The Sandwich generation, also known as Gen S, is perhaps in the toughest phase of their lives – emotionally, physically and financially. This is especially true for mothers of this generation as they juggle with the dual responsibility of caring for an elderly parent and simultaneously planning for their children’s future.

The dramatic rise in a household’s lifestyle expenses in recent years, especially in urban geographies, puts pressure on this generation to carefully navigate the needs of children and aging parents. This makes it imperative for them to put in place a holistic financial plan, for both short-term and long-term obligations.

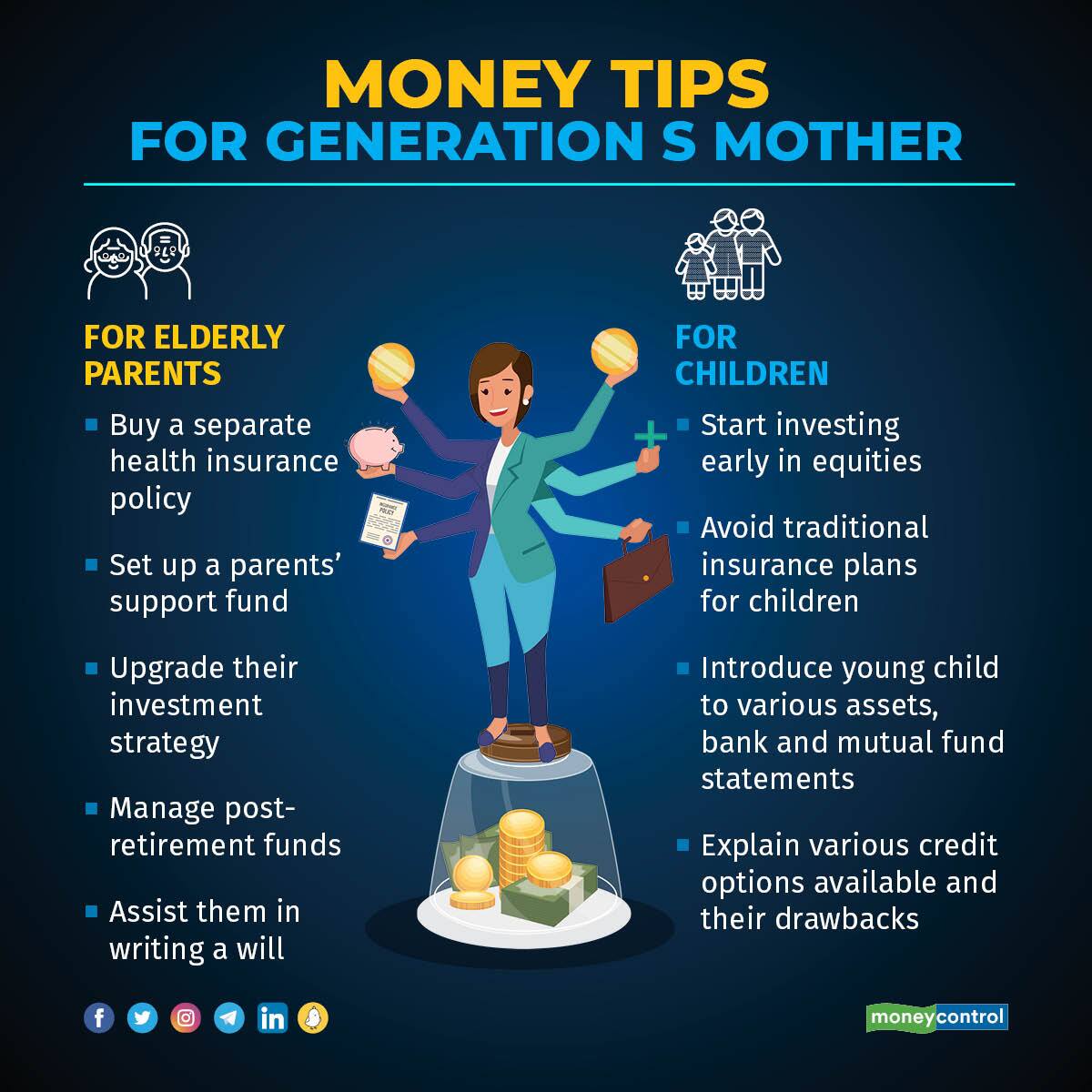

This Mother’s Day, here are a few tips for the sandwiched generation.

