As a young professional, finding a rental property is a significant milestone. After securing a job and a place to call home, you diligently pay rent, which accounts for about 30 percent of your monthly income. However, when applying for a home loan, you may still face rejection if you are new-to-credit (NTC), as credit information companies do not take rent payments into account while generating your credit scores. Likewise, banks do not factor in your payment track record while evaluating your loan applications.

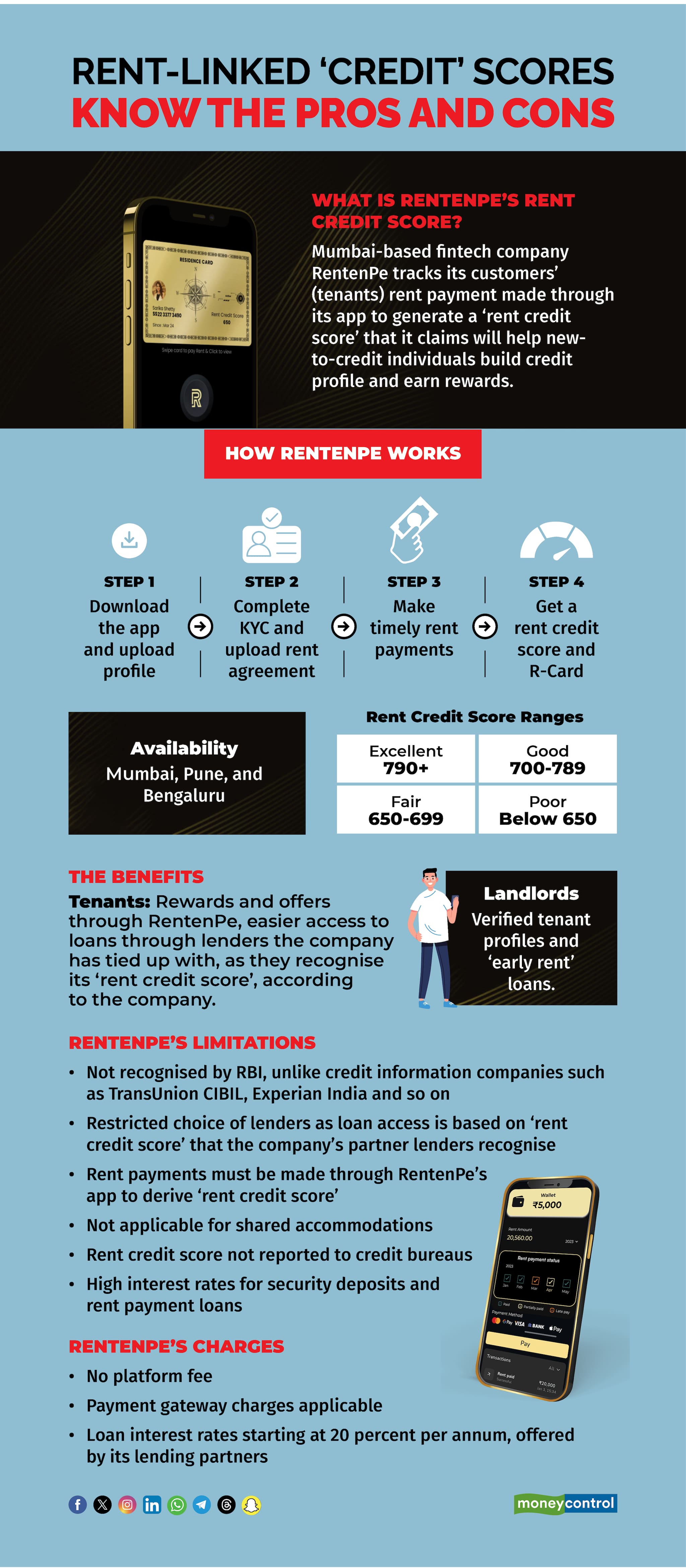

RentenPe, a Mumbai-based fintech company, has come up with a solution in the form of ‘rent credit score’ which, it claims, can bridge this gap. To obtain this score, tenants will have to make their rent payments through Residence Card (R-card), its payment tool. “RentenPe is governed by the rent control act of India. RentenPe is a data company which complies with the central banks digital and lending laws. Ernst&Young has conducted market research and business ratification for RentenPe," says Sarika Shetty, Co-Founder and CEO of RentenPe.

The offeringsTo access this service, a registered rent agreement is required, in compliance with guidelines of banks, payment gateways, and the Reserve Bank of India (RBI). Therefore, RentenPe mandates a rent agreement for its services. "We have ensured adherence to all legal aspects of rental payments and exclusively cater to the structured market. By making timely rent payments, you'll not only build a strong rental history but also a comprehensive ‘rent credit score’, get an R-Card, that is, a digital storage solution for all your rental information and earn rewards on rent payments,” explains Shetty.

