Globally, passive Investing is a multi-trillion dollar industry. In India, the trend of passive investing is now gaining momentum, especially in the large-cap segment. The increased appetite amongst investors has led AMCs to come up with many passive funds tracking different indices. In this context, a slightly deeper understanding of the underlying benchmarks and their strategies becomes necessary for a more informed selection of passive funds.

For example, NSE lists over 25 index funds and over 30 ETFs in the large-cap category alone. And majority large-cap passive funds track either the Nifty 50 or Nifty Next 50; so how should one choose between the two strategies?

While Nifty 50 represents the largest Indian companies based on market leadership and scale of operations, Nifty Next 50 comprises the next 50 of the largest listed companies in the Nifty 100 index. We look at four key parameters you should evaluate when choosing between Nifty 50 and Nifty Next 50 index for large cap allocation.

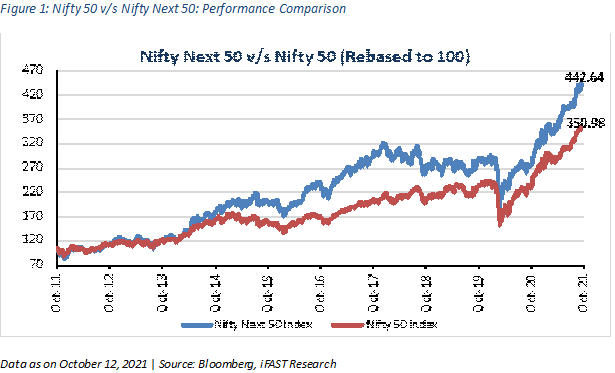

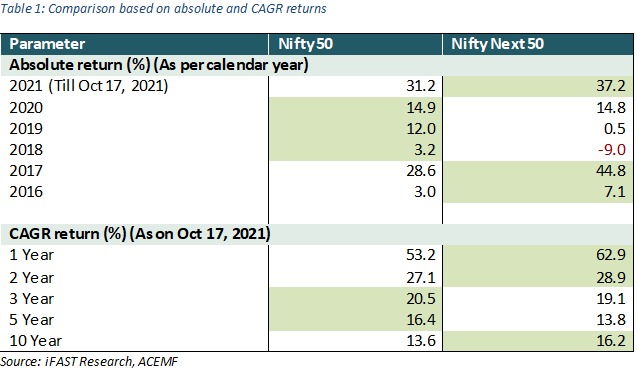

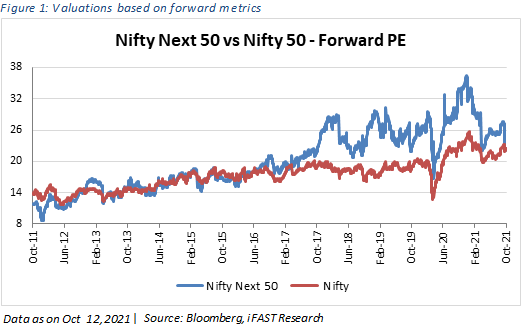

Long-term performanceOver the last 10-year period, the Nifty Next 50 index has delivered a return of 16 percent (CAGR) while the Nifty 50 Index has given a return of 13.5 percent (CAGR), an outperformance of around 255 bps over a 10-year period. As seen in Figure 1, Nifty Next 50 started to show differentiated performance in 2015, and the outperformance has been more pronounced in recent years, as emerging sectors have gained more importance than the traditional ones.

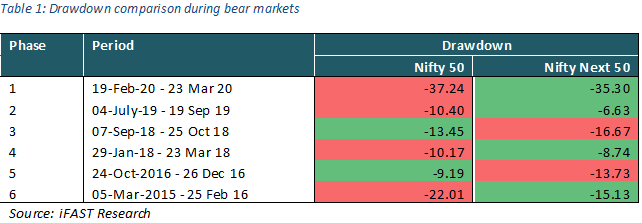

In addition to outperforming the Nifty 50 in the long term, the Nifty Next 50 has experienced lower drawdowns in bear market cycles. So, out of 6 bear market instances (Table 2), Nifty Next 50 has lesser drawdowns in 4 observations vis-à-vis Nifty 50 Index.

Another parameter one can look at in conjunction with drawdowns is volatility measured in terms of standard deviation from market returns. Nifty Next 50 has shown a 1.13 percent deviation from average of daily returns in last 10 years, and Nifty 50 has shown 1.08 percent deviation, indicating that the former index has marginally higher volatility.

However, despite the slightly higher volatility on average, Nifty Next 50 has witnessed lower drawdown in majority of instances versus Nifty 50 during the bear market cycles, as shown by the drawdown table.

