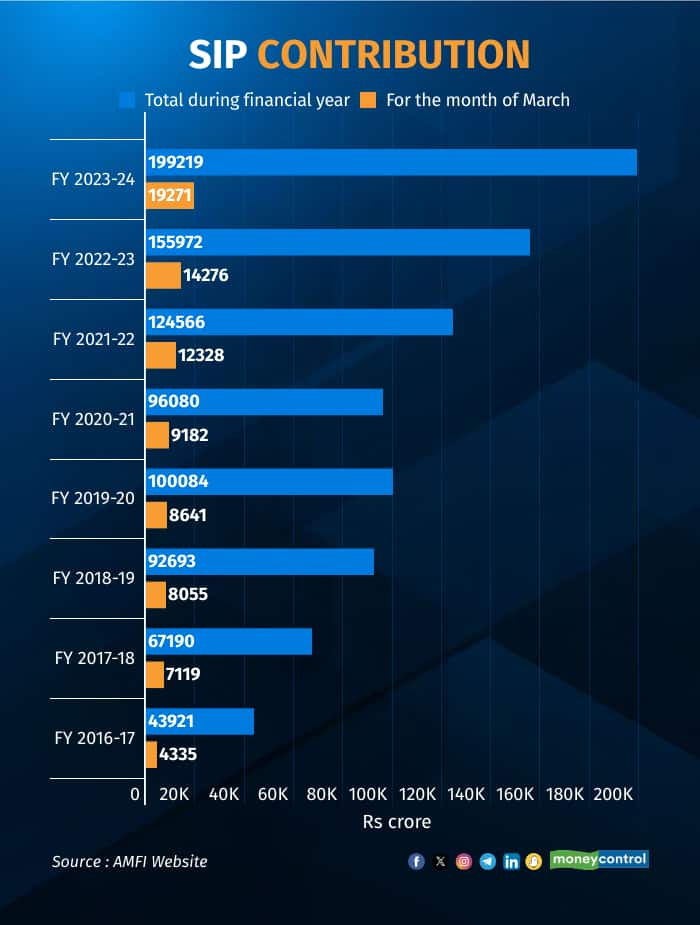

Investors love a good SIP. We saw nearly Rs 2 lakh crore in SIP (systematic investment plan) inflows last fiscal, and over Rs 19,000 crore in monthly SIP flows in March 2024 — a five-fold jump from 2016-17, as per the Association of Mutual Funds in India (AMFI) data.

In February alone, 49.8 lahks new SIP accounts were opened while 21.33 lakh were closed, indicating that almost 40 percent of SIPs may not be long-term.

So, is SIP truly what the doctor ordered? Are there situations where SIPs are sub-optimal?

Also read | Will the right financial advisor for me please stand up?

Below are some scenarios when one can go slightly wrong with SIPs:

a) When the quantum of savings using SIPs is not aligned with your goals.

b) We start a SIP, but panic in a market downturn and stop it (when we should be buying as prices are low), especially when it comes to mid and small-cap SIPs.

c) We wait to start a SIP and try to time the bottom of the market instead of simply getting on with investing.

