The Reserve Bank of India (RBI) on December 6 held the repo rate steady at 6.5 percent for the 11th time, leaving home loan rates and monthly instalments unchanged, even as it cut cash reserve ration (CRR) to ease liquidity in the system.

“MPC (monetary policy committee) believes that only with durable price stability can we secure a strong foundation for high growth. MPC is committed to restoring inflation-growth balance in the interest of the economy,” RBI Governor Shaktikanta Das said.

Since October 2019, banks have linked floating-rate retail loans such as home loans to an external benchmark, which is the repo rate in the case of most banks. Any repo rate changes immediately impacts the rates on these loans. Borrowers benefit when the repo rate is cut but their interest burden increases when it is hiked.

Follow the latest updates on the RBI MPC right here

Higher rates may continue till FebruaryIndia's retail inflation surged to a 14-month high of 6.2 percent in October, up from 5.5 percent in September, driven by a sharp increase in food prices, particularly vegetables, pulses, cereals and edible oils. "Last mile of disinflation turning out to be prolonged and arduous for economies," says Shaktikanta Das.

With inflation exceeding the RBI target of 4 percent, the monetary policy committee (MPC) seems to have taken a cautious approach. It sought to balance concerns about slower growth and high inflation.

The MPC changed its stance from "withdrawal of accommodation" to "neutral" in October, marking a departure from its approach since May 2022.

According to Rajani Sinha, Chief Economist at CARE Ratings, "Growing concerns about economic growth make a rate cut likely in the February policy meeting, when inflation is expected to ease." Sinha also expects CPI inflation to drop below 5 percent in the fourth quarter, paving the way for a 25 basis point rate cut.

Globally, central banks are cutting interest rates to stimulate economic growth. In November, the US Federal Reserve and Bank of England reduced their interest rates by 25 basis points.

The central banks of New Zealand and Sweden made more significant cuts, slashing their interest rates by 50 basis points each.

One basis point is one-hundredth of a percentage point.

Also read | Should you invest your surplus income in SIPs or increase your EMI?

New Borrower? Explore loans with narrowest possible spreadHDFC Bank increased its home loan rates for new borrowers by 40 basis points this year despite the repo rate remaining unchanged. The lowest interest rate on Rs 50-lakh home loan went up from 8.35 percent to 8.75 percent.

Other banks such as State Bank of India (SBI) and Bank of India (BoI) also raised their effective new home loan rates by a smaller margin of 10 bps.

In April, SBI and BoI were offering their lowest home loan rates at 8.4 percent and 8.0 percent, respectively, for a Rs 50-lakh loan. The SBI rate increased to 8.5 percent and BoI at 8.4 percent from May.

Financial experts attribute this hike in effective home loan rates to liquidity constraints affecting several banks, including HDFC Bank.

The RBI Governor announced cash reserve ratio (CRR) cut by 50 basis points to 4 percent, effective in two tranches on December 14 and December 28. CRR is the portion of deposits banks are required to park with the central bank. “When the CRR is cut, banks get access to more funds for lending. This means better liquidity in the system but not necessarily higher interest on deposits. For borrowers, it can mean lower interest rates and easier access to loans—a potential win for economic growth,” says Adhil Shetty, Chief Executive Officer (CEO), BankBazaar.com.

Borrowers can explore switching to lenders offering narrower spreads and lower interest rates to reduce their interest burden. Experts advise new home loan borrowers to opt for banks with the narrowest possible spread to minimise interest payable.

"Factors such as high capital values, inflation pressures, and uncertainty around the RBI's repo rate cut may lead some homebuyers, especially in metros, to adopt a wait-and-watch approach," says Kanika Singh, Chief Risk Officer at the Indian Mortgage Guarantee Corporation (IMGC). Meanwhile, Tier 2 and 3 cities continue to drive growth in housing loans.

Benefits for existing home loan borrowersMost home loans in India have floating interest rates. With no change in the repo rate, your EMIs are unlikely to rise for now. That’s welcome news for borrowers managing tight budgets. “Banks are likely to keep lending rates stable. If you’re planning to buy a home or refinance your loan, this could be a good time to negotiate a better rate,” says Shetty.

This is a good time to take a moment to review your loan terms. “If your interest rate is higher than the current market rate, consider refinancing. If you have extra funds, use them to prepay your loan. This helps lower your principal and reduces the total interest you’ll pay,” says Shetty.

Also read | Can a rent ‘credit score’ help unlock better rental deals?

