In the pandemic year 2020, many ended up taking personal loans and revolving credit card debt to tide over the economic crisis, ending up in a debt trap in the process. If you have a resolution to get out of it in the new financial year 2021-22, then you must start with retiring high-cost debt. Personal loans and credit cards come with exorbitant interest rates, as these are unsecured debt. To reduce your overall loan burden, you must look at liquidating your investments. If that is not possible or is not enough, you can also consider taking lower cost loans to reduce your interest payable. Gold is one such asset that can come to your aid in times such as these.

Also read: IDBI Bank, Punjab National Bank offer the best rates on savings accounts among public sector peers

Public sector banks offer the best rates

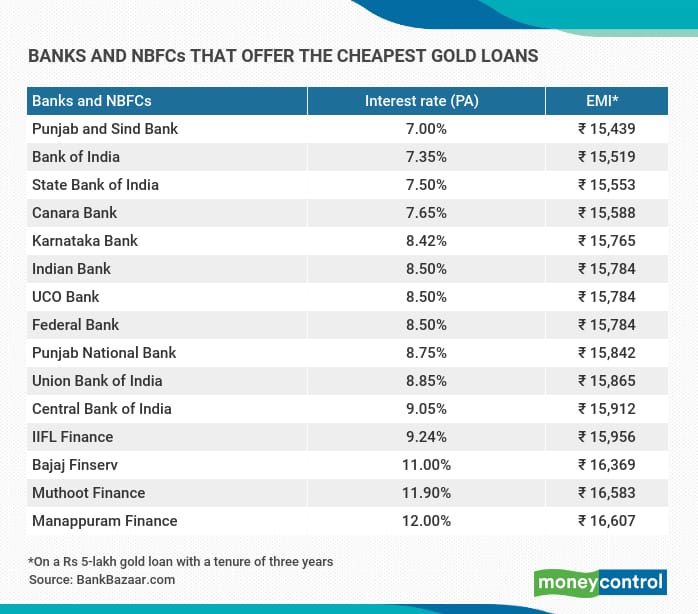

Punjab & Sind Bank offers interest rate of 7 percent on a gold loan of Rs 5 lakh, with repayment tenure of three years, as per data from Bankbazaar. Bank of the India (BoI) is the second on the list of cheapest lenders, charging an interest rate of 7.35 percent. The State Bank of India (SBI), Bank of Baroda gold loans carries an interest rate of 7.5 percent and 9 per cent per annum respectively.

Non-banking financial companies (NBFCs) that are highly active in this space offer loans at comparatively higher rates. IIFL Finance’s gold loans come at an interest of 9.24 percent, which is the cheapest amongst NBFC gold loans. Bajaj Finance’s gold loan rates start at 11 percent, while the two major players in this space – Muthoot and Manappuram – levy interest rates of 11.90 percent and 12 percent, respectively.

Also read: Yes Bank and DCB Bank offer the best rates on three-year FDs for senior citizens

A note about the table

Interest rate on Gold Loan for all listed (BSE) public-private sector banks and selected NBFCs have been considered for data compilation. Banks for which data is not available on their websites are not considered. Data collected from respective banks’ websites as on March 18, 2021. Banks are listed in ascending order on the basis of interest rate i.e. bank/NBFC offering lowest interest rate on gold loan (for various loan amount) is placed at top and highest at the bottom. Lowest rate offered by the banks/NBFCs is considered in the table. EMI is calculated on the basis of interest rate mentioned in the table for a Rs 5-lakh loan with tenure of three years (processing and other charges are assumed to be zero for EMI calculation).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.