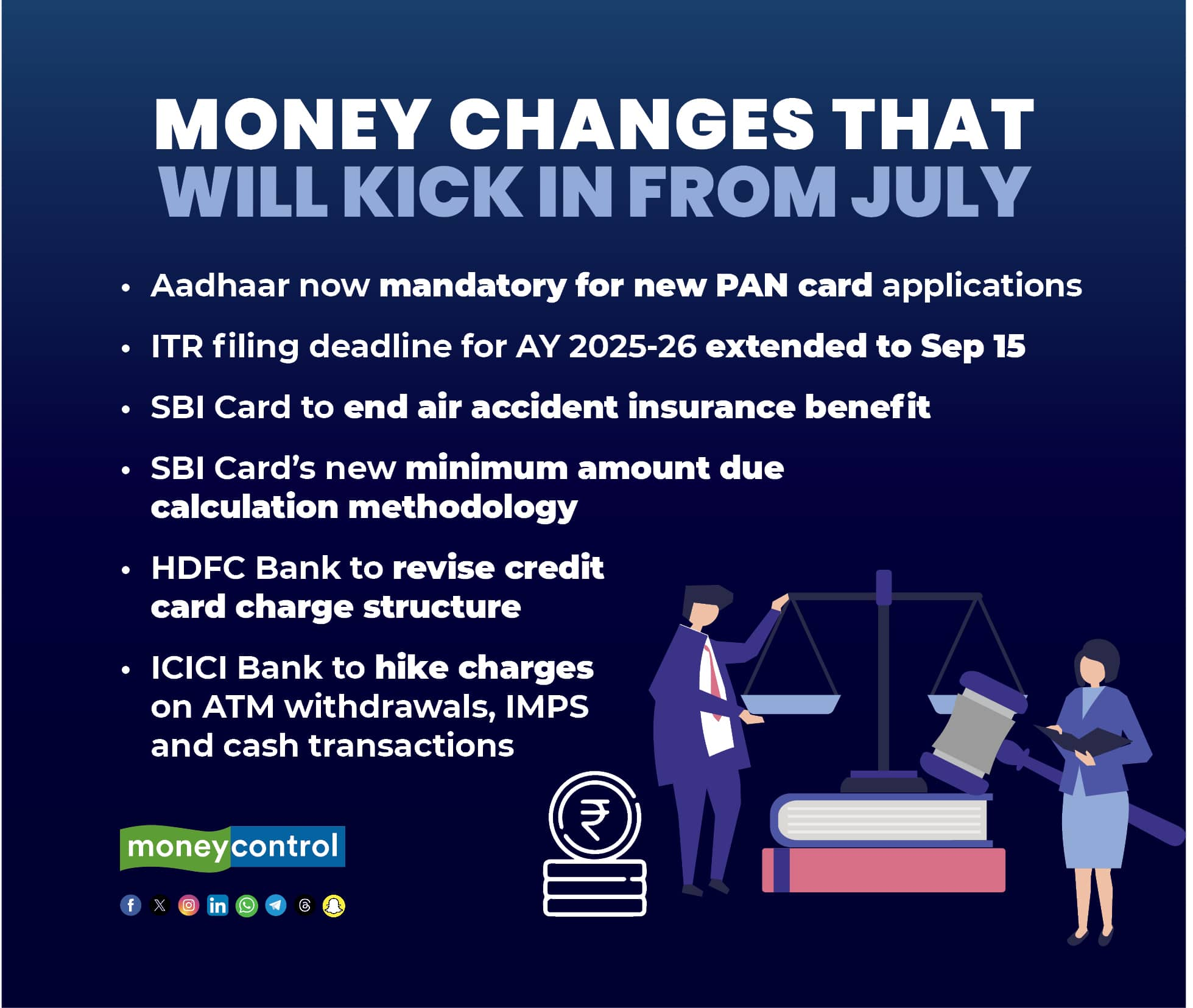

Several key financial changes, including extension of the July 31 ITR filing deadline and revisions in bank charges on credit cards and savings accounts, will take effect in July, impacting individual account holders and taxpayers.

The Central Board of Direct Taxes (CBDT) has made Aadhaar verification mandatory for new Permanent Account Number (PAN) card applications, while also extending the ITR (income tax return) filing deadline from July 31 to September 15.

Meanwhile, SBI Card is discontinuing air accident insurance on select premium cards and introducing a new minimum amount due (MAD) calculation.

Moreover, HDFC Bank and ICICI Bank will also revise charges on select transactions, which could affect your spends.