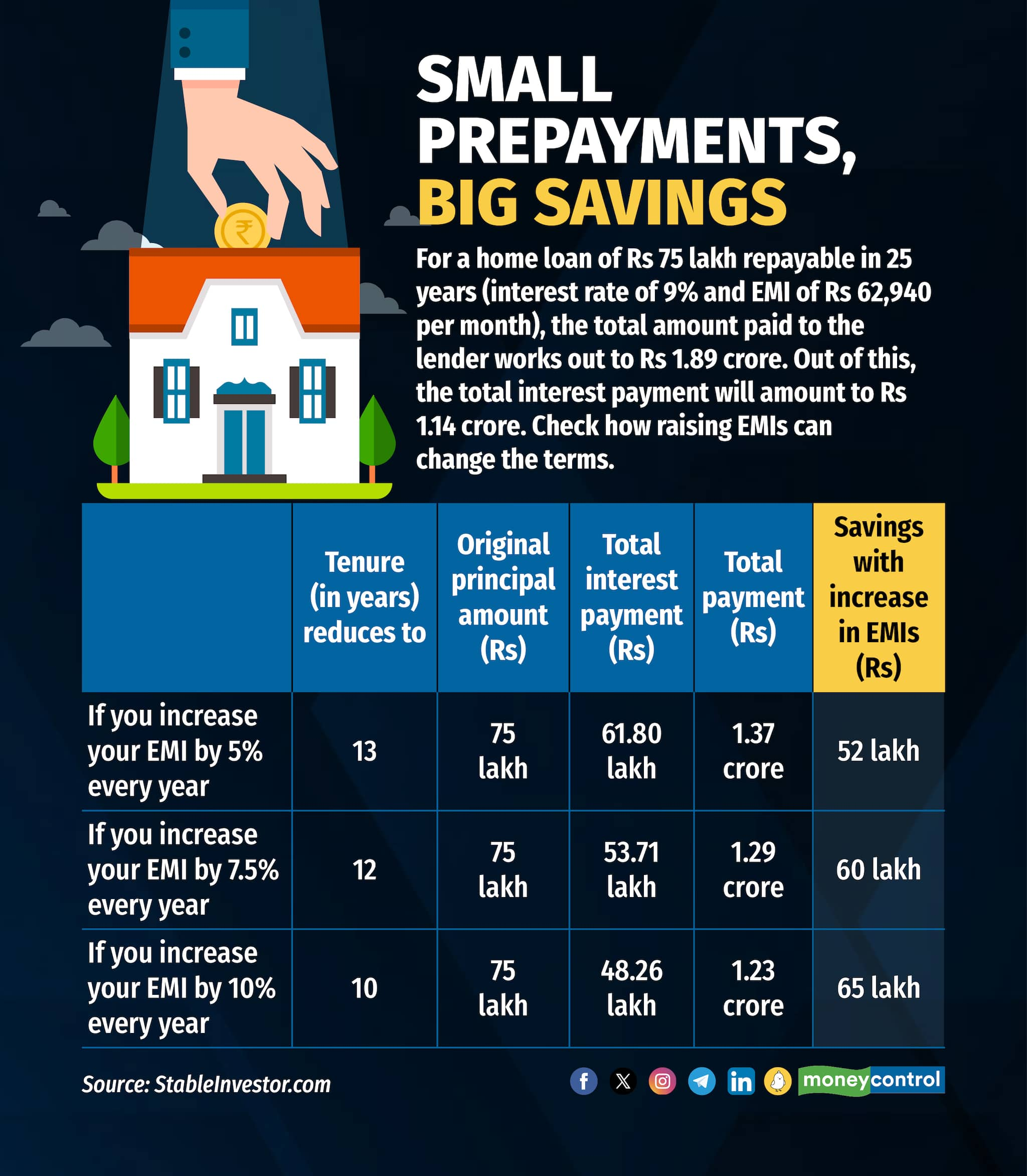

How partial prepayments can help you save bigMaking strategic partial prepayments on home loan can significantly reduce your financial burden. By setting aside a few thousand rupees each month, you can reduce the principal amount and substantially lower your interest payments.

This approach calls for small sums but its long-term impact can be substantial, potentially saving you lakhs of rupees in interest (see graphic). Consider making annual partial prepayments using your yearly bonus, turning it into a habitual practice to efficiently manage your housing loan.

With numerous banks offering home loans starting at 8.35 percent, borrowers can explore opportunities to switch lenders. If you have a home loan linked to older benchmarks like MCLR or base rate, consider reassessing your interest rate and loan terms. You could be paying higher interest rates compared to newer loans benchmarked against the repo rate.

Switching lenders or transferring your loan could help you capitalise on lower interest rates and reduce your interest burden.

By tracking market rates and negotiating with your lender, you can significantly reduce your interest expenses. Although banks lack a formal conversion process, they may lower rates during negotiations, especially if you indicate plans to switch.

In contrast, non-banking finance companies (NBFCs) and housing finance companies (HFCs) offer official conversion options, allowing you to transition to lower rates for a fee.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.