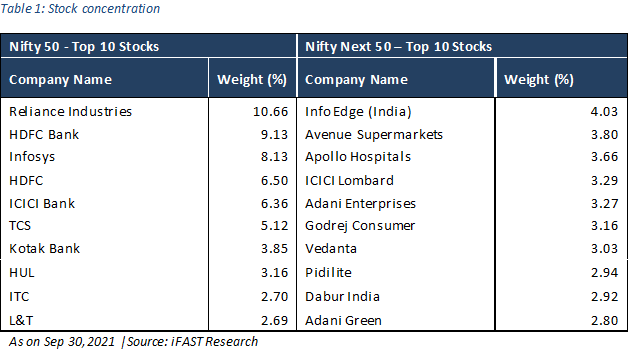

Diversification & Stock ConcentrationNifty Next 50 has lower stock concentration of the two indices; the top ten holdings of Nifty 50 represent 58.3 percent of the index, which, in the case of Nifty Next 50, is only 33 percent. Nifty is more heavily concentrated towards leader stocks in their respective sectors; as a result, top holdings of Nifty 50 may cross 10 percent individually in some cases. None of the top holdings in Nifty Next 50 cross 5 percent.

As a result, Nifty Next 50 tends to outperform the Nifty 50 index in cases where the broader market participates. The Nifty 50 index, in turn, performs well in polarised markets.

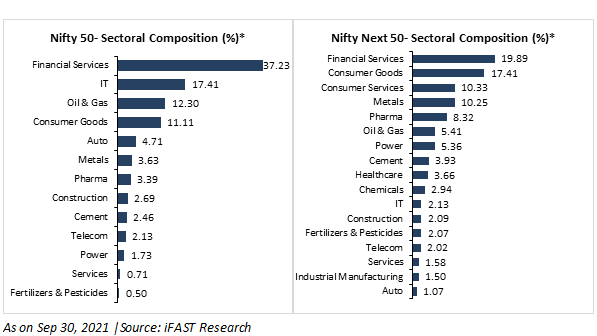

Nifty Next 50 is more diversified with relatively lower exposure to financials, while Nifty 50 is overweight on old economy and well discovered sectors like FMCG, IT, and banking & financial services. Nifty Next 50 index includes exposure to emerging sectors such as insurance, consumption (retail, discretionary, staples), IT and pharma, among others.

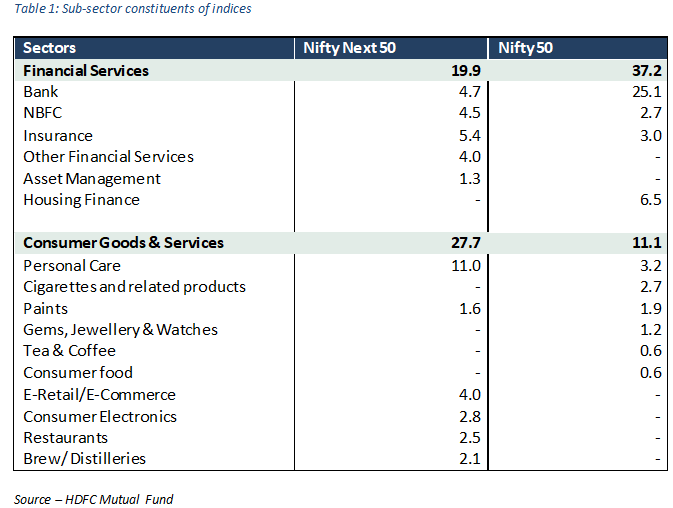

Also, a deeper study of the sectoral allocations shows that the sectoral sub-constituents of both these indices are materially different.

Nifty 50 has higher allocation to cyclicals (66 percent) versus the Nifty Next 50 (56 percent), while Nifty Next 50 has higher allocation to defensives (44 percent) versus the Nifty 50 (33 percent). Historical data suggests that cyclicals outperform when the economy is on the rebound, while secular growth stocks are more defensive in nature and offer benefits of steady, long term compounding.

Thus, Nifty 50 may be preferred by investors who want relatively higher exposure to cyclicals with higher beta, whereas investors who prefer steady compounding and benefits of higher allocation to defensives should choose Nifty Next 50.

Nifty Next 50 is trading at a PE multiple of 22.4x on forward earnings, compared to its 10-year historical average of 20.12x. Nifty 50 is trading at PE multiples of 22.4x on forward earnings, compared to its 10-year average of 17.46x. Currently, therefore, Nifty 50 appears to be trading at a higher premium compared to its historical average.

Nifty 50’s premium can be understood in terms of the constituents. A key factor is its significant exposure to the Banking and Financial services sector (37 percent), which is currently in the consolidation phase and is well poised to gain due to structural factors and expected rerating due to uptick in financial performances and loan books for high quality banks and selected NBFCs.

On the other hand, the Nifty Next 50 index consists of emerging blue chips that are usually consistent steady compounders, and also has good exposure to new age sectors that are becoming increasingly relevant in the headline indices. This explains its higher average valuation on a long-term basis.

In our view, either of Nifty 50 or Nifty Next 50 indices can be considered as an integral part of large-cap allocation, depending on investors’ risk and return profile. Nifty 50 takes a more concentrated bet on established market leaders, and offers outperformance during polarised markets. With a less-concentrated composition, and higher allocation to defensives, Nifty Next 50 can help investors looking for steady compounding over the long term.

Based on the preferred index strategy, investors can invest in the index funds and ETFs currently available in the market. Those who prefer the SIP route should look at index funds, while demat account holders who wish to invest on the basis of real-time NAVs can look at ETFs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.