Multiple responsibilities

The Sandwich generation of mothers are mainly in the thirties or forties. They have to look after the physical and emotional needs of the aged and the children. They have to manage medical emergencies, provide financial aid and look after legal requirements.

Health cover, parents' support fund needed

An insurance cover can help you prevent losing your hard-earned life savings. Healthcare expenses have risen in the last two years of COVID-19. Medical emergencies and healthcare inflation of around 12-15 percent annually have eaten up many household savings.

“You should have a separate health insurance policy for senior citizen-parents as adding them in your existing policy will increase the cost of premium,” says Dilshad Billimoria, MD and Principal Officer, Dilzer Consultants Pvt Ltd, a SEBI- registered investment advisor.

There are policies, particularly for senior citizens up to 75-85 years, from Star Health, Niva Bupa, etc. “If senior citizens have pre-existing diseases, such as diabetes, or hypertension, the premiums can be exorbitant,” says Prathiba Girish, a Certified Financial Planner and Founder of Finwise Personal Finance Solutions.

In such a situation, you can opt for top-up insurance and ensure that a separate corpus is in place to take care of the basic medical expenses.

“You can set up a parents' support fund which basically takes care of medical emergencies, their travel or for gifting purpose on special occasions, such as weddings in the family, etc,”says Billimoria.

The corpus should be at least up to Rs 5 lakh and it should be separate from contingency funds. You can invest the amount in arbitrage funds or in liquid funds, depending on the time horizon and the purpose of investment.

Assist parents to manage post-retirement funds

One of the biggest responsibilities of a Gen S mother is to manage her parents' post-retirement funds. “Parents are not used to investing in wealth-creating products. They are used to buying real estate and gold and investing in traditional insurance plans. They will continue to do that instead of investing in equities. You need to assist them and upgrade their investments,” says Girish.

They have another 20-30 years after retirement. You can’t afford to keep their retirement funds in fixed deposits and other traditional plans.

“It has to be managed in a way that parents keep getting regular income and their capital is protected,” says Gurleen Kaur, Founder, Hareepatti. This includes a senior citizens saving scheme (SCSS), annuity plans, and the Pradhan Mantri Vaya Vandana Yojana. The strategy should be to not invest in haste: make sure it is in sync with parents' objectives, and decide to invest.

Provide aid in writing a will

Explain the importance of having a will in place to your parents and guide them. A will is a document stating how your parents want their assets to be distributed to their legal heirs after their demise. “It helps distribute the assets your parents have accumulated over a lifetime to the family members,” says Kaur.

Start investing early in equities for children's goals

The Sandwich generation of mothers should start investing early for children's goals, so that money gets compounded and children have enough corpus for their higher education. “Prefer an equity SIP over child education traditional insurance plans, as equity SIP will ensure a bigger corpus over the long term,” says Kaur.

Inculcate financial discipline in children when young

Talk to your young children about the family's finances often. Make them understand the magic of compounding in investments and the benefits of investing early. Introduce them to various assets and explain the benefits, drawbacks, and risks of investing in them.

You can ask children to accompany you to a bank whenever you are going and let them observe the operations. Show your mutual fund statements. “Discuss your investment strategy and lessons learned from mistakes. Explain that you have been investing for their higher education expenses over the years by saving part of the income every month,” says Girish.

The days of getting credit are no longer a challenge. There are several startups offering unsecured loans at lower rates of interest, and more are coming up. “Mothers have to make sure that their children do not fall prey to any of these lucrative credit options,” says Kaur. Make them understand it is always wise to spend within means and not beyond, she says. Explain to them that credit cards are a convenience and not a loan.

Stay away from investing in exotic products

While you strive to financially secure your parents and children, do not forget to take care of your investment portfolio at the same time. Financial experts advise mothers to stay away from exotic investment products. “Don’t invest in any asset or scheme following the herd,” warns Girish.

Invest in cryptocurrencies, initial public offerings (IPOs) in equity markets, real estate investment trusts (REITs) and so on only after understanding them. The investment in exotic schemes shouldn’t exceed 5 percent of your overall portfolio.

“Also, do not invest in traditional insurance schemes because someone in the network has recommended,” says Girish.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.