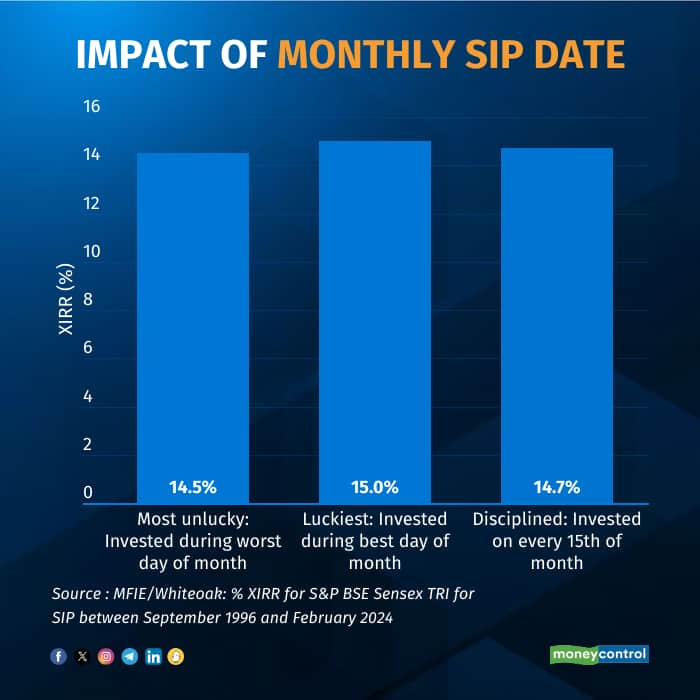

d) We fuss about whether we should do daily / weekly/monthly SIPs, and which day of the month we should start, rather than just being present in the market.

SIP not aligned to goals

An inadequate SIP quantum will give a sense of well-being, but when you need the money for your goal, you may fall short. Another issue is that often we keep the SIP quantum static, instead of increasing it with growing income. Lifestyle costs keep going up while savings are not boosted to the same extent, leading to an eventual goals and savings mismatch. However, one can see a dramatic shift in one's savings potential with top-ups.

A SIP for all cycles

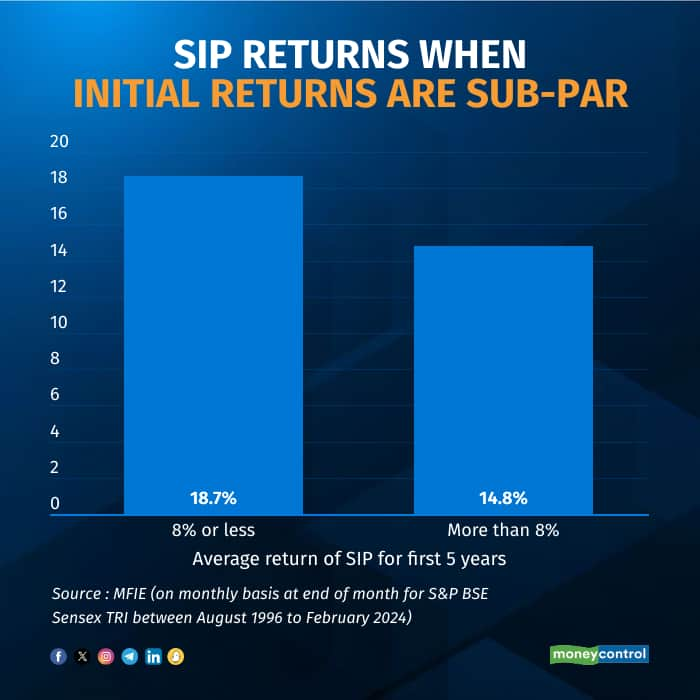

SIPs give the best results if continued through all market cycles, because “time in the market” often outweighs “timing the market,” especially when it comes to this investment strategy. Thus, if you see relatively lower returns in the initial five years, you're likely to see better returns on a 10-year basis. Also, data suggests that staggered investment works best with mid and smallcap stocks.

A caveat: past performance may or may not be sustained in the future. However, it shows the merit of sticking with SIPs for the long term, especially in times of volatility, for best results.

Delaying SIPs to time the market

We often see investors postponing their SIPs to time the market.

Studies have indicated that while there is a slight increase in returns (in percentage terms) if one starts a SIP at the bottom of the market instead of the top, the total savings are often much lower because of a lesser savings period. If the market takes longer to reach the bottom, the difference becomes lower still.

Also read | Does the recent price breakout justify a higher long-term allocation to gold?

To give an example from the recent COVID crisis, if one started a monthly SIP of Rs 10,000 from Jan 2020, and another started the same from the bottom (Mar 2020), the Jan investment would be worth Rs. 6.6 lakh and the March one would be worth Rs 6.3 lakh, delivering 13.7 and 13.9 percent returns, respectively.

Any day is good

Data shows that the day of the month one starts one's SIP has minimal impact on returns. The main thing is to do one's research, plan, and start.

In sum, while past data is not a predictor of future returns, we find that SIPs deliver the maximum bang for the buck when aligned to goals, regularly topped up, and sustained for the long term. Otherwise, they may indeed turn out to be less than optimal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.