Safe haven demand has gold brought back on the minds of the investors. In the last couple of years, demand for gold as an investment avenue has surged, indicated by increasing investments in sovereign gold bonds (SGBs) and gold exchange-traded funds (ETFs).

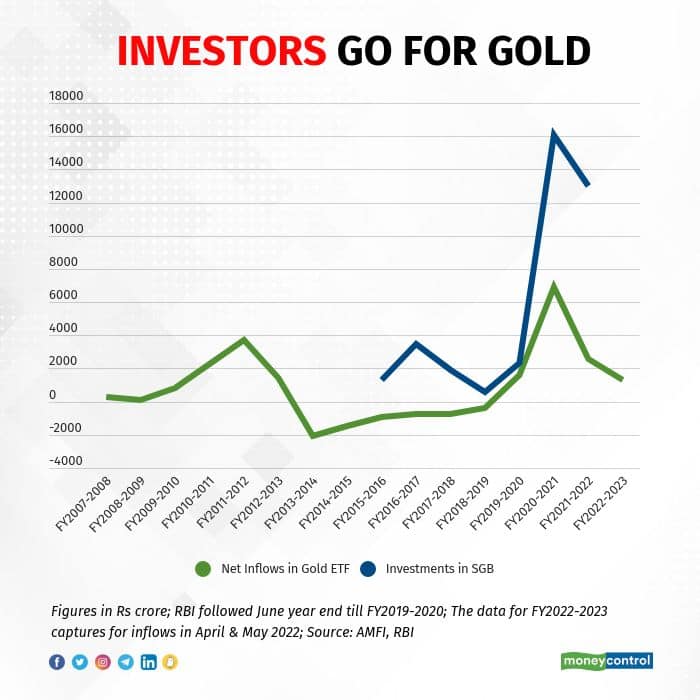

From Rs 9,568 crore in the five years since launch in 2015, investments in SGBs jumped to Rs crore 16,049 crore in FY21 and Rs 12,991 crore in FY22. Similarly, gold ETFs received the highest ever net inflows in a financial year since the product was introduced in India, standing at Rs 6,918 crore in FY21. Though the number went down to Rs 2,540 crore in FY22, it still is the third largest inflows in any given financial year since launch in FY08.

Traditionally, investors looked at gold as an effective hedge against volatility in the stock market. After the global financial crisis, the stock markets remained relatively stable if we ignore short-lived bouts of volatility. That made many investors look at equity and fixed income as core components of the portfolio and ignore gold. A strong dollar also led to gold prices remaining weak.

The tables turned when the pandemic hit. The stock markets turned volatile again and the liquidity infusion by central banks ensured that inflation was back at the door. In the initial phase of Covid-19, it was the uncertainty that pushed up gold prices, and rising expectations of inflation chipped in to support in the later part of CY21.

Pankaj Mathpal, founder and managing director, Optima Money Managers, says, “Indian investors always invested in gold. However, over a period of time, with the rising awareness, physical gold is gradually getting replaced by various financial products tracking the performance of the price of gold. To achieve exposure to gold, investors prefer regulated products such as sovereign gold bonds and gold exchange-traded funds.”

Over the last few years, increasing digitisation also ensured that more investors got to invest in a convenient manner. As investors opted to take the online route to investments, some of the allocation also went to gold-focused products such as SGBs and gold ETFs. The ability to pay for SGBs and a discount of Rs 50 per gram in the public issue also attracted many investors on digital platforms. Investors found it attractive to invest in SGBs as it offered interest at 2.5 percent per year and allowed tax-free capital gains if the bonds are held till maturity. Since it is backed by sovereign guarantee, there is no credit risk. The only concern SGBs faced is the low liquidity in the secondary market, though it is partly addressed with an option to surrender the bonds after completing five years, ahead of each interest payment date.

Shyam Sekhar, chief ideator, ithought Advisory, says, “Regular payment of interest makes SGBs an interesting product for long-term investors seeking an investment in gold. However, if you are a relatively short-term investor, it is better to invest in gold ETFs.”

Investments in gold help to contain downside risks to the portfolio, as gold acts as a hedge in volatile times. While traders may want to take advantage of short-term moves in gold prices, the long-term investor has to take a measured approach.

“Instead of allocating money to gold based on the returns in the recent past, it makes sense to allocate money in line with asset allocation needs,” says Mathpal.

If you are a long-term investor saving for a goal such as retirement, it makes sense to invest in a mix of stocks, bonds and gold. Depending on one’s risk-taking ability, one should have an allocation of up to 10 percent to gold. Rebalancing at regular intervals can help optimise your portfolio returns, rather than chasing past returns.

“Investors should have an allocation to gold and it should be built gradually. Currently, the gold prices are in favour of investors. Investors should take advantage of the same,” says Sekhar.

Gold prices were quoting at Rs 50,554 per 10 grams on MCX. Over last three- and five-year periods, gold funds have returned 13.25 percent and 10.77 percent, respectively, according to Value Research data.

Gold prices are impacted by many macroeconomic factors. While rising inflation expectations and elevated geopolitical risks have been supportive of gold prices, a strong dollar and hawkish stance by central bankers leading to increases in interest rates should push them down. Navneet Damani, senior vice-president, commodity and currency research, Motilal Oswal Financial Services, see gold prices finding support at Rs 48,000 per 10 grams and good selling opportunity around Rs 55,000 over the next one year. “Central bank demand for gold and overall import data, especially on the domestic front, are supporting the sentiment. We maintain a neutral stance on gold for the next few quarters,” he added.

Investors are better off staggering their purchases in gold-backed investments to achieve their desired asset allocation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.