In mid-April, Vikas Sharma, a self-employed professional from Kolkata, was stunned to receive a message from WifiCash, an app-based lending platform run by a non-banking financial company (NBFC) Chadha Finance. Apart from threatening to declare Vikas a fraudster, the message also warned him that a police compliant will be filed and a legal notice would be issued against him, he alleges. Why this hostility? Because Vikas had taken a short-term loan of Rs 11,500 for his business from WifiCash in the month of March before the lockdown was announced. As business ground to a halt, he couldn’t repay this loan by the April 3 deadline. He had approached the lender for a loan moratorium after the Reserve Bank of India (RBI) allowed it in end-March, but his request was rejected. The message he got on his mobile was allegedly sent to him by a recovery agent of WifiCash. But it wasn’t the first time. “Earlier, there were a couple of daily reminder messages on his registered mobile number, followed by a call from recovery agents asking him to repay the total outstanding loan and explaining the consequences of non-repayment,” he claims. Moneycontrol reached out to WifiCash for comments, but the company did not respond till the time of publishing this story.

Of course, it is not mandatory for lenders to offer a moratorium. WifiCash not only rejected Vikas’ loan moratorium application, but also charged one per cent penalty for each day after the loan amount was due. There are some of the NBFCs that have given loan moratoriums based on an internal review process.

Ilica Chauhan, Vice President of PC financial service an NBFC which backs CashBean app-based digital lending platform says, “We analyse the profile and eligibility of borrowers applying for the loan moratorium. Then take a decision of deferring repayment only for those borrowers who we identify as genuine applicants unable to repay the loan instalment.”

By April 3, his dues went up to Rs 17,020; by May 3, it was Rs 22,195. After repeated complaints, the lending company reduced the overdue charges and Vikas repaid the loan amount by borrowing from relatives.

Borrower’s misery

Vikas’ case is not an isolated one. Several instances (as can be seen on social media) have come to light about borrowers being hounded by recovery agents. Borrowers have alleged that these companies are charging steep interest rates on borrowed amounts and levying penalties (overdue fees), threatening to call up immediate relatives and other people from phone contacts, in case a person fails to repay by the due date.

Complainants like Vikas say that digital lending applications have the permission to access phone their contact lists, as approval is sought at the time of installing the apps. Consent is also given to approach references and people in the contact list while applying for the loan.

When you borrow, you’ve got to repay. But can lenders humiliate you and use aggressive methods to recover dues?

How payday loans ballooned?

Pay day loans are small credits, typically disbursed by online websites or mobile apps. The amounts can range from Rs 1,000 to Rs 3 lakh. Says Chauhan, “A pay day loan is mainly disbursed to salaried people and the target borrowers are in the age group of 21-35. These loans are applied for paying school fees of children, medical emergency, etc.” The self-employed borrow small amounts to meet business needs. Most of them borrow for seven days to three months. However, the tenure can go up to one year. These are expensive loans; interest rates vary from 25-40 per cent a year, while the processing fee is 15-20 per cent. In addition, an 18 per cent goods and service tax (GST) is levied on the processing fees. Also, after the due date, lenders charge huge penalties as discussed above.

According to a report from credit scoring firm CreditVidya, released in May, digital personal loans and payday loans had been driving growth in fintech lending. The number of loans originated as per records with CreditVidya increased to 94 lakh in the January-March quarter of 2020 from 31 lakh in the July-September quarter of 2018. The report says that the value of such loans has increased by 11 times over the past seven quarters.

“The guidelines which are set for a non-banking financial companies (NBFCs) to repay loans and recovery are applicable to pay day loan lenders because most fintechs are NBFCs themselves or have partnered with NBFCs,” says Parijat Garg, a credit scoring consultant.

New code of conduct for digital lenders

Recently, the Digital Lenders’ Association of India (DLAI) has issued a fresh code of conduct for all its members to ensure that ethical practices are followed. These guidelines say that excessively high and non-transparent late payment fees must be avoided, pricing must be transparent and customers should be informed about late payment fees at the time of borrowing.

Prithvi Chandrasekhar, President, Risk and Analytics, InCred says, “It also provides clear guidance on fair and responsive collection practices, such as not calling or threatening to call any family member of the borrower.” Soon, the new code will be implemented with a strict process for compliance.

As a fair practice code, the complainant has to give 30 days to the lender for response. If the customer doesn’t get a satisfactory reply or if there is no response from the company, then the person has to reach out to RBI’s consumer protection cell or RBI’s ombudsman.

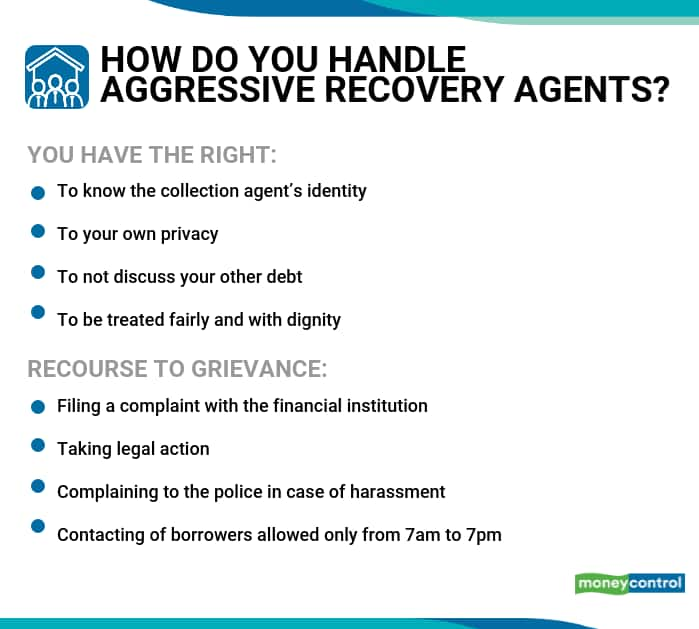

Apart from a code, the RBI has specified rights to ensure that debt collectors don’t fleece borrowers.

What if the borrower defaults?

Talk to your lender and ask for a loan moratorium. See if you can restructure your loan. “In many cases the banks/NBFCs offer the borrower a flexible and easy option to repay the loan while restructuring,” says Harshil Morjaria, a certified financial planner at ValueCurve Financial Solutions.

You can even negotiate with the lender for a one-time settlement of the loan amount with interest and penalty charges waived off.

“Your credit score gets impacted adversely because you did not repay in full,” says Morjaria.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.