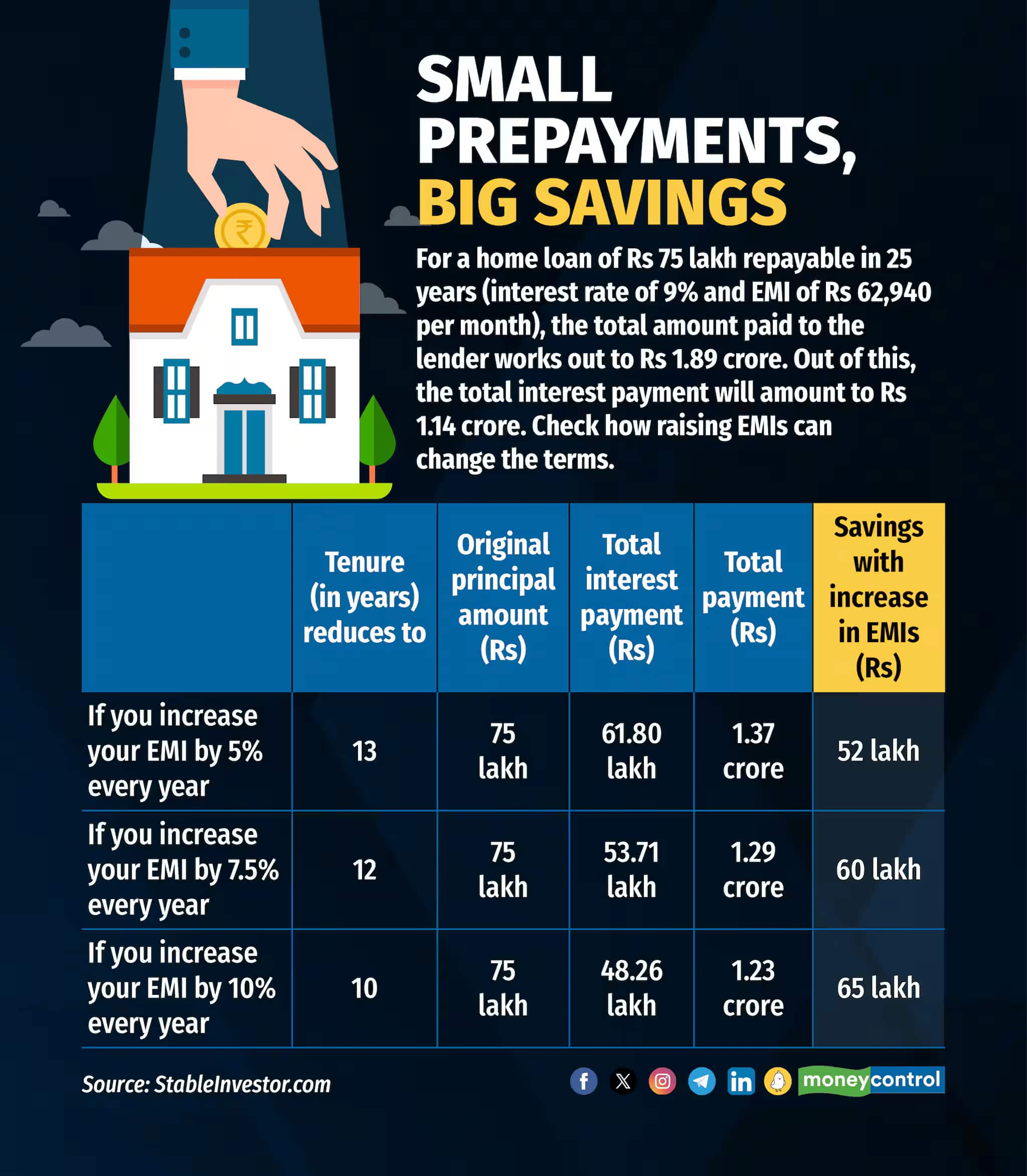

By allocating these savings towards strategic partial prepayments on your home loan, you can alleviate your financial burden considerably. Setting aside a modest amount each month can help reduce the principal loan amount, resulting in substantial savings on interest payments over time.

This strategy involves small, manageable contributions, but its long-term benefits can be substantial, potentially saving you lakhs of rupees in interest (see graphic). Consider leveraging your annual bonus to make regular partial prepayments and making it a habitual practice to optimise your housing loan management and maximise your savings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.