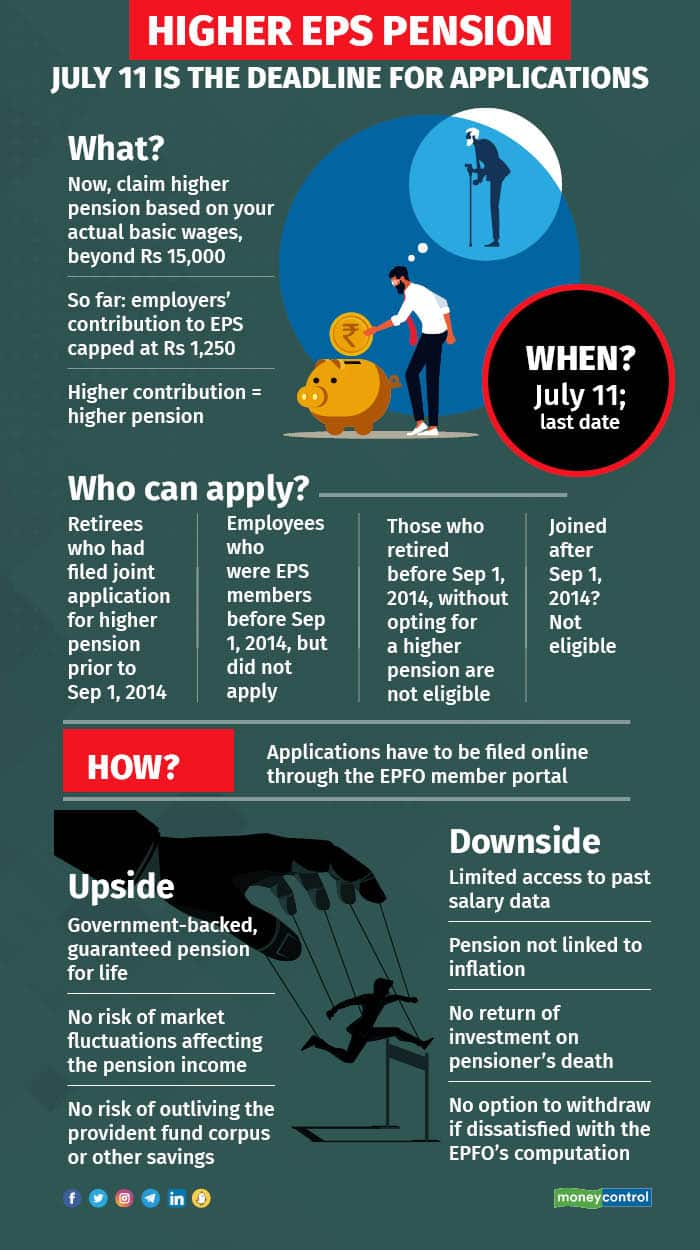

Your final chance to opt for a higher pension under the EPS (Employees’ Pension Scheme) based on your actual basic salary, beyond the statutory limit of Rs 15,000 will end tomorrow.

Though the deadline has been extended thrice so far, it is unlikely that the labour ministry and the Employees’ Provident Fund Organisation (EPFO) will be lenient yet again. So, if you want to get a higher pension for your lifetime post retirement, you have no time to lose.

You can read about the mammoth exercise that was rolled out after an SC order in November 2022, the formula used to compute the higher pension, and the procedure to apply here, here and here.

Despite a number of clarificatory circulars and the launch of a pension calculator to compute dues to be transferred from one’s provident fund (EPF) to avail of a higher pension, doubts persist. Yet, you have to now make your final decision based on the information that you have today.

Also read: Seeking higher EPS pension? Time is running out

Here are some last-minute pointers.

Why should an employee opt for higher pension by directing a higher chunk of the employers’ provident contribution towards EPS?

Government-backed, assured lifetime annuity is the key reason to opt for a higher pension. At present, 8.33 percent of your basic salary (plus dearness allowance, if applicable) is directed to the pension scheme. It joins the fund pool comprising all member contributions.

However, the basic salary (or wages) considered for the calculation is Rs 15,000, the statutory limit since September 1, 2014. So, only Rs 1,250 (8.33 percent of Rs 15,000) flows towards EPS, with the balance being directed to your EPF. An employee is eligible to draw pension at retirement at the age of 58, after completing at least 10 years of service.