Aadhaar verification mandatory for new PAN cardsFrom July 1, 2025, obtaining an Aadhaar number and undergoing Aadhaar verification will be mandatory for individuals applying for a new PAN card, as per a new rule introduced by CBDT. This aims to boost digitisation and tax compliance, experts say.

Currently, a valid identity card and birth certificate suffices for new PAN card applications.

ITR deadline extendedCBDT has extended the deadline for filing income tax returns for the assessment year 2025-26 to September 15, from the original date of July 31. The extension implies that salaried individuals will get an additional 46 days to file returns.

However, you can initiate the process right away instead of waiting till September 15 to ensure that any glitches on the income tax portal due to heavy traffic closer to the due date does not affect you.

SBI Card offers complimentary air accident insurance when flight tickets are purchased using their card. The insurance benefit only covers the primary cardholder. From July 15, it is discontinuing this on select premium cards. Thus, cards like SBI Card ELITE, Miles ELITE, and Miles PRIME will no longer offer the Rs 1-crore cover. Additionally, the Rs 50 lakh cover on SBI Card PRIME and PULSE will also be withdrawn.

SBI Card has introduced a new methodology to calculate the minimum amount due (MAD) on credit its products.

From July 15, 2025, the MAD will be calculated thus: total GST + EMI amount + 100 percent of fees and charges + 100 percent of finance charges + 2 percent of outstanding dues (retail spends + cash advances) + any overlimit amount.

Until July 15, 2025, the MAD calculation is: total GST + EMI amount + 100 percent of fees and charges + the higher of either 5 percent of (finance charges + retail spends + cash advances) or 100 percent of finance charges + any overlimit amount.

The change in MAD calculation can significantly impact your payments. For instance, if you had Rs 20,000 in retail spends, Rs 10,000 in cash advances, and Rs 5,000 in interest, your MAD would increase from Rs 5,000 to Rs 5,700 per the new calculation. If your retail spending were higher, say Rs 50,000, the MAD would increase from Rs 5,000 to Rs 6,300.

MAD is the smallest payment your bank requires you to pay by the due date to avoid late fees. While paying the MAD helps you steer clear of extra charges, keep in mind that interest will still be charged on the outstanding balance and any new transactions. This means that paying only the MAD can lead to a longer payback period and more interest over time. To manage your finances effectively and avoid debt, aim to pay your entire bill by the due date.

Also read | Flexicap, largecap, value funds cut cash in May; midcap, smallcap schemes stay cautious

HDFC Bank revises charges on credit cardsFrom July 1, HDFC Bank is revising charges on select credit card transactions. A 1 percent fee, capped at Rs 4,999 per transaction, will be applied to: rental transactions (1 percent of the transaction amount); online skill-based gaming expenditures above Rs 10,000 per month (1 percent of the total monthly spend); utility expenses (excluding insurance transactions) exceeding Rs 50,000 per month (1 percent of the total monthly spend). Additionally, a 1 percent fee, capped at Rs 4,999, will be charged on wallet loading transactions above Rs 10,000 per month.

On a separate note, insurance transactions will earn rewards, with a monthly cap of 10,000 points.

Also read | Smart Planning: How to make your retirement fund last a lifetime

ICICI Bank to modify service chargesICICI Bank has revised several service charges, which will come into effect from July 1.

The bank has revised charges for ATM transactions. For ICICI Bank ATMs, the first five financial transactions each month will remain free, after which you'll be charged Rs 23 per transaction; non-financial transactions will continue to be free.

When using non-ICICI ATMs, customers will have three free transactions per month in metros and five in non-metro locations, beyond which they'll be charged Rs 23 per financial transaction and Rs 8.50 for non-financial ones. For international ATMs, the bank will charge Rs 125 per cash withdrawal, a 3.5 percent currency conversion fee, and Rs 25 for non-financial transactions.

The bank has also updated its charges for IMPS (Immediate Payment Service) transfers. The new charges range between Rs 2.5 to Rs 15 per transaction, depending on the amount transferred.

The bank has also introduced changes to cash transactions at branches and cash recycler machines (CRMs). Customers will get three free cash transactions per month at the bank, after which they'll be charged Rs 150 per transaction.

Additionally, for cash deposits exceeding Rs 1 lakh in a month, a fee of Rs 150, or Rs 3.50 per Rs 1,000 (whichever is higher) will be applied. The limit for third-party cash deposits remains Rs 25,000 per transaction.

The bank allows three free cash withdrawals at branches per month. After that, a fee of Rs 150 per transaction applies, and withdrawals exceeding Rs 1 lakh in a month would incur charges. The bank also has a Rs 25,000 limit per transaction for third-party withdrawals.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.