Bhushan Kedar

The Union Budget 2020-2021 will bring a paradigm shift in the way investors view savings and investments. The government has repealed the Dividend Distribution Tax (DDT) and introduced a new tax regime that allows investors to forgo tax-saving investments. It basically provides more cash in their hands. Second, the dilemma: to avail the benefits of the new regime or continue with the old one?

More dividend money, but taxable

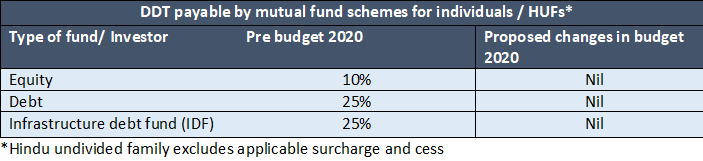

The removal of DDT increases dividend money in investors’ hands, while doing away with the double-taxation incidence that occurred previously; DDT was first deducted when received by the mutual fund and then again when received by the investor.

Here’s a look at what has changed:

So, getting more money in your hands does sound good. But here’s the deal: while it is great for taxpayers at lower levels of income (Rs 10 lakh and less), it does not bode well for those in the higher slabs, as their tax liability increases. It also means that investors who don’t need regular cashflow would be better off investing in the growth option of mutual funds, as they will be taxed on their capital gains, which can be preferential if held for more than a year in the case of equity funds (10 per cent on gains above Rs 1 lakh per year) and if held for more than three years in case of debt funds (20 per cent after indexation).

Choose SWP if you need regular income

While those with the ability to hold on to their investments for longer periods can opt for growth options of mutual funds, what about those who need regular cashflows, but want to reduce the additional tax incidence? Systematic withdrawal plans (SWPs) from mutual funds will work for them. The flow of funds consistent, and investors can also fix the amount and periodicity of cashflows. This is unlike dividend schemes because the frequency and amount of dividends depend on the discretion of the fund house and are subject to the profits generated by the scheme.Exemptions and taxes

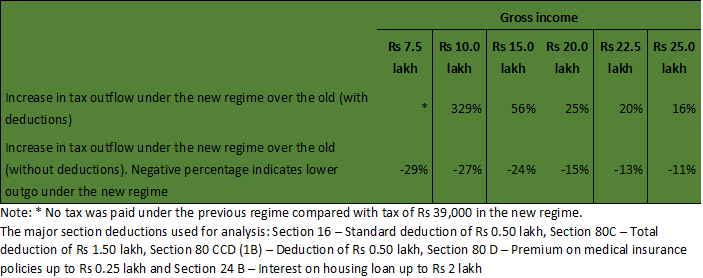

The alternative income tax regime reduces the tax liability of investors. But the catch is that investors would need to forgo around 70 exemptions that they used to avail of in the old regime. The choice between the new and the old lies with the investors based on their profiles and financial plans.

CRISIL ran some numbers to identify the overall tax outflow across various income tax brackets and the analysis shows that investors will be able to save money in the old regime if they avail of major exemptions, including investments under Section 80C, compared with the new regime. However, in case they don’t utilise the exemptions, the new regime increases the surplus in their hands (reduces taxes). Further, it is important to note that not all exemptions excluded in the new regime were availed of by investors based on their preferences.

Here’s an interesting point: if investors do opt for the new regime to get more cash in hand, based on behavioural dynamics, this money might not be saved compulsorily for delayed gratification like in the previous regime and instead may get used for consumption purposes (immediate gratification). Historically, most of this money would be invested in medium/ long-term products. A drop in such savings could impact long-term financial planning.

However, we can’t ignore the opportunity investors will get to invest more funds in the product of their choice, based on their risk profile and horizon, than they could earlier. Most importantly, investors must understand (and seek expert advice if necessary) as to how the change works before committing to any tax regime.

(The writer is Director, Funds & Fixed Income Research, CRISIL)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.