Instead, if you opt to contribute based on your actual basic salary (what EPF contributions are based on) beyond the Rs 15,000-statutory limit, your pension income will be much higher.

Many are convinced that receiving a fixed, higher pension will ensure peace of mind and hence, is worth the effort. “There is no right or wrong answer to this question, it depends on your circumstances. If you are in your early 50s and have a fair idea of what your salary is likely to be closer to retirement, it will be easier to make the decision - it will be beneficial for you,” says Kuldip Kumar, Founder, Mainstay Tax Advisors. However, he points out that changes to the scheme - for instance, definition of pensionable salary - cannot be ruled out.

Also read: SC permits pension contributions on higher salary. What’s in store for employers and employees?

Do note, however, that the pension will not increase in line with inflation. “If you opt for the higher pension, you are guaranteed a risk-free fixed pension for life. Since the pension is not market-linked, you eliminate the risk of the pension amount falling in case of a poor economic environment. But this comes at a cost. The higher pension that gets decided at the start of retirement remains fixed for life. It doesn’t increase with inflation. And we all know what a monster inflation can be,” says Dev Ashish, a SEBI-registered investment advisor, and Founder, StableInvestor.

If you are not disciplined when it comes to managing money, this might be a reliable option. “If such folks don’t opt for a higher pension, and instead get a bigger EPF corpus on retirement, the onus will be on them to create a solid retirement income strategy. And, a large majority of people do not do that very well. In which case, maybe a higher pension is more useful,” he says.

July 11 is the last date to apply for higher pension on actual salary beyond Rs 15,000

July 11 is the last date to apply for higher pension on actual salary beyond Rs 15,000

What do I need to do to get a higher pension?

You will have to calculate the past dues — the amount to be transferred from your provident fund account with retrospective effect — and apply through the EPFO member portal by July 11. Your employer have time till September 30 to validate this data. The EPFO’s field officers will then verify the data and facilitate the payment of higher pension.

If you decide to opt for a higher pension, a larger proportion (9.49 percent – 8.33 percent, plus an additional 1.16 percent as per the EPFO’s decision) of your employers’ provident fund contribution will go towards EPS. Put simply, 9.49 percent of your actual basic salary beyond the Rs 15,000-limit will be directed to EPS.

This will be applicable retrospectively. Since contributions were capped at Rs 1,250 until now, there is bound to be a deficit — you will have to make good this shortfall by agreeing to divert the required amount from your provident fund. “Alternatively, you can fund it out of your savings, which is what those who have already retired and received their provident fund payout will have to do,” says Pankaj Mathpal, Founder, Optima Money Managers.

What are the hurdles I am likely to face?

The toughest obstacle is lack of access to past salary records to be able to calculate the amount to be diverted from the PF corpus. Many employees would have switched jobs or companies would have shut shop, making it difficult to fetch records over the long-term. However, those who have been employed with the same company throughout will have it easier.

Also, employees might make the decision based on today’s formula, but the definition of pensionable salary could change later if laws are amended. “The EPFO circular (on pension computation) states that the formula is applicable ‘as of now’. It does not rule out the possibility that it could be amended in future,” said Saraswathi Kasturirangan, Partner, Deloitte India.

Why a higher pension might not make sense

For one, you will be diverting a large chunk of your PF corpus towards EPS, and pension income is taxable. “This amount will not be ‘returned’ to you, unlike annuity plans that come with the return of purchase price option, where the invested amount is handed out to the nominees upon the pensioner’s death. Since no one is sure of their lifespan, in general, pension plans do not make great sense,” says Suresh Sadagopan, Founder, Ladder7 Financial Advisories.

If the pensioner were to die within, say, five years of starting to receive the pension, the corpus will not be returned to the family. Small consolation: the spouse will receive 50 percent of the pension. Also, “If someone doesn’t want to work till very late in life (and wants to retire early), then going for a higher pension (based on the last five years' average income) may not be very beneficial as they will quit working / earning much before their peak earning years,” said Dev Ashish.

Further, if there is a difference between your pension calculations and the EPFO’s, you will not have the option of withdrawing your application.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.