For instance, the company will pay one month’s rent on behalf of tenants with an ‘excellent’ rent score who make regular rent payments through the app. Landlords who install the app and create an account are granted access to tenant profiles verified by RentenPe.

According to the company, a rent credit score below 650 is deemed poor, while a score above 790 is considered excellent. This score is primarily determined by a customer's payment history. For instance, tenants get up to one month free rent amount for making regular rent payments through the app. Landlords, on the other hand, gain instant access to verified tenant profiles, making it easier to find reliable tenants.

“This rent credit score can be leveraged to secure favourable rental agreements, rent-related loans, pre-approved home loans, and potential savings on rent,” says Shetty. However, the fintech has not disclosed the names of partnered banks and NBFCs for loans.

“It could be beneficial for youngsters, especially NTC customers who do not have traditional credit scores yet,” says Parijat Garg, a digital lending consultant.

Currently, RentenPe operates in Mumbai, Pune, and Bengaluru, and has plans to expand its presence to Hyderabad and Kolkata.

There is no platform fee on the app, but payment gateway charges will be applicable depending on the transaction amount.

However, loans for tenants, including security deposits and rent payments, as well as early rent loans for landlords, are offered through the firm’s lending partners – banks or NBFCs - with interest rates starting at 20 percent per annum through the app.

Also read | Keeping Score: Your credit record will be updated every fortnight, if not earlierThe usage nitty-grittiesUpon downloading the app and uploading your profile, you'll receive a default rent credit score of 650 on your R-Card. This score will evolve as you complete KYC, upload your rent agreement, and make consistent rent payments. Your rent credit score will be updated every 15 days based on your payment history.

To establish a reliable rent credit score, you'll need to make timely rent payments for at least 3-6 months. As you continue to pay rent, your score will be updated accordingly. Here's how your rent credit score can benefit you:

- Excellent (790+): Eligible for home loans and up to one month's free rent

- Good (700-789): Eligible for security deposit loans and rent loans

- Fair (650-699): Eligible for rent rewards and better rental deals

- Poor (Below 650): Room for improvement to access better benefits

Shetty says that her company’s lending partners are currently utilising the rent credit score data as an additional assessment tool. In future, as the database evolves, she believes it could become one of the factors for evaluating borrower creditworthiness.

Also read | 7 tips to improve your credit scoreWhat works?Though rent payment can strongly indicate whether or not a borrower can be relied upon to pay loan EMIs on time, currently, it is not taken into account by credit bureaus.

“Now, RentenPe's rent credit score changes this, recognising renters' responsible payment habits. This breakthrough unlocks better rental agreements, potential rent negotiations, and easier loan approvals (through the lenders RentenPe has tied up with),” says Satish Mehta, Founder, Athena CredXpert, a credit counselling firm.

First-time homebuyers who apply for loans through RentenPe’s partner lenders will be able to gain access to easier loan terms and smoother processes, which is particularly advantageous for long-time renters with limited credit history.

A strong rent credit score can significantly enhance loan approval prospects, especially for first-time borrowers. Mehta notes, "A positive rental history can be a decisive factor in securing loan approvals, a common challenge faced by many new-to-credit individuals."

“Even individuals with existing credit scores below the desirable threshold of 700 can benefit from this platform. By using it to create a strong RentScore while renting, they can complement their lower CreditScore and potentially improve their overall creditworthiness,” adds Garg.

Also read | How credit score is calculated and what affects it: ExplainedWhat doesn’t workWhile the concept may seem useful, it comes with several restrictions. For one, it is mandatory to make rent payments through RentenPe's app to enable the company and its partner lenders to track payment history and generate a score. Consequently, rent payments made through third-party apps like Cred, NoBroker, or others will not be considered for rent credit score calculation.

Limited adoption by the lending institutions who make the credit decisions is another limitation. Tenants who sign up for this facility in the hope of securing favourable home loan terms in future need to bear in mind that several large banks and NBFCs that offer lower interest rates may not have tied up with RentenPe. Therefore, their rent credit score will be useful only if they pick RentenPe’s partner lending institutions.

Put simply, its scope is limited. "RentenPe may not be advantageous for individuals residing in shared accommodations, highlighting a notable exception to its applicability,” adds Mehta.

Building a rent credit score takes several months, particularly for first-time renters. According to Garg, "This can be inconvenient for young professionals who frequently move homes, as they'll need to repeat the setup process each time."

It’s important to know that currently, this rent credit score is not being reported to the four credit bureaus in India.

Tenants are bound to find the interest rates of over 20 percent for security deposits and loans for rent payments to be steep.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.