Financial advisors are busy allocating their clients’ assets in debt funds after the US Federal Reserve cut interest rates by 50 basis points this month. The Reserve Bank of India (RBI) is also expected to cut rates by the end of this year. Since bond yields tend to move ahead of rate action, investors can consider increasing their fixed income allocation to benefit from rising bond values potentially, experts say.

Bond prices and interest rates have an inverse relationship: Bond prices typically increase when interest rates fall, which boosts the value of the bonds held by debt funds, leading to higher returns.

Debt mutual funds with moderate to long duration stand to gain as interest rates fall.

However, experts suggest that allocation to moderate duration debt funds may offer a more balanced approach for investors looking to capitalise on the expected bond value appreciation. We believe that Sundaram Corporate Bond Fund (SCF) is a good vehicle to ride the fall in interest rates. Here is why.

When will the RBI cut rates?

Sandeep Agarwal, debt fund manager at Sundaram Mutual Fund believes that the RBI would take its time to respond to the US Fed. “Aggressive and faster rate cuts by the RBI could impact flows. Further, considering the present conditions wherein the banks are struggling to get deposit growth they won't be in a situation to reduce lending rates,” he says. He expects some RBI action from the December policy.

Also see: A debt mutual fund that acts as a buffer to your long-term equity portfolio

The expectation of the rate cut has already been priced in and there has been a rally on the long end of the curve. “However, it is a fact that when the rate cut rally begins, the long-end rates fall sharply. However, the short and medium of the curve will perform better than the longer ends when you get closer to the cuts and the cuts begin,” says Agarwal.

Debt schemes like SCF whose strategy is to construct portfolios with ‘moderate’ duration such as short duration, and corporate bond funds are likely to benefit from the rally post the rate cut.

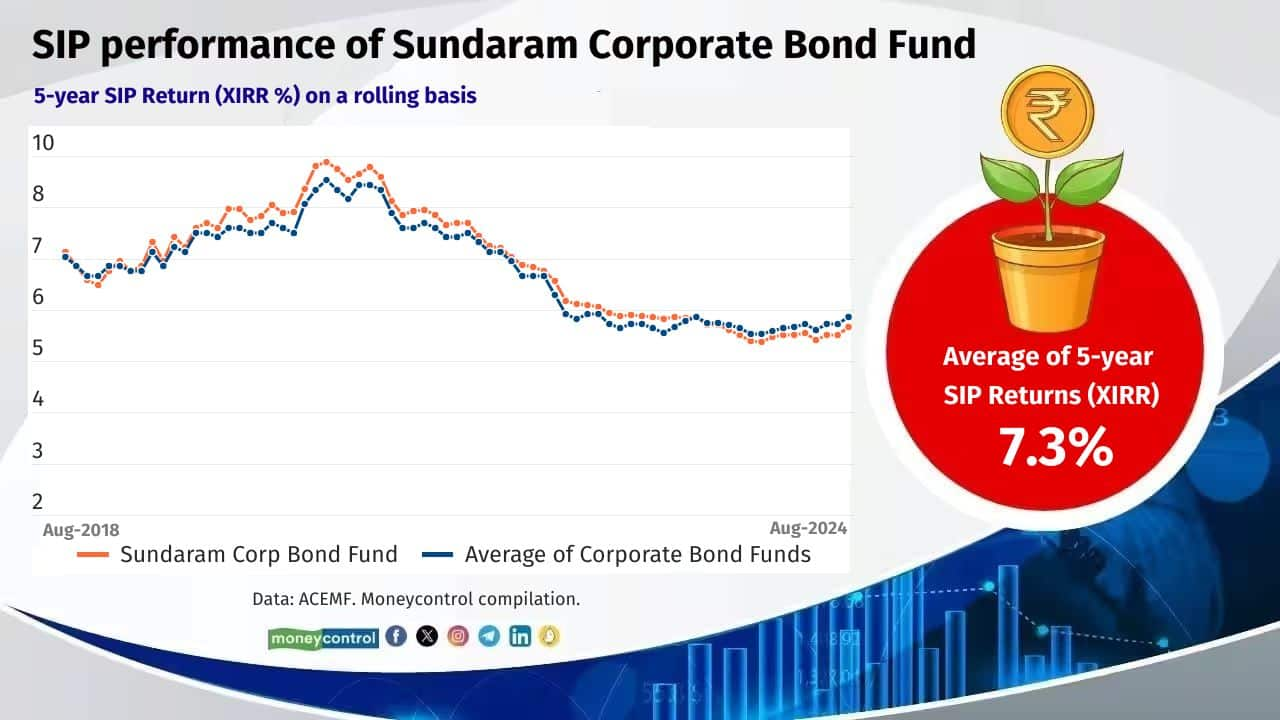

One of the eight debt funds in the basket of MC30, SCF has managed to deliver better returns than its peers in most of the time frames.

Dwijendra Srivastava and Sandeep Agarwal jointly manage the scheme.

Good quality portfolio that avoids credit risks

Schemes in the corporate bond funds category carry low credit risk, as they are mandated to invest at least 80 percent of their assets in AA+ and higher rated instruments.

But SCF is one of the few schemes within the overall mutual fund industry that have been consistently investing all of its corpus only in AAA securities for the past nine years.

It invests in securities issued by government owned firms and private-sector companies with strong financials.

Also see: Should retirees invest in tax-free bonds in secondary markets?

“Maintaining the right maturity profile and sticking to securities whenever the spreads are attractive have helped the fund outperform its category across timeframes,” says Agarwal.

SCF has managed to avoid credit accidents in the past. The scheme allocates 10-20 percent in government securities depending on the interest-rate outlook.

Over the last one year, the duration of the portfolio has increased significantly to 4.4 years from 2.8 years as the scheme increased its allocation to the long-duration government securities. Currently, it holds one-fourth of the portfolio allocation into government securities. Agarwal believes that government securities are looking attractive in terms of demand and supply metrics.

Barring a few private corporate ones, about 60 percent of its portfolio has been invested in the bonds issued by government owned (or Public Sector Units; PSU) companies. It is one of the few schemes in the category managed with only AAA securities. This is a good strategy because PSU bonds are highly liquid securities and at the forefront to benefit from the rate cut cycle, Agarwal explains.

A long-term performer

SCF is conservative and that has meant that its performance has been subdued in the short term. However, its relative performance over the medium and long term has been noteworthy.

Performance, as measured by the 5-year rolling return calculated from the last 10 years’ net asset value (NAV) data, shows that SCF generated a compounded annualised growth rate (CAGR) of 7.6 percent while the category gave 7.1 percent (category average was calculated after excluding the schemes that were hit badly by distressed assets).

“Given the recent rate cut by the US Fed, the global interest rate environment is gradually changing. The central bank's policies influence interest rates and subsequently affect corporate bond markets,” cautions Ravi Kumar TV, founder of Gaining Ground Investment Services.

Also see: SIPs work in debt mutual funds too. Here’s why this is the right time to invest

If this rate easing cycle plays out as expected, bond funds should do well over the next 18 months, adds Kumar.

While investing in a corporate bond, one has to assess the credit, interest rate and liquidity risks within the portfolio, Kumar says.

Considering its high-quality, well managed portfolio and moderate duration, SCBF can be part of your fixed-income long-term portfolio. The minimum time horizon should be three years.

Also see: No new sovereign gold bonds? Check out the most liquid ones on the NSE

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.